Are These Stocks Bargains Before Earnings?

Image: Bigstock

Many investors are always on the lookout for stocks that may be bargains due to their valuation or growth prospects. Next week’s earnings lineup features quite a few stocks that appear to trade at discounts considering their affordable price tags and fundamental metrics.

Let’s see if it’s time to pounce on the opportunity to buy these stocks at their current levels.

Cleveland-Cliffs (CLF - Free Report)

Starting the list is Cleveland-Cliffs, which is set to report its fourth-quarter earnings on Tuesday, Feb. 14. Cleveland-Cliffs is the largest producer of iron ore pellets and flat-rolled steel in North America.

With a specific niche among its industry, Cleveland-Cliffs stock currently sports a Zacks Rank #1 (Strong Buy) in correlation with earnings estimates rising 87% over the last quarter for fiscal 2023 as the company rounds out its FY22.

Image Source: Zacks Investment Research

Q4 Preview

Cleveland-Cliffs has been dealing with lingering maintenance costs as Q4 earnings are expected at -$0.33 per share, compared to EPS of $1.78 in Q4 2021, which capped off a record year for income and revenue.

Fiscal 2022 earnings are now projected to drop -55% to $2.61 per share after an exceptional 2021 with EPS at $5.87. Fiscal 2023 earnings are projected to decline another -20% to $2.08 per share, but estimates are much higher.

On the top-line, Q4 sales are forecasted to be $5.35 billion and virtually flat from a year ago. Total sales are now anticipated to be up 14% for FY22, but they are also expected to decline -12% in FY23 to $20.45 billion. However, Fiscal 2023 sales would still be a very impressive 733% increase over the last five years, with 2018 sales at $2.33 billion.

Image Source: Zacks Investment Research

Earnings ESP

The Zacks Expected Surprise Prediction indicates that Cleveland-Cliffs could miss on its Q4 bottom-line, with the Most Accurate Estimate at -$0.37 per share and the Zacks Consensus having EPS at -$0.33.

Image Source: Zacks Investment Research

Takeaway

Despite a down quarter, the rising earnings estimates for Cleveland-Cliffs fiscal 2023 is very intriguing and allude to the possibility of a stronger outlook for the year. With guidance being more important than anything this earnings season, CLF stock also makes the case for being somewhat undervalued at 9.5X forward earnings, and it sports an “A” Style Scores grade for Value.

Plus, the correction in Cleveland-Cliffs stock last year may be a long-term buying opportunity considering its niche as an iron and steel producer, with CLF shares up +166% over the last three years to blast the S&P 500’s +23%.

Herbalife (HLF - Free Report)

Another company whose stock makes that case for being a bargain at its current levels is Herbalife, which is also set to report Q4 earnings on Tuesday, Feb. 14. Herbalife is a global network marketing company that offers a wide range of science-based management products, nutritional supplements, and personal care products to support weight loss and health.

Trading at around $16 per share and just 7X forward earnings, Herbalife stock sports an “A” Style Scores grade for Value and lands a Zacks Rank #3 (Hold) at the moment. Shares of HLF trade 67% below its decade high of 21.4X and at a 42% discount to the median of 12.2X.

Image Source: Zacks Investment Research

Q4 Preview

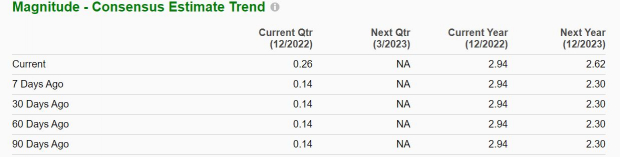

Herbalife’s Q4 EPS is expected at $0.26 a share, down -54% from $0.57 per share in Q4 2021. This would round out fiscal 2022 earnings at $2.94 per share, compared to EPS of $4.79 a share in 2021. Fiscal 2023 earnings are projected to dip another -11% to $2.62 per share, but earnings estimates revisions are up 14% in the week leading up to its quarterly release.

Image Source: Zacks Investment Research

Fourth-quarter sales are forecasted to be $1.12 billion, down -15% from the prior year quarter. Total sales would be down -11% year-over-year for FY22 and are projected to drop another -9% in FY23 to $4.67 billion. It is important to note that FY23 would reflect -4% growth over the last five years, with 2018 sales at $4.89 billion.

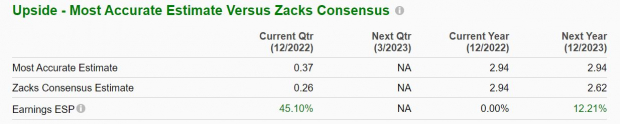

Earnings ESP

Despite the annual dip in its bottom line, Herbalife may significantly top Q4 earnings expectations, with The Zacks Consensus at $0.26 per share and the Most Accurate Consensus at $0.37 a share.

