The AI Trade: Opportunity Or Warning?

Image Source: Pixabay

Market Brief – AI Trade Lives On As “Santa Rally” Comes Into View

The markets experienced another volatile trading week as we head into a shortened trading week due to the Thanksgiving holiday. The S&P 500 and Nasdaq both closed the week lower, but rallied on Friday as options expiration took hold. The consistent selling pressure in AI and semiconductor-related stocks had reversed previous overbought conditions enough for a bounce. The big news was Nvidia’s earnings. Despite the market’s poor reaction (a very normal response following its earnings report), the numbers were stellar.

(Click on image to enlarge)

Nvidia’s earnings beat didn’t just meet expectations; it crushed them on nearly every metric. Revenue jumped 34% quarter over quarter, with data center sales up 41%. Demand for high-performance GPUs continues to outpace supply, and CEO Jensen Huang dismissed fears of a bubble, saying, “This is the beginning of a new industrial revolution.” That quote made the rounds for good reason. The stock’s post-earnings surge lifted the entire tech complex and added another leg to the year’s dominant trade: AI infrastructure.

(Click on image to enlarge)

Importantly, Nvidia’s numbers were more than a sentiment boost. They were confirmation that capital expenditures in AI, particularly by the largest tech platforms, remain robust. Microsoft, Amazon, and Meta are all spending aggressively on AI buildouts, and Nvidia sits at the center of that spend. That’s why the stock’s move matters: it’s not just about one company, it’s a read-through on the entire AI supply chain.

On the macro side, the data flow stayed supportive. Jobless claims ticked up slightly, but not enough to suggest deterioration. Inflation expectations, as measured by both breakevens and consumer surveys, remained anchored. Bond yields eased modestly, allowing equities more breathing room. This backdrop checks the boxes on what Nomura refers to as the “Santa Rally” setup: cooling inflation, stable employment, improving liquidity, and no immediate Fed pushback.

Still, not all signals are green. Valuations, particularly in the tech sector, remain elevated, with the forward P/E ratio on the Nasdaq 100 above 25x, significantly higher than historical averages. Meanwhile, earnings growth has slowed in some areas. The market is clearly pricing in an ideal scenario, continued growth, disinflation, and no policy mistakes. That leaves little room for error.

Heading into December, the seasonal tailwinds remain intact, as noted above. December is historically the best month for equities, with the “Santa Claus rally” often delivering average gains of 1.5% to 2.0%. With corporate buybacks in full swing, adding $5-6 billion in daily volume, investor positioning remaining stable, and professional managers underweight in exposure, particularly in technology companies, the fuel for a rally is present. However, the market also remains fragile due to poor underlying breadth and rising volatility, so caution is advised.

The near-term outlook is constructive, provided the Fed remains quiet and bond volatility remains contained. But any surprise, in inflation, growth, or geopolitics, could shift sentiment quickly. The key for investors is discipline. Don’t chase the rally blindly. Stick to quality, stay diversified, and use elevated prices to trim into strength where appropriate. While the potential for a year-end rally is higher after the recent correction, nothing is guaranteed.

Let’s review the technical backdrop.

Technical Backdrop – Breadth Tumbles

The bullish run of the past few weeks lost its footing as the S&P 500 closed back below its 50-day moving average, ending the week at 6,603. That break is notable. This level, which had previously served as reliable support since the late October low, gave way under broad selling pressure across sectors. Volume picked up on the move lower, and market breadth weakened significantly, with relative strength and breadth remaining very weak. Furthermore, money flows show the shift from accumulation to distribution.

(Click on image to enlarge)

From a technical standpoint, the index broke below the 50-day moving average, a key support level, and fell to the 100-day moving average during Thursday’s market reversal. While there was much speculation about why the market reversed so significantly on Thursday, most of that reversal was likely due to positioning changes ahead of the options expiration on Friday, which was the largest November expiration on record.

