Tesla: Who Saw This Coming

The Tesla Buy Signal In December

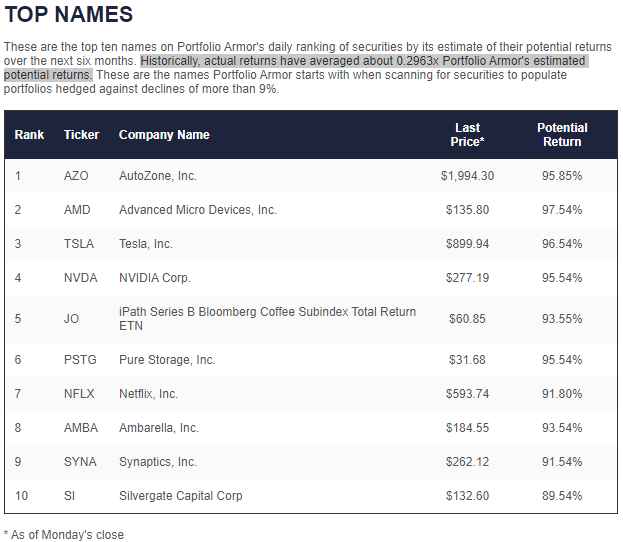

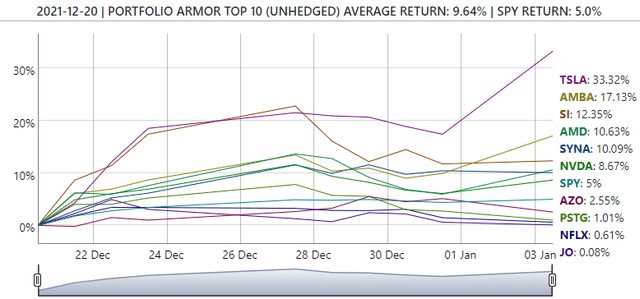

In a post here last month (Time To Buy Tesla), we wrote that it was time to buy Tesla (TSLA), for a couple of reasons. The first was that it was one of our top ten names on December 20th, as measured by our system's gauges of stock and options market sentiment.

Tesla sedans getting recharged in a local Wawa convenience store parking lot (photo by author).

Screen capture via Portfolio Armor on 12/20/2021.

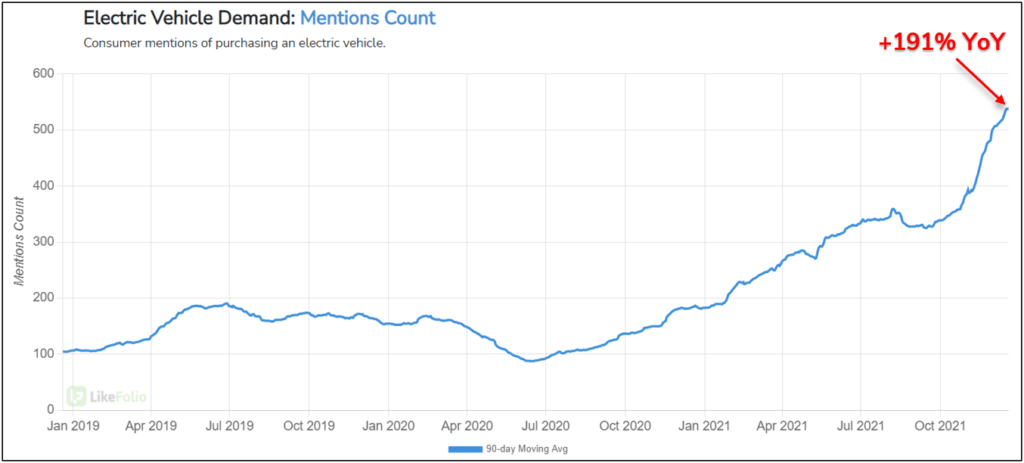

The second was that social data was extremely bullish on the company, as measured by our friends at LikeFolio.

What Social Media Data Said About Tesla

Social media, as we pointed out in December, is essentially a firehouse of people broadcasting their thoughts. A lot of those thoughts are of little interest to others outside of their social media followers, but LikeFolio zeroes in on the thoughts that are relevant to investors: in particular "purchase intent" mentions. If you aggregate all the people talking about how they are about to buy a particular product, you get a sense of the demand for that product. According to LikeFolio, consumer demand for electric vehicles late last year had never been higher.

