Time To Buy The Post Earnings Rally In Cava Group's Stock?

Image: Bigstock

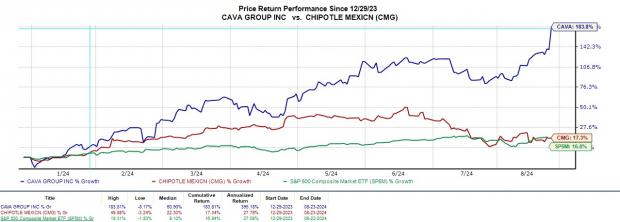

With its business model somewhat mirroring Chipotle Mexican Grill (CMG - Free Report) in regards to Mediterranean cuisine, Cava Group (CAVA - Free Report) has been one of the top-performing stocks since its IPO last year.

The remarkable rally in Cava Group’s stock continued after the company was able to exceed Q2 top and bottom line expectations Thursday evening.

However, investors may be wondering if they should chase the rally in Cava stock, which popped +19% on Friday and has now skyrocketed +183% year-to-date, largely outperforming the broader market and Chipotle’s +17%.

Image Source: Zacks Investment Research

Cava Group’s Q2 Results

Cava Group posted Q2 sales of $233.5 million, which soared 35% from $172.89 million in the comparative quarter. This also exceeded estimates of $222.03 million by 5%.

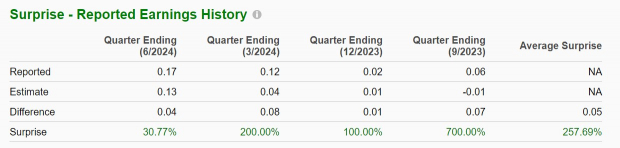

On the bottom line, Q2 EPS of $0.17 dipped from $0.21 per share a year ago, but surpassed estimates of $0.13 a share. Other highlights included a 9.5% spike in traffic, with Cava Group opening 18 new restaurants, including locations in Chicago, in a bid to enter the Midwest market.

Notably, Cava Group has exceeded earnings expectations in each of the five quarters it has reported since going public.

Image Source: Zacks Investment Research

Cava Group's Growth Trajectory

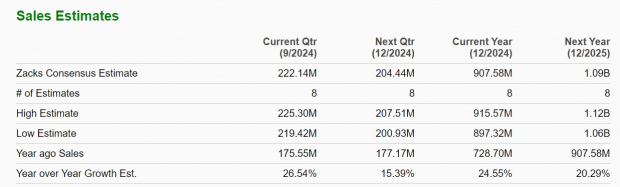

Based on Zacks estimates, Cava Group’s total sales are now projected to climb 24% in fiscal 2024 to $907.58 million compared to $728.7 million in 2023. Cava Group’s top line is expected to expand another 20% in FY25 to $1.09 billion.

Image Source: Zacks Investment Research

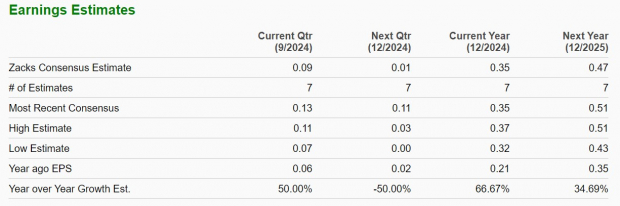

Annual earnings are expected to soar 66% to $0.35 a share versus EPS of $0.21 last year. Plus, FY25 EPS is slated to increase another 34%.

Image Source: Zacks Investment Research

Cava Group’s Valuation

Despite its expansive growth trajectory, Cava Group has been trading at a far-stretched forward earnings premium of 291.3X, although this can be expected for a company that recently went public.

However, Cava Group also trades at a noticeable sales premium to the broader market at 12.8X, with the S&P 500’s average at 5.4X and Chipotle at 6.4X.

Image Source: Zacks Investment Research

Bottom Line

Although Cava Group’s Q2 results helped to reconfirm its expansion, the stock lands a Zacks Rank #3 (Hold) rating. Cava Group is certainly an intriguing long-term investment, but there could be better buying opportunities considering its monstrous year-to-date rally which has stretched the company’s valuation.

More By This Author:

4 Integrated Energy Stocks To Watch Amid Industry Turbulence2 Small Caps Recently Upgraded To Outperform

3 Highly Ranked REITs To Buy With Rate Cuts Ahead

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more