These 3 Companies Recently Unveiled Fresh Buyback Programs

Image: Bigstock

Stock buybacks, also known as share repurchase programs, are commonly implemented by companies to boost shareholder value. A stock buyback occurs when a company purchases outstanding shares of its stock, essentially re-investing in itself.

There are several reasons companies elect to buy back their stock: companies have decided to utilize excess cash, want to limit dilution caused by employee stock option programs, or simply because they believe their shares are undervalued.

Three companies – NVIDIA (NVDA - Free Report), NVR (NVR - Free Report), and Ameriprise Financial (AMP - Free Report) – have all recently unveiled repurchase programs. Let’s take a closer look at each.

NVIDIA

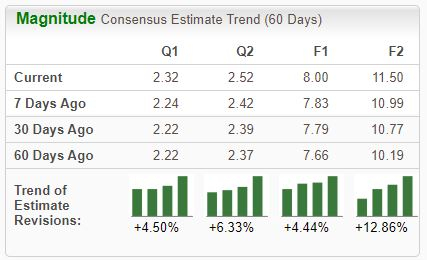

NVIDIA unveiled an additional sizable $25 billion share buyback following its latest blowout quarter, undoubtedly to the likes of investors. The stock is a Zacks Rank #1 (Strong Buy), with earnings estimate revisions hitting the tape across the board.

Image Source: Zacks Investment Research

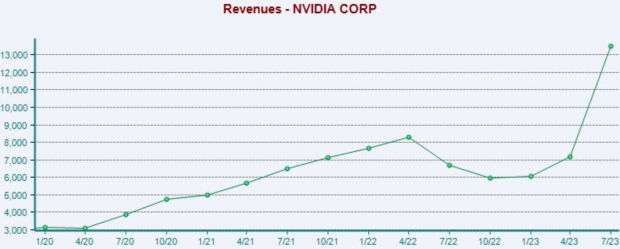

Regarding the mentioned quarter, the company exceeded the Zacks Consensus EPS Estimate by nearly 30% and posted a 20% revenue beat.

Earnings improved 430% year-over-year, whereas revenue jumped 100% from the same period last year. Data Center revenue, which consists of AI chips, grew a remarkable 140% sequentially and 170% year-over-year, crushing expectations.

Image Source: Zacks Investment Research

NVR

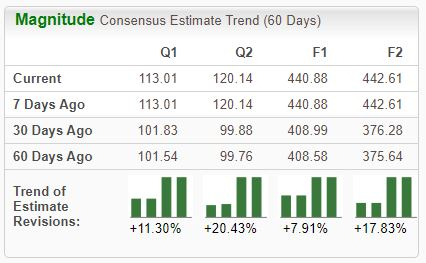

Directors of NVR recently authorized a $500 million share buyback on Aug. 2. Analysts have taken their earnings expectations higher across the board, helping land the stock into a Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

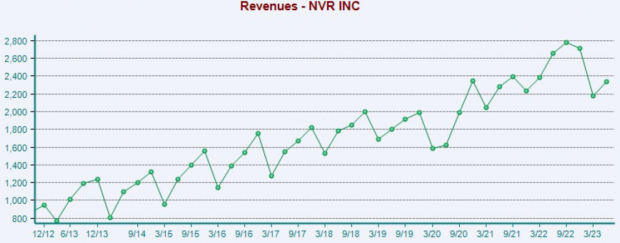

The company has consistently exceeded quarterly estimates, sporting an average 10% EPS beat across its last four quarters. Just in its latest release, the company beat bottom line expectations by more than 15%, but it delivered a slight revenue miss.

Image Source: Zacks Investment Research

Ameriprise Financial

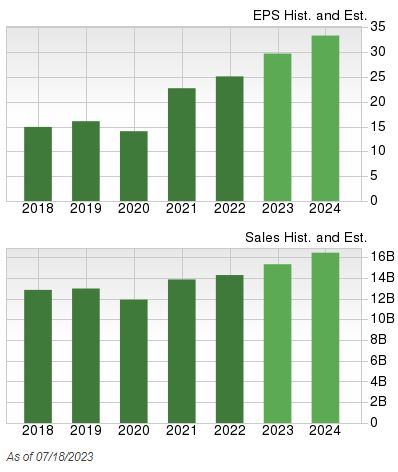

Ameriprise Financial authorized an additional $3.5 billion share repurchase program in late July. The stock is currently a Zacks Rank #3 (Hold).

The company’s growth profile is hard to ignore, further reflected by its Style Score of “B” for Growth. AMP’s earnings are forecasted to climb 20% in its current year on 10% higher revenues. Peeking ahead to FY24, expectations allude to a further 12% bump in earnings paired with 7% higher sales.

Image Source: Zacks Investment Research

Bottom Line

A common way that companies boost shareholder value is through implementing share buybacks. In its simplest form, buybacks represent a company essentially re-investing in itself. In addition, it can provide a nice confidence boost for investors, as the buybacks indicate that the company is utilizing its excess cash and not just hoarding it.

All three stocks discussed above – NVIDIA (NVDA - Free Report), NVR (NVR - Free Report), and Ameriprise Financial (AMP - Free Report) – have recently unveiled repurchase programs, attempting to maximize shareholder value.

More By This Author:

3 Basic Materials Stocks To Buy For Sound Growth & Value

Buy These 3 Low-Beta Stocks To Navigate Volatility

Bear of the Day - Ashland Inc.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more