Image Source: Zacks Investment Research

Takeaway

While Herbalife’s annual top- and bottom-line growth has contracted, at its current levels, the stock could be moving towards oversold territory. The possibility of an earnings beat and better-than-expected guidance as FY23 earnings estimates have soared could lead to a rally in Herbalife shares. For now, holding on to the stock could be rewarding down the line.

TripAdvisor (TRIP - Free Report)

Rounding out the list is TripAdvisor, which is set to report its fourth-quarter earnings on Feb. 14. TripAdvisor is one of the largest online travel research companies in the world, and it could start benefiting from a booming industry as travel demand is expected to be higher in 2023.

To that note, TripAdvisor’s broader Internet-Commerce Industry is currently in the top 18% of over 250 Zacks Industries. TripAdvisor stock currently lands a Zacks Rank #3 (Hold), and it trades attractively relative to its past despite trading at 43.4X forward earnings. This is well below its extreme decade-long high of 3,600X and nicely below the median of 48.9X, with earnings expected to rebound.

Image Source: Zacks Investment Research

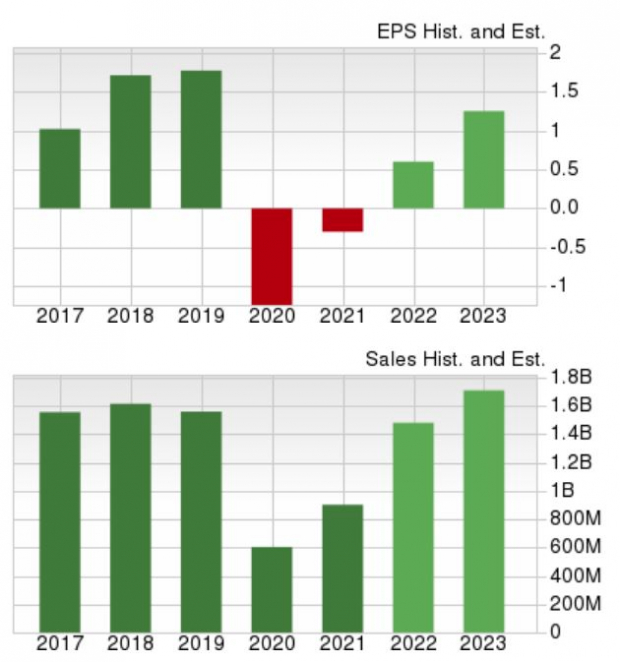

Q4 Preview

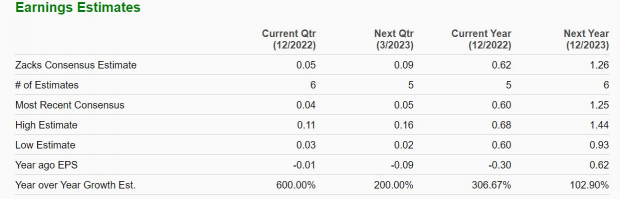

TripAdvisor’s Q4 earnings are expected to be up at $0.05 per share compared to EPS of -$0.01 in Q4 2021. Overall, fiscal 2022 earnings are now projected to be up to $0.62 per share, with EPS at -$0.30 in 2021.

Even better, fiscal 2023 earnings are projected to climb another 103% to $1.26 per share. On the top-line, Q4 sales are forecasted to be $343.79 million, up 42% from the prior year quarter. Total sales are now forecasted to jump 64% for FY22 and rise another 17% in FY23 to $1.73 billion. More importantly, FY23 sales would be 11% above pre-pandemic levels, with 2019 sales at $1.56 billion.

Image Source: Zacks Investment Research

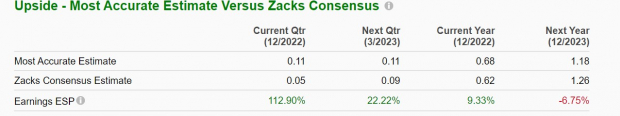

Earnings ESP

The Zacks Expected Surprise Prediction indicates that TripAdvisor could top Q4 bottom-line expectations, with the Most Accurate Estimate at $0.11 per share and the Zacks Consensus having EPS at $0.05.

Image Source: Zacks Investment Research

Takeaway

With TripAdvisor stock trading attractively relative to its past from a valuation standpoint, a strong earnings beat and positive guidance could lead to more upside. Shares of TripAdvisor have rallied 34% to start the year largely outperforming the broader indexes.

The company’s outlook will be important during its quarterly release, and for now, holding on to TripAdvisor stock could pay off as we move closer to the peak travel months during the summer.

Bottom Line

These three stocks are starting to stand out from a valuation standpoint as they look to recover from the broader economic challenges and higher operating costs. Monitoring the guidance and outlook they offer in their quarterly reports will be important, as positive commentary in this regard could help these stocks soar from current levels.

More By This Author:

These 3 Companies Generate Serious CashCisco Q2 Preview: Another EPS Beat Inbound?

PayPal Tops Q4 Earnings Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more