Cisco Q2 Preview: Another EPS Beat Inbound?

Image Source: Pixabay

Earnings season is always busy, with an extensive list of companies unveiling what’s transpired behind the scenes daily.

We’ve already seen many notable companies report, including big tech, banks, and many others.

Now, Cisco Systems (CSCO - Free Report) is gearing up to unveil its quarterly results on February 15th, after the market close.

Cisco Systems is an IP-based networking company offering products and services to service providers, companies, commercial users, and individuals.

How does the company currently stack up? We can use results from a peer, International Business Machines (IBM - Free Report), as a small gauge. Let’s take a closer look.

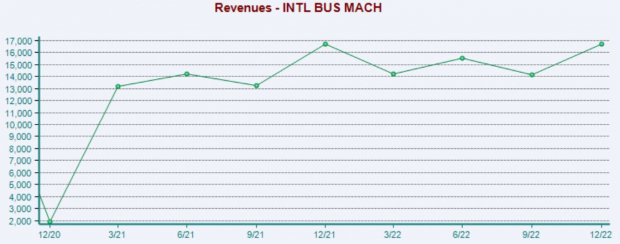

International Business Machines

IBM posted mixed top and bottom line results, falling short of the Zacks Consensus EPS Estimate by a marginal 0.3%.

Quarterly revenue totaled $16.7 billion, exceeding the Zacks Consensus Sales estimate by more than 7% but remaining flat year-over-year. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Further, net cash from operating activities totaled $4 billion, up $1.4 billion year-over-year. And free cash flow throughout the quarter tallied $5.2 billion, growing $1.9 billion from the year-ago quarter.

And to top it off, the company provided guidance for FY23 –

IBM expects constant currency revenue growth in the mid-single digits and forecasts consolidated free cash flow of $10.5 billion, climbing more than $1 billion year-over-year.

Arvind Krishna, CEO, on the quarter, “Our solid fourth-quarter performance capped a year in which we grew revenue above our mid-single digit model. Clients in all geographies increasingly embraced our hybrid cloud and AI solutions as technology remains a differentiating force in today’s business environment."

Now, let’s take a look at Cisco.

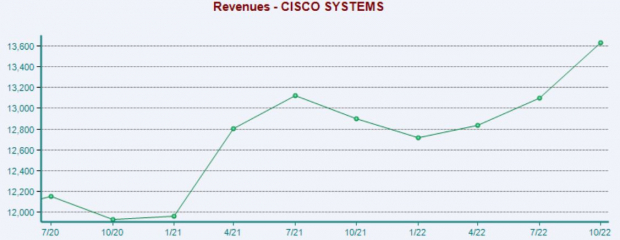

Cisco Systems

Quarterly Estimates –

A singular analyst has upped their earnings outlook for the quarter to be reported over the last 60 days, with the Zacks Consensus EPS Estimate suggesting a 2.4% Y/Y uptick.

Image Source: Zacks Investment Research

In addition, our consensus revenue estimate stands firm at $13.4 billion, indicating an improvement of roughly 5.6% year-over-year.

Quarterly Performance –

Cisco has posted better-than-expected results as of late, exceeding both earnings and revenue expectations in back-to-back quarters.

Just in its latest release, CSCO registered a 2.4% EPS beat and reported sales more than 2% above expectations.

Image Source: Zacks Investment Research

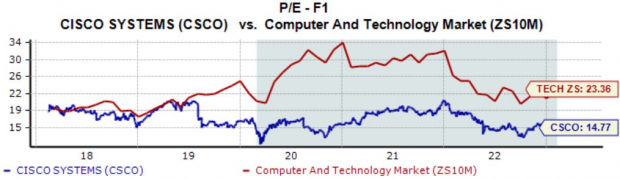

Valuation –

CSCO shares currently trade at a 14.7X forward earnings multiple, below the 16.7X five-year median by a fair margin.

Image Source: Zacks Investment Research

Further, the company’s forward price-to-sales currently works out to be 3.5X, again below the 4.1X five-year median.

Image Source: Zacks Investment Research

CSCO carries a Style Score of “C” for Value.

Putting Everything Together

Earnings season is one of the most critical periods for stocks, and for obvious reasons.

So far, we’ve received an extensive list of quarterly prints, and many more are on their way in the coming weeks.

Next week, we’ll receive results from Cisco Systems.

A singular analyst has upped their earnings expectations for the quarter to be reported, with estimates suggesting positive year-over-year changes in earnings and revenue.

In addition, the company’s forward price-to-sales and forward earnings multiple sit below their five-year medians.

Heading into the release, Cisco Systems (CSCO Quick QuoteCSCO - Free Report) is a Zacks Rank #3 (Hold) with an Earnings ESP Score of 1.7%.

More By This Author:

PayPal Tops Q4 Earnings EstimatesCrocs Earnings Expected to Grow: What to Know Ahead of Next Week's Release

Kellogg Q4 Earnings And Revenues Beat Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more