Time To Buy These "Unique" Top-Rated Stocks As Earnings Approach

Image: Bigstock

As we move through February and continue to progress through a crucial earnings season, there are two top-rated stocks among the Zacks Computer & Technology sector and the Oil & Energy sector that are starting to stand out.

Here is a look at these two ‘unique’ companies that investors may want to consider buying as their quarterly reports approach.

Arista Networks (ANET - Free Report)

Arista Networks, which provides cloud networking solutions for data centers and cloud computing environments, is set to report its fourth-quarter earnings on Monday, Feb. 13.

Arista Networks' Communication-Components Industry is currently in the top 32% of over 250 Zacks Industries. The company looks set to benefit from a strong business environment with earnings estimates rising throughout the quarter, landing the stock a Zacks Rank #2 (Buy) rating.

Image Source: Zacks Investment Research

Q4 Preview

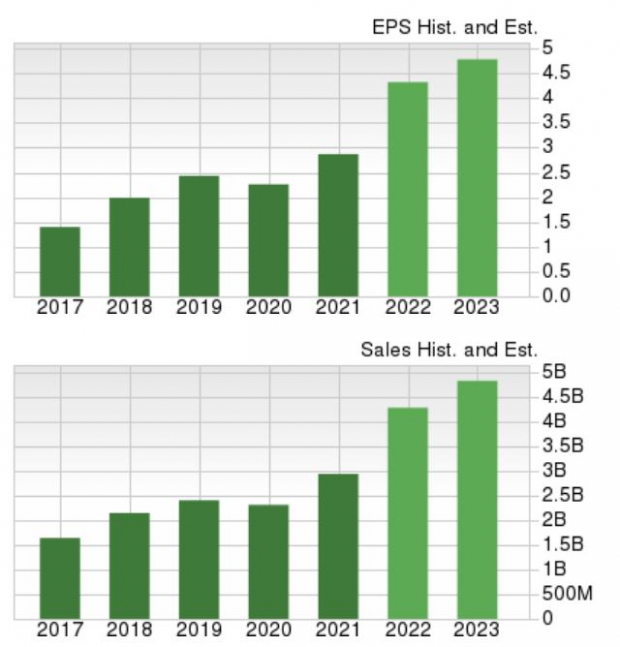

Arista’s Q4 earnings are expected at around $1.21 per share, which would be a 47% increase from Q4 2021. Fiscal 2022 earnings are now projected to climb 52% to $4.38 per share compared to EPS of $2.87 in 2021. Plus, fiscal 2023 earnings are forecasted to jump another 19% to $5.23 per share.

On the top-line, Q4 sales are forecasted to be $1.20 billion, up 45% from the prior year. Total sales are now anticipated to be up 46% for FY22 and pop another 22% in FY23 to $5.24 billion. More impressive, Fiscal 2023 sales would represent 143% growth over the last five years, with 2018 sales at $2.15 billion.

Image Source: Zacks Investment Research

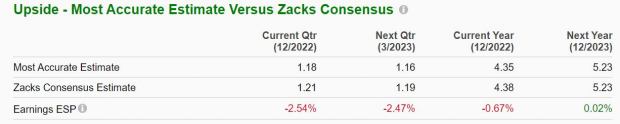

Earnings ESP

The Zacks Expected Surprise Prediction indicates that Arista could miss Q4 bottom-line estimates, with the Most Accurate Estimate at $1.18 per share and the Zacks Consensus having EPS at $1.21.

Image Source: Zacks Investment Research

Takeaway

Despite the possibility of missing bottom-line expectations, the rising earnings estimates are a good sign and indicate that Arista Networks could provide better-than-expected guidance, which has been crucial this earnings season. Furthermore, Arista’s annual top- and bottom-line growth is very intriguing as the importance of cloud technology solutions continues to grow.

Lastly, Arista stock is now up +131% over the last three years to largely outperform the S&P 500’s +23% and the Nasdaq’s +21%. This largely reflects Arista’s unique and expansive niche among the broader technology sector.

