Buy These 3 Low-Beta Stocks To Navigate Volatility

Image: Bigstock

Volatility has hit the market following the end of the Q2 cycle, with several areas facing pressure in the near-term. Technology has gotten a haircut after its remarkable run, whereas energy stocks have primarily enjoyed positive price action amid the recent rise in oil prices.

During times of market volatility, investors can benefit by targeting low-beta stocks, as they’re less susceptible to the general market’s movements.

Three low-beta stocks – Arch Capital Group (ACGL - Free Report), NetEase (NTES - Free Report), and Chubb Limited (CB - Free Report) – could all be considerations for those looking to shield themselves against volatility. Let’s take a closer look at each.

Arch Capital Group

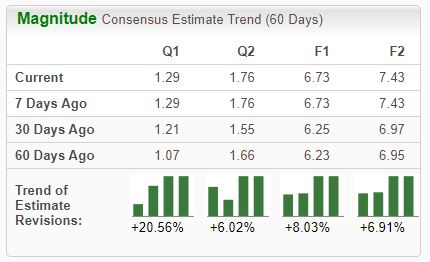

Arch Capital Group writes insurance, reinsurance, and mortgage insurance worldwide. The company is a Zacks Rank #1 (Strong Buy), with earnings expectations increasing across the board.

Image Source: Zacks Investment Research

Given its growth trajectory, the company’s shares aren’t expensive, currently trading at an 11.2X forward earnings multiple. ACGL is forecasted to see 40% earnings growth in its current year on 30% higher revenues, with estimates for FY25 alluding to a further 10% bump in the bottom line paired with a 15% sales increase.

Image Source: Zacks Investment Research

Arch Capital is a consistent earnings performer, exceeding the Zacks Consensus EPS Estimate by an average of 27% across its last four releases. Just in its latest print, ACGL exceeded consensus earnings and revenue estimates by 16% and 2%, respectively.

NetEase

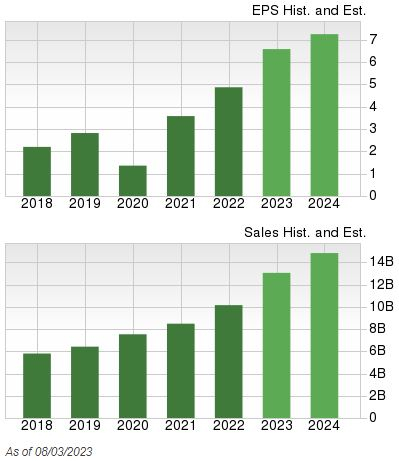

NetEase, a current Zacks Rank #1 (Strong Buy), is an Internet technology company engaged in the development of applications, services, and other technologies for the Internet in China. Analysts have taken their earnings expectations higher across all timeframes.

Image Source: Zacks Investment Research

For those who prefer dividends, NTES shares have that covered; shares currently yield 1.9% annually, paired with a payout ratio sitting at 22% of the company’s earnings. Dividend growth is also apparent, with the company sporting a sizable 25% five-year annualized dividend growth rate.

And similar to ACGL, NetEase shares aren’t expensive given the company’s forecasted growth, with earnings forecasted to see a 23% improvement on 4% higher sales in its current year. Shares trade at a 15.9X forward earnings multiple (F1), nowhere near the steep 26.3X five-year median.

Image Source: Zacks Investment Research

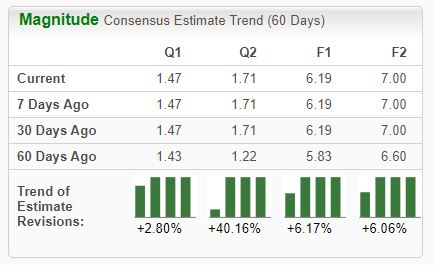

Chubb Limited

Chubb, a Zacks Rank #2 (Buy), is the world's largest publicly traded property and casualty insurance company. Like NTES, the company sports a shareholder-friendly nature, with shares currently yielding 1.7% annually. Chubb’s payout has grown by a modest 3% annualized over the last five years.

Image Source: Zacks Investment Research

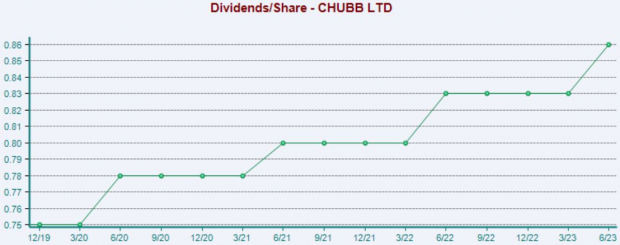

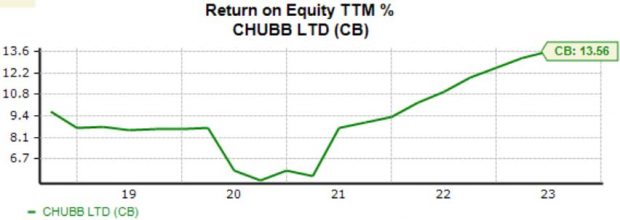

In addition, the company’s return on equity (ROE) has been on a solid trajectory, as illustrated in the chart below. This reflects that Chubb has been successfully generating profits from existing assets, which is undoubtedly a positive.

Image Source: Zacks Investment Research

Bottom Line

Targeting low-beta stocks can help shield against volatility, as these stocks are less sensitive to the general market’s movements. And with volatility ticking higher as of late, it could be beneficial to consider adding low-beta stocks.

And all three stocks discussed above – Arch Capital Group (ACGL - Free Report), NetEase (NTES - Free Report), and Chubb Limited (CB - Free Report) – could be considered, as their earnings outlooks have recently shifted positively.

More By This Author:

Bear of the Day - Ashland Inc.Ulta Beauty Tops Q2 Earnings And Revenue Estimates

3 Invesco Mutual Funds For Impressive Returns

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more