While Friday’s strong bounce of the 100-day moving average is encouraging, we are not out of the woods just yet. As noted above, relative strength and breadth continue to be a concern. Should the 100-day moving average not hold, the next area of support sits around the 200-day moving average near 6,163. However, for now, the current pullback remains within a larger bullish structure, but pressure is mounting that should not be dismissed.

Other markets did not escape the selling pressure this past week. The Nasdaq Composite saw downside follow-through, losing nearly 2.75% on the week and closing back below short-term support levels. The AI-related stock basket declined by more than 5%, while Bitcoin fell by almost 10%. Overall, it was a tough week for investors, but the good news is that most markets are now decently oversold, which is enough for a bounce.

We suggest that investors who struggled emotionally during the recent selloff reassess their positioning. If you found the drawdown difficult to handle, take some action:

- Trim Back to Your Risk Tolerance: If the recent decline caused panic or second-guessing, it’s a signal your risk exposure may be too high. Use the bounce to reduce position sizes in volatile or high-beta names. Rebuild your portfolio around positions you can hold through 10–15% corrections without emotional strain. Don’t wait for another leg down to adjust.

- Raise Cash Strategically: Cash is not a missed opportunity — it’s optionality. If you had no flexibility during the decline, use the rally to raise some cash. Trim weaker positions or those that only work in one market scenario. A 10–20% cash allocation gives you the ability to buy future dips rather than sell into fear.

- Reassess Asset Allocation: Market pullbacks test more than individual stock picks — they expose flaws in allocation. Were you too tech-heavy? Too concentrated? Use this bounce to shift into a more balanced mix of growth, value, and defensives. Ensure your exposure isn’t overly reliant on a single theme, such as AI, small caps, or speculative sectors.

- Review Your Exit and Stop Levels: The last two weeks exposed the cost of not having an exit plan. Use this rally to establish or tighten stop-loss levels based on support/resistance — not emotion. Define your max risk per trade or position and write it down. If the market weakens again, you’ll respond with rules, not reactions.

- Document What Went Wrong: Use this bounce as a debrief. What specifically made you uncomfortable during the decline? Was it overexposure, leverage, position sizing, or lack of diversification? Write it out. Then build a checklist for your following trades or allocations. Market stress is unavoidable, but self-inflicted damage can be minimized with better preparation.

This is not the time to chase losses or gamble on full recovery. Use strength to reposition with discipline and clarity. Let the market work for you, not against your temperament.

Key Catalysts Next Week

Next week is a shortened trading week due to the Thanksgiving holiday, but that doesn’t mean it will be quiet. Liquidity will be thinner, which can exacerbate volatility around key data releases. The most important report to watch is the October PCE Price Index, the Fed’s preferred measure of inflation. It will be released on Wednesday and could have a significant impact on rate expectations leading up to December’s FOMC meeting.

Markets are coming off a technically weak stretch, and any upside surprise in PCE could pressure yields higher, further challenging equity valuations. On the flip side, a soft print would reinforce the “Goldilocks” narrative and increase the odds of a continued year-end rally. Also worth watching will be consumer sentiment and spending data. With the holiday shopping season underway, any signs of weakness could impact retail stocks, which have underperformed broadly in the fourth quarter.

Additionally, Fed officials are entering the quiet period ahead of the following policy meeting, meaning this is the final week to hear public comments. Traders should pay attention to any comments around financial conditions or balance sheet policy. With the bond market still adjusting to the Fed’s recent dovish tilt, language from speakers like Waller and Goolsbee could matter more than usual.

With fewer trading sessions and lower volume, markets will be more sensitive to headline risk. Stay nimble and be selective with your positioning as we enter a potentially volatile week.

Need Help With Your Investing Strategy?

Are you looking for comprehensive financial, insurance, and estate planning services? Need a risk-managed portfolio management strategy to grow and protect your savings? Whatever your needs are, we are here to help.

AI Trade Falters

The recent market correction places the “AI trade” under intense scrutiny. Stocks tied to artificial‑intelligence infrastructure, software, and platforms have pulled back, signalling more than a simple sentiment swing. According to Reuters, “investors are fretting over the pace of rate cuts and pricey valuations of heavyweight artificial‑intelligence stocks that have fueled much of the rally.” However, beyond valuation concerns lies a more profound problem: mounting debt issuance and rising credit default-swap (CDS) spreads in key AI-leveraged firms.

