Top 5 Consumer-Centric Stocks Amid Rising Consumer Confidence

Image: Bigstock

Wall Street is set to close an impressive 2023 after a highly disappointing 2022. Year-to-date, the three major stock indexes — the Dow, the S&P 500, and the Nasdaq Composite — have rallied 12.8%, 23.6% and 44.1%, respectively. With just five days of trading left to finish 2023, U.S. stock markets will maintain their momentum in all likelihood.

Consumer Confidence Thrives in December

The Conference Board reported that its consumer confidence index for December came in at 110.7, beating the consensus estimate of 104.5. November’s data was revised downward to 101 from the reading of 102 reported earlier.

The sub-index for the present situation climbed to 148.5 in December from 136.5 in November. The sub-index for expectations surged to 85.6 in December from 77.4 in November. This marked the highest level for expectations index since July.

Dana Peterson, Chief Economist at The Conference Board, said “Assessments of the present situation rose in December, as seen by the more positive views of business conditions and the employment situation. Consumer expectations for the next six months also increased in December, reflecting improved confidence about future business conditions, job availability, and incomes.”

Consumer Sentiment Climbs

In a similar kind of study, the University of Michigan reported that the preliminary reading of the index for consumer sentiment jumped 13% to 69.4% in December from a six-month low of 61.3 in November. The consensus estimate was 62.4. The preliminary reading for December was the highest since August.

The sub-index for the current condition climbed to 74 in December from 68.3 in November. The sub-index for future expectations surged to 66.4 in December from 56.8 in November.

In December, Americans expect the inflation rate to cool down to 3.1% next year from 4.5% in November. The metric for December marked the lowest level since March 2021. Expectations of inflation over the next five years fell to 2.8% in December from 3.2% in November. The metric for November was the highest since 2011.

Our Top Picks

We have narrowed our search to five consumer-centric large-cap (market capital more than $10 billion) stocks that have strong potential for 2024. These stocks have seen positive earnings estimate revisions in the last 30 days. Most of our picks boast either a Zacks Rank #1 (Strong Buy) or Rank #2 (Buy).

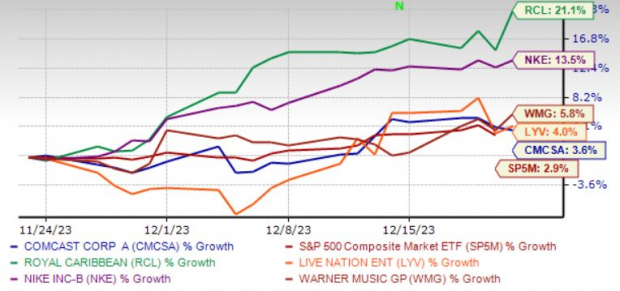

The chart below shows the price performance of our five picks in the past month.

Image Source: Zacks Investment Research

Live Nation Entertainment Inc. (LYV - Free Report)

This company is benefiting from pent-up demand for live events, robust ticket sales, and the sponsorship and advertising business. Live Nation remains optimistic about its growth prospects in 2023.

For concerts, the company stated that it has already sold more than 117 million tickets (as of June 2023), up 20% from the 2022 levels. In terms of tickets, Live Nation is likely to benefit from the market pricing trend. Also, the emphasis on new client and venue additions bodes well.

This Zacks Rank #1 (Strong Buy) company has an expected revenue and earnings growth rate of 8.2% and 61.1%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 3.9% over the last 30 days.

Royal Caribbean Cruises Ltd. (RCL - Free Report)

This company has been benefiting from solid demand for cruising and acceleration in booking volumes. Royal's emphasis on strong pricing (on closer-in-demand) bodes well.

In the third quarter, the company reported accelerating demand for 2024 sailings. It intends to focus on new innovative ships and onboard experiences to boost its offering and deliver superior yields and margins.

This Zacks Rank #1 (Strong Buy) company has an expected revenue and earnings growth rate of 13.7% and 38.1%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.9% over the last 30 days.

NIKE Inc. (NKE - Free Report)

This company has displayed strength over the past year. Continued progress on Consumer Direct Acceleration strategy, compelling product innovation, and digital leadership have all been drivers of this growth. This aided the company's retail sales across Nike Direct and wholesale businesses in first-quarter fiscal 2024.

Its digital business has been gaining from robust consumer trends, including momentum in the NIKE mobile app led by improved traffic and increased member buying frequency. Backed by solid consumer momentum, a robust innovation pipeline, and strong inventory, management provided a solid outlook for fiscal 2024.

This Zacks Rank #3 (Hold) company has an expected revenue and earnings growth rate of 3.6% and 16.1%, respectively, for the current year (ending May 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.3% over the last seven days.

Warner Music Group Corp. (WMG - Free Report)

This next one is a music-based content company. Warner Music Group's operating segment consists of Recorded Music and Music Publishing. The Recorded Music segment is involved in the discovery and development of recording artists. The Music Publishing segment owns and acquires rights. The company operates principally in the United States, the United Kingdom, and internationally.

This Zacks Rank #2 (Buy) company has an expected revenue and earnings growth rate of 6% and 23.8%, respectively, for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days.

Comcast Corp. (CMCSA - Free Report)

Finally, this next company is benefiting from a growing wireless subscriber base. Comcast's plan to transition to DOCSIS 4.0 is noteworthy. The technology will help CMCSA expand much faster and at a lower cost compared with competitors.

Recovery in the park and movie business bodes well for Comcast's profitability. The company's streaming service, Peacock, is a key catalyst in driving broadband sales. The stock's strong free cash flow generation ability is also noteworthy.

This Zacks Rank #3 (Hold) company has an expected revenue and earnings growth rate of 2.7% and 9.9%, respectively, for next year. The Zacks Consensus Estimate for next-year earnings has improved 0.2% over the last seven days.

More By This Author:

KLA Laps the Stock Market: Here's Why

3 Beaten-Down ETFs To Buy For A Turnaround In 2024

Bear Of The Day: Cisco Systems

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more