Was This The Fund That Sparked The Massive Media Stock Liquidations Yesterday?

Yesterday lunchtime we were among the first to highlight some dramatic block trades being flushed through the Chinese tech and US media sector stocks. As we noted at the time, "something odd" was going on as the scale and frequency of the trades was highly unusual.

At the time we pointed out around $7 billion of trades had gone through, but by the close of the day, over $10 billion in blocks had been liquidated in the market, sparking massive plunges in a number of until-then-high-flying stocks.

Bloomberg is reporting more details on the mysterious block trades this morning, noting that Goldman Sachs was responsible, as the prime broker, for dumping the majority of the blocks (including $6.6 billion worth of shares of Baidu, Tencent Music, and Vipshop; followed by the sale of $3.9 billion of shares in ViacomCBS, Discovery, Farfetch, iQiyi, and GSX Techedu).

More of the unregistered stock offerings were said to be managed by Morgan Stanley, according to people familiar with the matter, on behalf of one or more undisclosed shareholders.

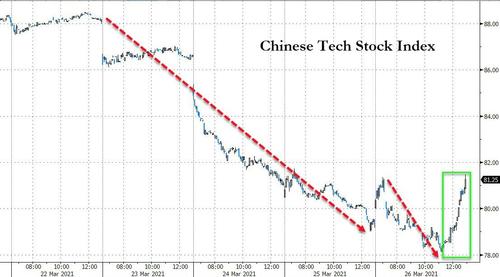

The result of the massive selling pressure was a bloodbath for Chinese Tech stocks (which was met with an even bigger wall of quant-buying in the last hour of day, as we detailed here)...

Source: Bloomberg

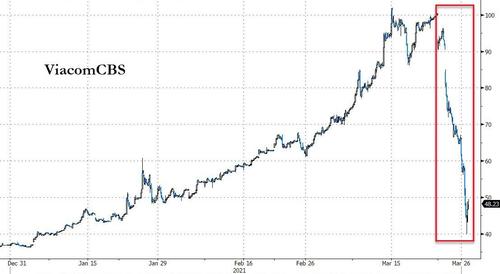

And US Media conglomerates (which bounced a little into the close but still had their worst day ever)...

Source: Bloomberg

But the question remained - what fund (or funds) was actually behind the selling?

We may have an answer as IPO Edge reports, according to people familiar with matter, that the liquidation of holdings at several major investment bank prime brokerages was tied to Tiger Cub hedge fund Archegos Capital Management LLC.

The common thread is defunct Tiger Asia Management LLC founder Bill Hwang, who now runs Archegos Capital. His fund was and may still be an large owner of shares in both ViacomCBS and Discovery. Mr. Hwang did not respond to phone calls, emails, or Bloomberg messages sent by IPO Edge.

IPO Edge reports further that Mr. Hwang’s fund is known for employing leverage, meaning it borrows to invest in more securities than it could own with its own capital.

Tbh Bill is a pure legendary degn

— Dovey “Rug The Fiat” Wan🪐🦖 (@DoveyWan) March 27, 2021

rarely will see someone like his size is still on such high lev without hedge reminds me of @AWice once said “linear wealth, not compounding wealth”

He will make it back I’m sure

One person familiar with the matter said Mr. Hwang’s fund received a margin call from one of the investment banks – not necessarily Morgan Stanley or Goldman Sachs – and was unable to meet it.

As a result, that bank and others began to liquidate stocks owned by Archegos.

Is this the start of things to come?

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more

Very interesting indeed. And what is learned is that "One should Never Be Where One Does Not Belong." (Bob Dylan, from " The Ballad of Judas Priest")