Recently, the credit markets have been flashing warning signs. For example, the 5‑year CDS spread for Oracle Corporation has surged to over 100 basis points, up markedly from earlier this year, reflecting increased cost to insure its debt. The trading volume in CDS tied to AI sector debt increased to approximately $4.2 billion over a recent six-week period.

As we discussed in our Daily Market Commentary,

“CDS stands for credit default swaps. These are derivative contracts in which one party, the default protection buyer, pays a quarterly fee, expressed in basis points. In return, the counterparty, or protection provider, assures that in the event of default, the buyer will receive par for their bonds. CDS spreads, or the cost of default insurance, provide the market with an easy way to quantify the implied market default probability. While simplified, here is the math to calculate default risk:”

Essentially, the formula divides the cost of insurance by the bond’s par value less the recovery rate. The recovery rate represents the percentage of the bondholders’ investment that will be recovered in the event of default. Often, the market assumes only a 30- to 40-cent recovery of the original investment. Therefore, if we apply that math to the five-year Oracle and CoreWeave CDS spreads, and assuming a 35% default recovery, we get the following annual default probabilities.

- Oracle CDS 108 bps: 108 / (10,000*(1-0.35)) = 1.66%

- CoreWeave CDS 675 bps: 675 / (10,000*(1-0.35)) = 10.38%

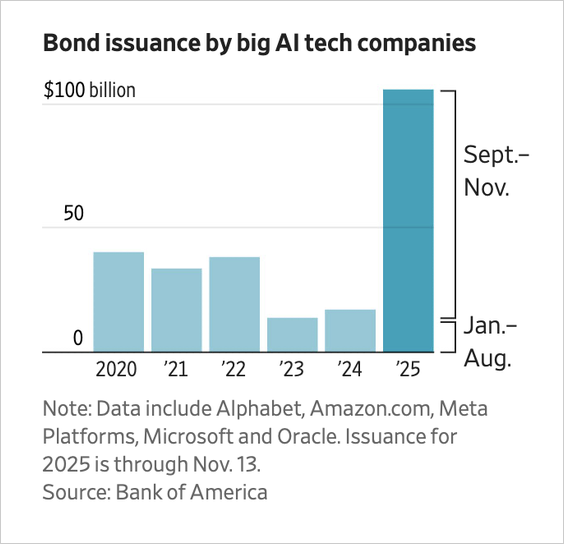

In other words, despite the fear-mongering of the media, default risks remain exceptionally low. So, why this spike? Because tech firms are raising huge sums to build AI data centres and platforms, which took the markets a bit by surprise. Oracle alone plans a $38 billion debt raise and could see net debt near $290 billion by 2028.

The increased leverage introduces refinancing and interest-rate risks, which were previously mostly nonexistent. While the “Mega-cap” companies have large free cash flows, a rising concern is that they are “over-investing” in the future.

“For the first time since Aug’05, a majority (net 20%) of FMS investors say companies are overinvesting; this jump is driven by concerns over the magnitude & financing of the AI capex boom.” – BofA

(Click on image to enlarge)

These are companies counting on large future cash flows to justify their expenditures and debt loads. When investors buy CDS protection, it means they assign a non-trivial probability to default or distress. That signals the market’s growing caution toward the AI growth narrative. Therefore, it is understandable why the recent correction in the “AI trade” has been more than just a minor fluctuation. It is reflecting investors’ demand for proof regarding execution, earnings, and balance-sheet resilience.

From an investor’s viewpoint, this means determining whether the current correction is genuinely a “thesis shift” or just a long-overdue price correction. The AI trade that powered recent rallies was built on promise and narrative. Now, the same firms are being evaluated on their ability to convert that promise into profits while managing sizable debt burdens in a higher interest rate environment.

These concerns raise a critical question.

Is the recent equity sell‑off an early warning or an entry point?

