Vertex Is Positioned For Upside

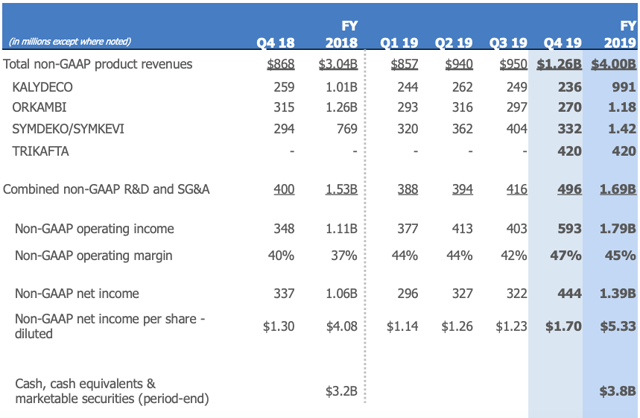

Vertex (VRTX) is the market leader in the treatment of cystic fibrosis - CF. The company's main products are Trikafta, Symdeko/Symkevi, Orkambi, and Kalydeco, these products are collectively approved for 60% of the 75,000 cystic fibrosis patients in main markets, and Trikafta looks like a remarkably promising growth engine for the company in the years ahead.

Trikafta is a triple combination regimen that was approved by the FDA in October 2019 for the treatment of CF in people aged 12 years and older. The drug is under review in Europe, while also being evaluated in younger patients in the US.

Management is remarkably optimistic about Trikafta, and the company believes that it has the potential to treat up to 90% of all people with CF. The fact that Trikafta already produced 420 million in sales during the fourth quarter of 2019 clearly indicates that demand has been more than strong.

(Click on image to enlarge)

Source: Vertex

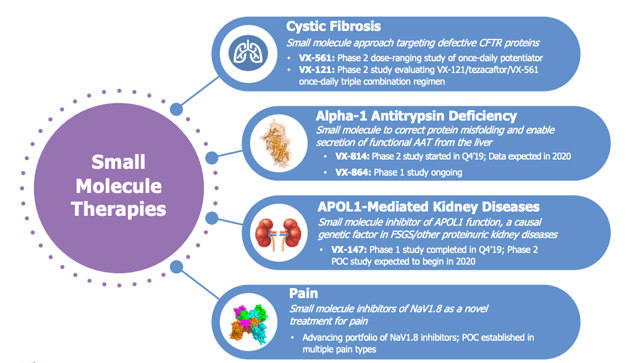

Beyond CF, Vertex is advancing its treatments for cell disease, thalassemia and pain management, among others.

(Click on image to enlarge)

Source: Vertex

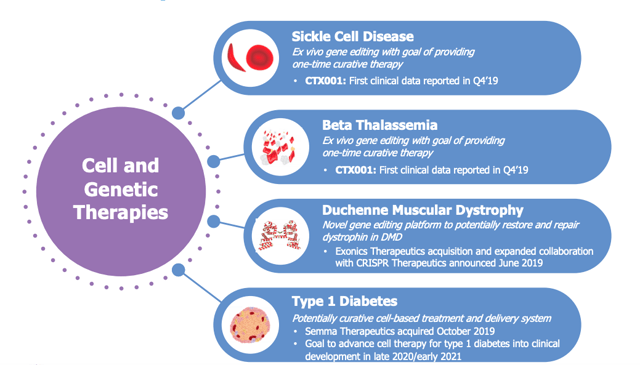

For further diversification and innovation, the company's pipeline programs include multiple modalities in addition to small molecules. Vertex is also working with new approaches such as cell and genetic therapies. For these new modalities, Vertex has acquired or partnered with leading companies with deep expertise and valuable technologies in these areas.

(Click on image to enlarge)

Source: Vertex

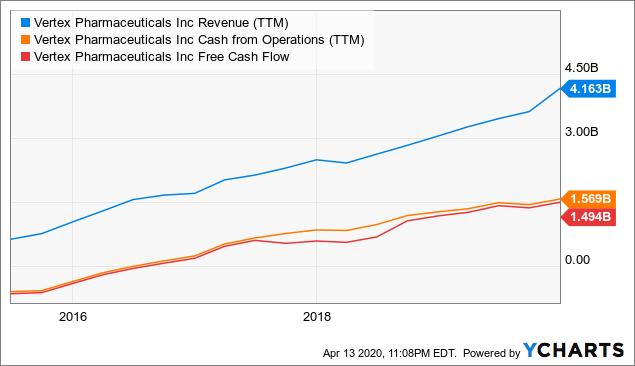

Financial performance has been impressive over the past several years, with both revenue and cash flows moving in the right direction over time.