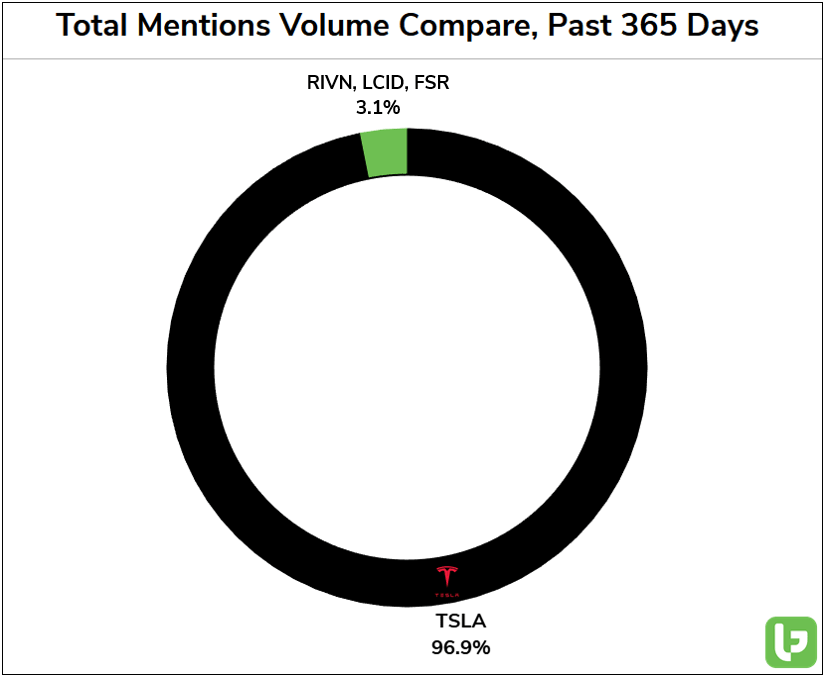

And when consumers talked about buying an electric car, 97% of the time, they were talking about buying a Tesla.

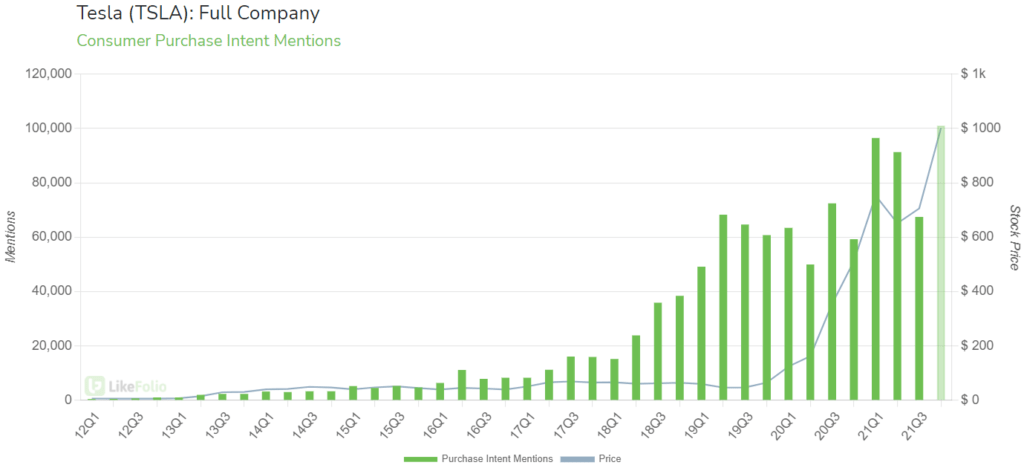

LikeFolio also reported that consumer purchase intent mentions for Tesla specifically the fourth quarter were on pace to be the highest ever.

Tesla Release Consistent With Social Data

Flash forward to this week. On Sunday, Tesla reported delivering 308,000 vehicles in Q4, blowing past Wall Street's consensus estimate of about 263,000 in the quarter. Social data proved more accurate than Wall Street analysts.

After spiking 13.53% on Monday, Tesla shares were up more than a third since we wrote that it was time to buy Tesla.

Other top names of ours up double digits since then were semiconductor companies Ambarella (AMBA), Advanced Micro Devices (AMD), and the crypto bank Silvergate Capital Corporation (SI).

Another Factor To Consider Going Forward

In addition to being a top ten Portfolio Armor name and LikeFolio being bullish on Tesla last month, another factor to consider is that, at the time, Tesla shares had pulled back about 28% from their recent highs. We've seen some preliminary data suggesting that, among our top names, ones that have pulled back recently may outperform. It could be simply a matter of avoiding blow-off tops, but it's something we plan to investigate further and use to refine our security selection process if the data checks out.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more

Tesla is a bubble waiting to burst

Telsa is a bubble waikting to burst https://seekingalpha.com/article/4469935-tesla-tsla-stock-ticking-time-bomb