Opportunity or Warning?

The structural opportunity for the “AI trade” remains substantial. According to a report from McKinsey & Company, generative AI and other advanced AI use cases could unlock as much as $4.4 trillion in productivity gains for business users alone. Meanwhile, research from S&P Global Market Intelligence indicates that the market for code‑generation tools is projected to grow at a compound annual growth rate (“CAGR”) of about 53% from 2024 to 2029.

These data points underscore a broad expectation: companies that adopt AI at scale will see top‑line growth and cost efficiency improvements. Another research piece from the Boston Consulting Group shows that the adoption of “agentic AI” is set to rise from 17% of total AI value in 2025 to 29% by 2028, suggesting a transition from pilot phases to genuine business deployments. Further adding to the opportunity, the Bank of England has flagged that between 2025 and 2028, AI infrastructure capital expenditure may reach as high as $2.9 trillion, with roughly $1.5 trillion of that coming from external capital sources.

While debt is being used to build data centers, that same debt is “productive” and will boost economic growth, which in turn increases revenues to these companies from increased demand. For more on the impact of spending on economic growth, you can read:

- The Deficit Narrative May Find Its Cure In Artificial Intelligence – RIA

- Economic Reacceleration: A Contrarian View – RIA

- Capex Spending On AI Is Masking Economic Weakness – RIA

Further supporting the bull case, Nvidia’s recent earnings shattered expectations. The company reported record sales and raised its guidance again, with CEO Jensen Huang explicitly rejecting the notion of an AI bubble.

“We are at the beginning of a new computing era. What we see is not hype. It’s real, broad-based demand across nearly every industry.” – CNBC

Demand for GPUs remains so high that hardware is selling out despite increased supply, a sign that adoption is continuing at a substantial pace. These fundamentals suggest that companies correctly positioned in the AI ecosystem may experience significant increases in revenue and cash flow. For example, platforms that host AI workloads, chipmakers who supply the infrastructure, and software vendors who embed AI into enterprise applications could all benefit from a multi-year growth phase. Given that many firms are still in the early stages of monetizing their AI investments, the long-term horizon remains favorable. In other words, if this thesis proves to be true, the current weakness in some AI stocks could represent a tactical entry point for the patient and selective investor.

However, the warning side of the ledger is equally essential.

The rapid advance of AI-related mega-cap stocks in 2025 has already delivered exceptional gains. According to Business Insider, investors are “rethinking the red‑hot AI trade,” noting that some firms with strong earnings still experienced share-price declines because valuation expectations had outpaced actual performance. Similarly, the Bank of England has raised concerns that a “sharp market correction has increased” given stretched valuations, especially in the AI‑tech segment. Goldman Sachs analysts estimate that much of the upside from the AI boom may already be reflected in current stock prices, as they estimate $5 trillion to $19 trillion in extra revenue upside. As noted, their concern, and a valid one, is that the market has already priced in a significant portion of that.

From a fundamental perspective, the warning is two-fold:

- While long-term revenue growth expectations remain strong, many companies have yet to convert investments into substantial cash flows. A study in the arXiv preprint archive introduces a “Capability Realisation Rate” (CRR) model. It states that many AI-native firms are valued based on their future potential rather than their current results, creating a “valuation misalignment risk.”

- The sheer pace of gains in AI‑exposed stocks has raised the bar for future performance. As one analyst put it: “Even a company like Palantir Technologies has seen its share price hammered, even though its results did top expectations, nosebleed valuations got in the way.” In other words, the risk is not just execution, but also expectations that are unrealistically high and already factored into the price.

In summary, the fundamentals support the AI opportunity, driven by a large addressable market, accelerated adoption, and potential for margin improvement. But at the same time, the warning signs are real, from elevated valuations, compressed margins for error, and a market that has already rewarded much of the expected growth. This brings us to two crucial takeaways:

- If you take the long view and are willing to invest in companies with proven execution and realistic valuation, then a measured exposure makes sense.

- But if you are chasing momentum in speculative names, this moment leans more toward caution than indiscriminate buying.