SolarEdge Technologies (SEDG - Free Report)

Another company with a unique business niche is Israel-based SolarEdge Technologies, which is also set to report its Q4 earnings on Feb. 13. SolarEdge is part of the Zacks Oil & Energy sector, and its Solar Industry is currently in the top 19% of all Zacks Industries. As the importance of alternative energy continues to expand throughout society, SolarEdge is benefiting as a leader in its space.

Specifically, SolarEdge is a leading provider of optimized inverter solutions, which consist of inverters and power optimizers incorporating a communications device that enables access to a cloud-based monitoring platform and smart energy management solutions.

Heading into its quarterly report, SolarEdge sports a Zacks Rank #2 (Buy), with earnings estimates starting to rise again for fiscal 2022 and continuing to go up for FY23.

Image Source: Zacks Investment Research

Q4 Preview

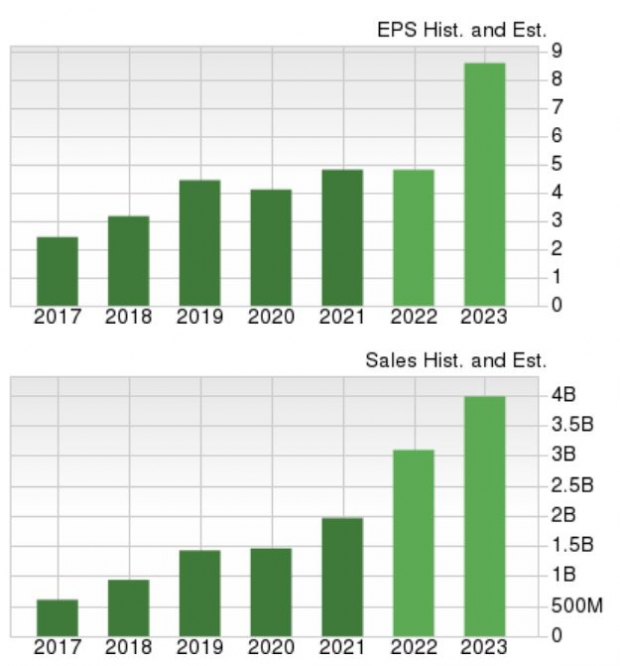

SolarEdge’s Q4 EPS is expected at $1.59, up 44% from $1.10 per share in Q4 2021. This would round out fiscal 2022 earnings at $4.79 per share, which is virtually flat from a year ago, but FY23 earnings are projected to soar 82% to $8.73 per share.

Fourth-quarter sales are forecasted to be $875.38 million, up 58% from the prior year quarter. Total sales would be up 57% year-over-year for FY22, and they are projected to jump another 28% in FY23 to $3.98 billion. Plus, with 2018 sales at $937 million, FY23 would see an outstanding 324% increase over the last five years.

Image Source: Zacks Investment Research

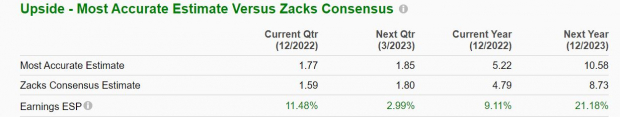

Earnings ESP

SolarEdge may post a nice earnings surprise for Q4, with The Zacks Consensus at $1.59 per share and the Most Accurate Consensus at $1.77 a share.

Image Source: Zacks Investment Research

Takeaway

SolarEdge stock still looks attractive at around $300 per share, with the company’s bottom-line standing out in fiscal year 2023. Although the company trades at 42.1X forward earnings, this is well below its decade high of 113.1X and 42% beneath the median of 72.9X with earnings on the rise.

Furthermore, a strong Q4 earnings beat and positive guidance could be a strong catalyst for SolarEdge stock, which is now up +101% over the last three years to easily top the benchmark and beat the Solar Market’s +82%.

Bottom Line

These two top-rated Zacks stocks have unique niches among their respective business industries. As innovation continues among the broader oil & energy and computer & technology sectors, both SolarEdge Technologies and Arista Networks look poised to benefit as leaders in their respective spaces.

More By This Author:

Are These Stocks Bargains Before Earnings?

These 3 Companies Generate Serious Cash

Cisco Q2 Preview: Another EPS Beat Inbound?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more