(Click on image to enlarge)

Data by YCharts

The company delivered better than expected earnings for the fourth quarter of 2019. Full-year adjusted product revenues reached $4 billion, a 32% increase year over year. Adjusted operating income grew by 61% versus the prior year.

Expanding profitability and cash flows provides the resources to reinvest in both internal and external innovation in order to create future medicines and long-term growth opportunities. In 2019 Vertex invested approximately $1.6 billion in external innovation through new acquisitions and collaborations.

More recently, on March 27 management confirmed its 2020 business outlook and the continuity of the company's supply chain for its approved cystic fibrosis medicines.

According to management:

The company has ample supply to meet commercial needs well into the future and remains highly confident in its ability to continue to supply all of its medicines to patients around the world. Additionally, the company's manufacturing facilities have remained operational and continue to produce new supply of the company's medicines.

The business produces plenty of cash and it has a solid balance sheet, so Vertex does not need any external financing. Besides, demand is not affected by the recession and the supply chain remains intact. For these reasons, Vertex looks well-positioned to continue delivering solid financial performance even in the midst of the COVID-19 pandemic.

Valuation In The Right Context

At first sight, Vertex can seem too expensive since the stock trades at a forward price to earnings around 32, which represents a premium versus other players in the sector. However, growth and value are actually two sides of the same coin, and Vertex can justify a valuation premium based on the company's superior potential for growth.

The price to earnings growth - PEG - ratio for Vertex is currently 1.24 versus an average of 1.98 for the median company in the healthcare sector. In simple terms, the stock is no bargain, but it is not overpriced either considering the company's growth prospects.

It is also very important to understand that the returns produced by a stock do not depend on the business performance alone, but rather on the business fundamentals in comparison to market expectations. The current stock price is reflecting a particular set of expectations for the business, if the company can exceed those expectations the stock price will do well, and vice-versa.

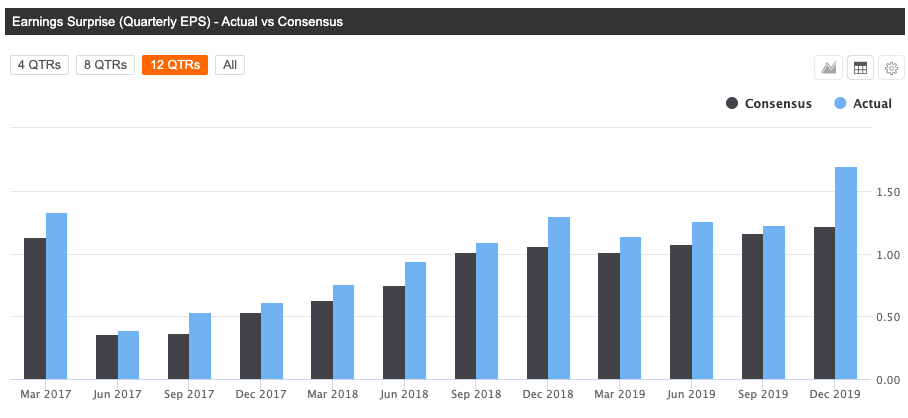

Vertex has delivered earnings numbers above Wall Street expectations in the past 12 quarters in a row, quite an impressive display of consistency. Management clearly tends to underpromise and overdeliver over time.

As long as the company continues delivering above expectations, this would mean that valuation going forward is actually more attractive than what the current valuation ratios are suggesting.

(Click on image to enlarge)

Source: Seeking Alpha

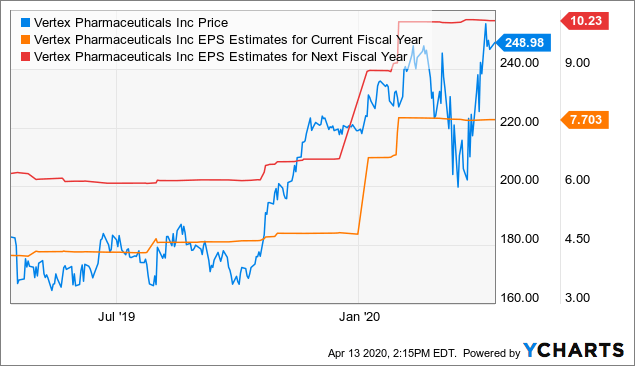

Since the company is consistently outperforming expectations, Wall Street analysts keep running from behind and raising their earnings estimates for Vertex. Unsurprisingly, earnings expectations and the stock price tend to move in the same direction, so strong fundamental momentum is a powerful driver for the stock price.