To succeed, you must know yourself.

Know Your Investing Behavior Before You Bet on AI

Before you take a position in the AI trade, you need to understand how you respond to volatility. This is not a casual theme. It is a long-term investment tied to one of the most transformational technologies in decades, but it also comes with risk, hype cycles, and rapid repricing. How you behave during corrections will shape your outcomes more than your entry point.

If you tend to panic sell at the first sign of a 10% decline, then the warning signs discussed earlier should weigh heavily in your decision-making. AI stocks have seen massive runs and are now facing increased scrutiny. The price declines we’ve seen recently are not anomalies, and they are reminders that high-momentum sectors can turn quickly. Even companies with strong fundamentals are vulnerable if investor expectations are unrealistic. As Credit Suisse’s recent behavioral finance outlook put it:

“Narrative-driven investing creates price swings that reward patience and punish emotional decisions.”

This is the phase we’re entering now.

If you’re a long-term investor and can withstand volatility, the AI trade may still be early in its cycle. According to Goldman Sachs, the bulk of AI-driven revenue gains may not materialize until 2027 or later, especially for enterprise use cases and infrastructure services. If you understand that, and you’re building a position with a 3–5 year horizon, the current reset offers an opportunity to build into positions that you will want to own. This assumes you’re disciplined about risk, diversified in your exposures, and clear-eyed about the timeline required for these investments to deliver.

If you don’t know how to manage risk, read: Portfolio Risk Management: Accepting The Hard Truth – RIA

AI is not a meme stock story. It’s a structural transition playing out unevenly across sectors and balance sheets. The volatility will continue, and if you’re inclined to sell during the inevitable drawdowns, then your odds of capturing the long-term value shrink. Recognize your personal investment behavior before deciding how — or if — to engage.

Taking On The AI Trade

If you decide to participate in the AI trade, you need a tactical plan that reflects both the opportunity and the risk.

- Start by narrowing your exposure to quality. Look for firms with proven revenue growth, strong balance sheets, and a clearly defined strategy for monetizing AI. That includes companies like Nvidia, which sits at the center of AI hardware, and Microsoft, which is embedding AI across its product stack. These are firms that have already shown cash flow strength while expanding their AI footprint.

- Next, avoid overconcentration. The “Magnificent Seven” tech stocks are deeply tied to AI but also dominate major indexes. Owning too many of them increases risk if sentiment toward mega-cap tech sours. Consider exposure through ETFs or sector baskets that include both infrastructure and software, but cap your weightings. BlackRock recommends thematic exposure at no more than 5–10% of a diversified portfolio.

- Separate AI narratives from fundamentals. Some companies are tagging AI in their earnings calls without a viable product or strategy. Use earnings transcripts and capital expenditures (Capex) disclosures to determine if their AI investment is credible or marketing-driven.

- Build positions slowly. The volatility in this theme means you are better off accumulating on pullbacks than chasing rallies. Dollar-cost averaging works better in high-beta themes, such as AI.

- Keep dry powder. As the recent spike in credit default swaps shows, debt is a growing concern in the AI build-out. If a major player missteps or if rates stay higher, you’ll see dislocations. Having capital ready lets you take advantage without being forced to sell other positions.

- Have an exit strategy. Whether you’re investing for growth, valuation expansion, or long-term disruption, be aware of your time horizon and risk limits. AI will reshape multiple industries, but not every company betting on it will win. Use fundamentals, sentiment, and your personal discipline to guide how and when you enter or exit.

If you approach this like a venture investor, sizing appropriately, remaining patient, and staying rational, the AI trade can add meaningful upside to your portfolio over time. But if you’re relying on momentum, news cycles, or short-term speculation, you may not be able to stomach the ride.

Trade accordingly.

(Click on image to enlarge)

More By This Author:

Capex Spending On AI Is Masking Economic Weakness

Rate Cut Odds Slip Due To Lack Of Data

Oracle And CoreWeave CDS Spreads Widening: Omen Or Jitters

Disclaimer: Click here to read the full disclaimer.