Time To Buy These Highly Ranked Building Products Stocks

Image Source: Unsplash

The construction sector may be of interest to investors with the Fed likely to implement a rate cut of 25 basis points in September.

Of course, lower interest/mortgage rates benefit homebuilders among other building product companies as demand is likely to rise for their services.

Keeping this in mind, here are three highly-ranked building products stocks that were added to the Zacks Rank #1 (Strong Buy) list this week.

LSI Industries (LYTS - Free Report)

We’ll start with LSI Industries, with it noteworthy that its Zacks Building Products-Lighting Industry is in the top 1% of over 250 Zacks industries. LSI Industries is benefiting from its strong business environment as an image solutions company that supplies high-quality lighting fixtures for applications in the retail, specialty niche, and commercial markets.

With its stock trading at $15, LSI Industries' valuation supports its affordable price tag. LSI Industries stock trades at a 17.3X forward earnings multiple with EPS expected to be up 6% in its current fiscal 2025 and projected to soar another 34% in FY26 to $1.18 per share. More intriguing is that LSI Industries stock trades below the optimum level of less than 1X sales with its top line slated to increase 14% in FY25 and projected to rise another 7% in FY26 to $577.31 million.

In addition to its strong buy rating, LSI Industries has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

Image Source: Zacks Investment Research

MI Homes (MHO - Free Report)

Among homebuilders, MI Homes stands out as one the leading builders of single-family homes in the United States. Notably, the Zacks Building Products-Home Builders Industry is in the top 6% of all Zacks industries.

MI Homes’ earnings potential is very lucrative with its robust bottom line expected to expand 21% this year to $19.58 per share versus EPS of $16.21 in 2023. Even better, MI Homes trades at just 8.4X forward earnings with FY25 EPS projected to rise another 7%.

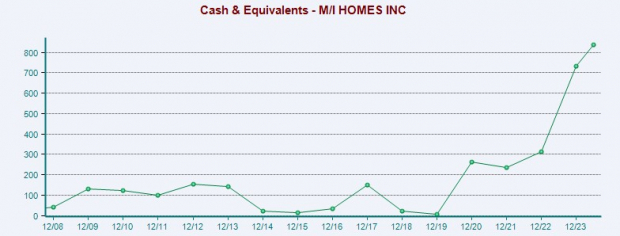

Investors may also be drawn to MI Homes’ balance sheet as its cash and equivalents have skyrocketed from $6 million in 2019 to $837 million at the end of Q2 2024. Furthermore, MI Homes has $4.34 billion in total assets which is nicely above its $1.59 billion in total liabilities.

Image Source: Zacks Investment Research

Century Communities (CCS - Free Report)

Also belonging to the top-rated Zacks Building Products-Homebuilders Industry is Century Communities. Century Communities engages in the acquisition of land and construction for single-family detached and attached residential home projects.

Century Communities’ has a solid balance sheet as well with high double-digit top and bottom line growth in the forecast for FY24. Trading at 9.5X forward earnings, Century Communities FY25 EPS is expected to increase another 15% to $12.24 per share.

Image Source: Zacks Investment Research

Bottom Line

In correlation with their strong business industries, earnings estimate revisions have gone up for these highly-ranked building products stocks. This makes now an ideal time to buy considering their favorable growth trajectories and reasonable valuations.

More By This Author:

BTC Rallies As Fed Signals Rate Cuts: NVDA, COIN, SQ to Gain

Time To Buy The Post Earnings Rally In Cava Group's Stock?

4 Integrated Energy Stocks To Watch Amid Industry Turbulence

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more