(Click on image to enlarge)

Data by YCharts

Valuation is about much more than simply looking at ratios such as price to earnings. These ratios should always be interpreted in the right context because a company that generates strong profitability and consistently beats expectations deserves a higher valuation than a business with below-average profitability and underperforming expectations.

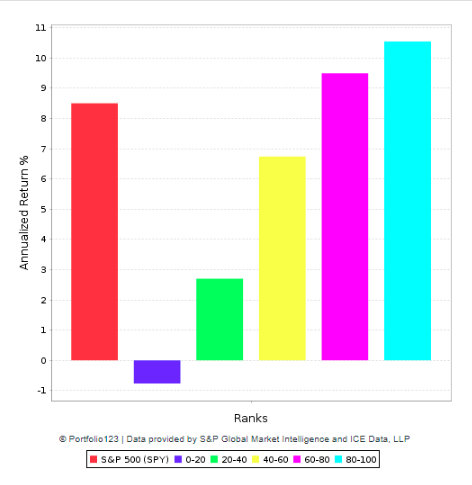

But sometimes it can be difficult to incorporate multiple factors in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking the higher the expected returns.

This bodes well for Vertex, as the company has a PowerFactors ranking of almost 99.98 as of the time of this writing, meaning that the company is currently in the top 1% of companies in the US stock market when considering valuation, financial quality, fundamental momentum, and relative strength together.

Backtested performance data for these kinds of algorithms should always be taken with a grain of salt. The backtested performance shows that a large number of companies with high PowerFactors rankings tend to deliver superior returns over the years, but this does not tell us much about how a specific company such as Vertex is going to perform in a particular year such as 2020.

Nevertheless, it is good to know that Vertex is attractively valued when considering valuation levels in the context of other return drivers. If the company continues delivering above expectations, then the stock should still offer attractive upside potential going forward.

Risk And Reward

Vertex is highly focused on cystic fibrosis for the time being. This deep focus has been remarkably rewarding for the company over the past several years, but it is also a considerable risk factor going forward. Vertex will be facing increased competitive pressure in the years ahead, with players like AbbVie (ABBV), Eloxx (OTC: ELOX), and Translate Bio (TBIO), among others, developing drugs for cystic fibrosis.

Over a longer timeframe, there is also the possibility that gene-editing technologies could be a disruptive innovation in cystic fibrosis, which could erode Vertex's leadership. In addition to this, pricing pressures and regulatory risks are especially relevant since Vertex's products are highly-priced.

Vertex has an interesting pipeline of developments targeting other therapeutic areas, but the timing for those developments is still quite uncertain, so the company needs to continue delivering attractive growth rates in cystic fibrosis in order to justify the stock price in the near term.

Vertex comes second to none in its main market, and it has the strength to fend off the competition. In fact, many competitors are studying their own candidates in combination with Vertex's molecules, which shows that Vertex is the undisputed leader in CF. Nevertheless, competitive pressure is always a relevant factor to watch in such a competitive industry.

Those risks being acknowledged, Vertex is a market leader in a very lucrative market, and the company has proven its ability to develop massively successful drugs in-house over time. Financial performance is rock-solid, and the stock is not too expensive considering the quality of the business.

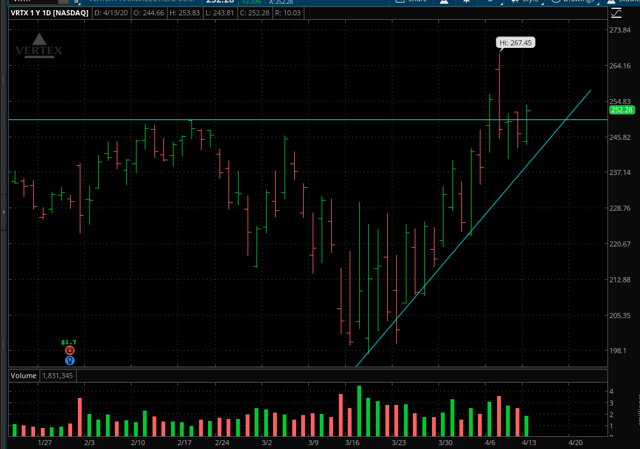

(Click on image to enlarge)

Source: TOS

Looking at the price chart, it is interesting to note that Vertex has a key resistance level at around $250, and it looks like it wants to break above such a level in the short term. If the breakout is confirmed and the stock gains strength above $250, this move could open the doors for strong gains in Vertex stock.

Disclosure: I/we have no positions in any stocks mentioned but may initiate a long position in VRTX over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more