Bear Of The Day - Ashland Inc.

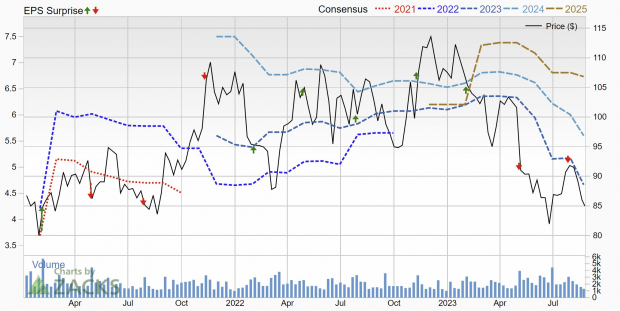

Ashland Inc. (ASH) , a specialty chemical company, is underperforming the market and experiencing earnings downgrades due to industry headwinds. Ashland Inc sales fell -15% YoY as customers de-stocked inventory due to macroeconomic uncertainty, while tight raw materials supply increased costs.

This challenging environment is showing up in earnings misses, a declining stock price, and earnings estimates that continue to roll over, giving ASH a Zacks Rank #5 (Strong Sell) rating.

(Click on image to enlarge)

Image Source: Zacks Investment Research

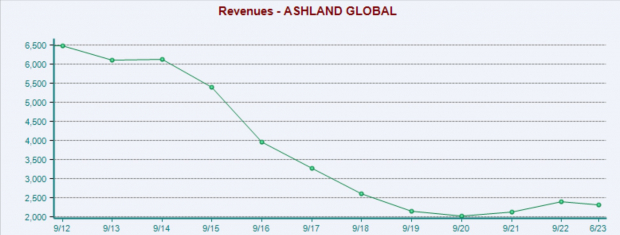

Sales Sliding

Sales and earnings have been falling at Ashland for some time, and the stream of recent challenges it faces only exacerbate that trend. Annual sales have been steadily declining over the last ten years, dropping from $6.5 billion to $2.3 billion today. It looked like 2020 may have been the trough, though the current situation lends to the possibility of new lows for revenue.

That being said, EPS have not declined nearly as much as sales. Over the last ten years EPS has fallen from $6.00 to $5.09, indicating that they have significantly improved profitability even with the lower sales. Nonetheless, near-term challenges mean the stock should be avoided until there is a material improvement in earnings estimates.

(Click on image to enlarge)

Image Source: Zacks Investment Research

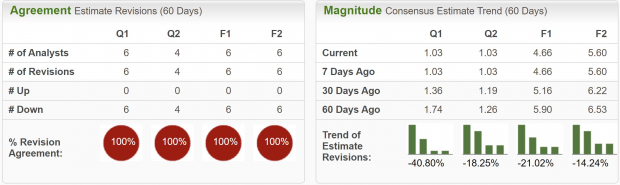

Earnings Estimates Crater

Current quarter earnings estimates have been downgraded by -41% over the last two months and are expected to fall 29.4% YoY to $1.03. Additionally, FY23 estimates have been revised lower by -21% and are forecast to fall -18.3% YoY to $4.66 per share.

Sales are also projected to fall in the current quarter, next quarter and FY23, however they are expected to rebound in FY24 with a 5% YoY gain.

Image Source: Zacks Investment Research

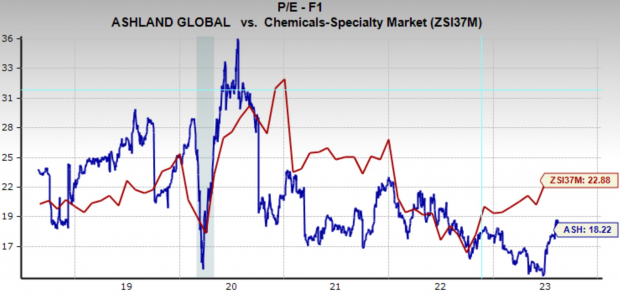

Valuation

ASH is trading at a one year forward earnings multiple of 18.2x, which is below the industry average of 22.9x, and below its five-year median. While this is a relatively fair valuation, falling sales growth and macroeconomic headwinds mean it is still too high.

Image Source: Zacks Investment Research

Bottom Line

Ashland Inc. is by no means a business that I expect to disappear. The company provides goods for an array of industries, has a dividend payment it regularly increases, and steadily repurchases shares. However, in the near-term, falling earnings estimates and shifting economic trends make the situation far too uncertain to consider investing in the stock.

While I think there is a path where ASH turns the business around, now is not the time to expect that to materialize and thus investors should look for opportunities elsewhere in the market.

More By This Author:

Ulta Beauty Tops Q2 Earnings And Revenue Estimates3 Invesco Mutual Funds For Impressive Returns

3 Dodge & Cox Mutual Funds For Strong Investment Returns

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more