These 3 Companies Generate Serious Cash

Image: Bigstock

Scouting for stocks can sometimes be tiring, especially with so many options out there. However, one common metric investors love to focus on is free cash flow. Still, what is free cash flow?

Free cash flow is the total cash a company holds onto after paying for operating costs and capital expenditures. It speaks volumes about a company’s financial health, but in what way?

A healthy free cash flow provides more growth opportunities, a higher potential for share buybacks, stable dividend payouts, and the ability to wipe out any debt with ease.

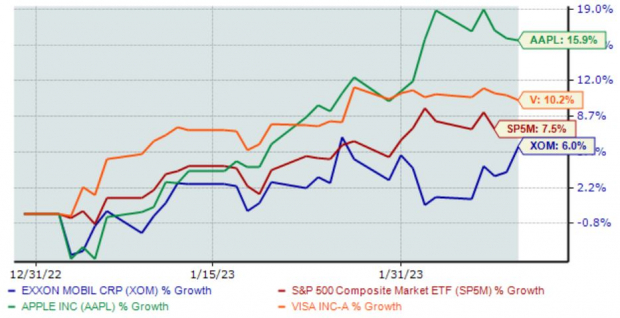

These three companies – Apple (AAPL - Free Report), Exxon Mobil (XOM - Free Report), and Visa (V - Free Report) – boast strong cash-generating abilities. Below is a chart illustrating the year-to-date performance of all three, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Exxon Mobil

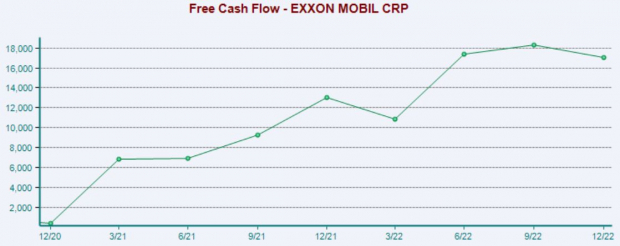

Exxon Mobil is a U.S.-based oil and gas entity, and one of the world's largest publicly traded energy companies. Rising energy prices have benefited the company significantly; XOM generated $17.1 billion in free cash flow throughout its latest quarter, growing an impressive 30% year-over-year.

Image Source: Zacks Investment Research

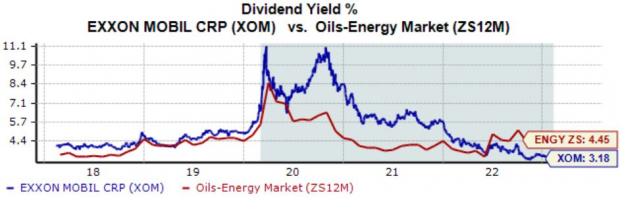

In addition, the company rewards its shareholders via its annual dividend, currently yielding a solid 3.2% paired with a sustainable payout ratio sitting at 26% of its earnings.

Image Source: Zacks Investment Research

Apple

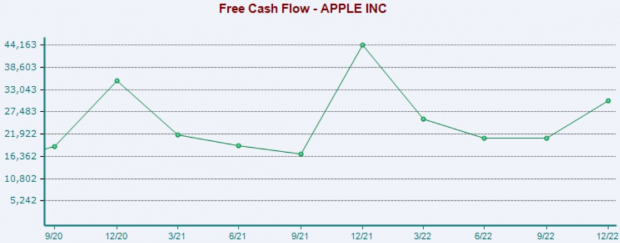

We’ve all become familiar with Apple, the mega-cap technology giant that’s been a portfolio staple for quite some time now. The company generated an impressive $30.2 billion in free cash flow throughout its latest quarter, growing 45% sequentially.

Image Source: Zacks Investment Research

In addition, AAPL shares have recently been seen trading trade at a 24.9X forward earnings multiple, below the steep highs of 31.3X in 2022 and modestly above the Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

Visa

A multinational financial services company, Visa facilitates electronic funds transfers through Visa-branded debit, credit, and prepaid cards. In the company’s latest release on Jan. 26, Visa reported free cash flow of nearly $4 billion, slipping marginally year-over-year in the face of a harsh economic environment.

Image Source: Zacks Investment Research

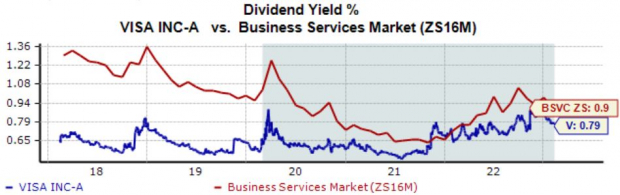

While the company’s 0.8% annual dividend is below the Zacks Finance sector average, Visa’s 15.3% five-year annualized dividend growth rate helps to pick up the slack in a big way.

Image Source: Zacks Investment Research

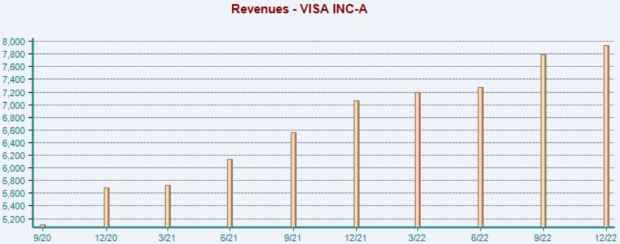

In addition, Visa has an impressive earnings track record, exceeding earnings and revenue estimates in 12 consecutive quarters. Just in its latest release, the company registered a nearly 9% EPS beat and reported revenue 3.4% above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Companies with strong cash-generating abilities are well-established and carry highly-successful business operations, which are undoubtedly perks that any investor would look for.

And all three companies discussed above – Apple (AAPL - Free Report), Exxon Mobil (XOM - Free Report), and Visa (V - Free Report) – have very little issue generating cash.

More By This Author:

Cisco Q2 Preview: Another EPS Beat Inbound?

PayPal Tops Q4 Earnings Estimates

Crocs Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more