Bear Of The Day: Cisco Systems

Company Overview

Zacks Rank #5 (Strong Sell) stock Cisco (CSCO) is a leading multinational technology company specializing in networking hardware, software, and telecommunications solutions. Known for its extensive product portfolio, Cisco provides a range of networking equipment, including routers and switches, and software solutions for network management, security, and collaboration. The company offers telecommunications equipment, such as IP phones and video conferencing systems, as well as data center technologies and cybersecurity solutions. Cisco's expertise extends to cloud services, Internet of Things (IoT), and it provides consulting, support, and training services. As a key player in the IT industry, Cisco plays a vital role in enabling connectivity, communication, and secure data management for businesses and organizations worldwide.

Relative Weakness

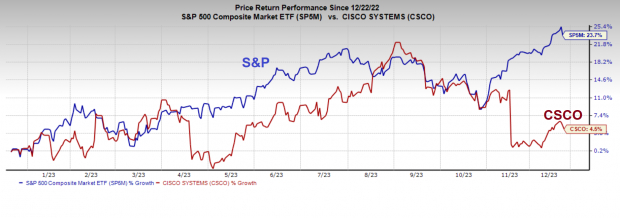

Nothing is more painful for an investor than being in a stock that is underperforming as the overall market is rising. Because 75% of stocks follow the general market’s direction, a major red flag for prospective CSCO investors should be its abhorrent price performance in 2023. While the tech-heavy Nasdaq 100 ETF (QQQ) is up more than 50% year-to-date, CSCO shares are flat. It’s safe to presume that CSCO will underperform even more if US equities retreat at any point in 2024.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Slowing Growth

What’s behind Cisco’s underwhelming price action? Cisco’s product orders are set to decline by 20% due to elevated inventory levels at the company’s largest customers.

(Click on image to enlarge)

Image Source: Zacks Investment Research

The troubling trend is expected to persist and hurt Cisco’s earnings performance over the next couple of quarters by diminishing top-line growth. Analysts agree – Cisco’s Earnings ESP (Expected Surprise Prediction) is negative. According to our intensive 10-year back test at Zacks, when a company sports a negative ESP score combined with a Zacks Rank of #5 (Strong Sell), most stocks will miss on earnings and will underperform over the twelve months.

Competition Puts CSCO Between a Rock and a Hard Place

Cisco has been forced to offer discounts and deals in response to stiff competition from competitors like Arista Networks (ANET), Juniper Networks (JNPR), and Hewlett Packard (HPE).

Industry Group

Beyond the overall market direction and earnings estimates, the most critical factor that drives a stock’s price is its industry group. CSCO’s Computer – Networking industry, ranks 235 out of 252, putting it in the bottom 7% of all industries tracked by Zacks.

Bottom Line

Cisco faces significant challenges that warrant investor caution. With a Zacks Rank of #5 (Strong Sell), the company has demonstrated relative weakness, lagging behind the market’s overall performance. Slowing growth, a cutthroat competitive landscape, and a weak industry group make CSCO shares an avoid at this juncture.

More By This Author:

This Semiconductor Stock Is Mounting An Epic Comeback With New Tech2 Expansive Commerce Stocks To Buy At Year's End

Bull Of The Day: Emcor Group, Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more