Time To Buy Tesla

After Getting Crushed

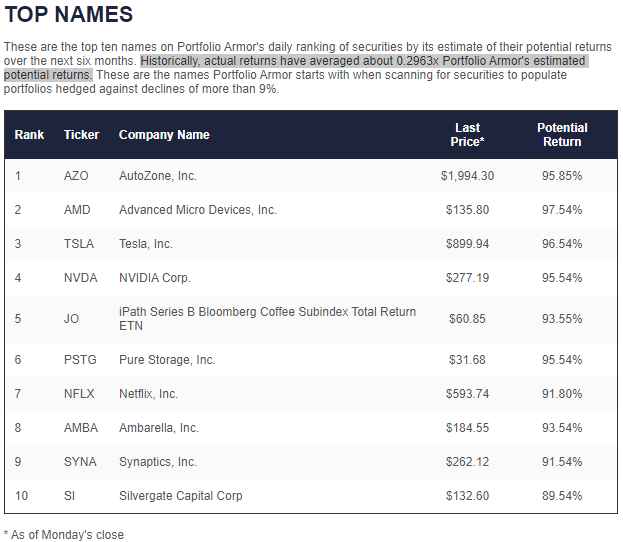

After we wrote about our top ten names from June 17th getting crushed, one correspondent wondered which names our system liked now, in the hopes of betting against them. We'd advise against that, but here you go:

Image Source: Pexels

Screen capture via Portfolio Armor on 12/20/2021.

One thing you may have noticed from Monday's top ten list is that it includes a few tech names that are down double digits over the last month: the chipmakers Advanced Micro Devices (AMD) and Nvidia (NVDA), the streaming content company Netflix (NFLX), and the electric car maker Tesla (TSLA). We'll focus on Tesla here, because, coincidentally, it was highlighted by our friends at the social data firm Likefolio on Monday as well.

What Social Media Data Says About Tesla

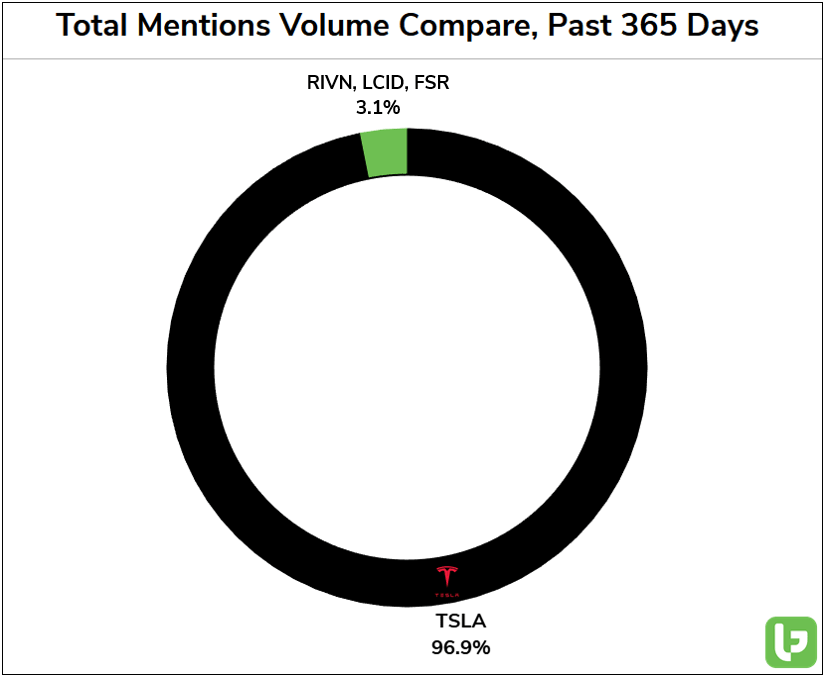

Social media is essentially a firehouse of people broadcasting their thoughts. A lot of those thoughts are of little interest to others outside of their social media followers, but Likefolio zeroes in on the thoughts that are relevant to investors: in particular "purchase intent" mentions. If you aggregate all the people talking about how they are about to buy a particular product, you get a sense of the demand for that product. According to Likefolio, consumer demand for electric vehicles has never been higher.

(Click on image to enlarge)

And when consumers talk about buying an electric car, 97% of the time, they're talking about buying a Tesla.

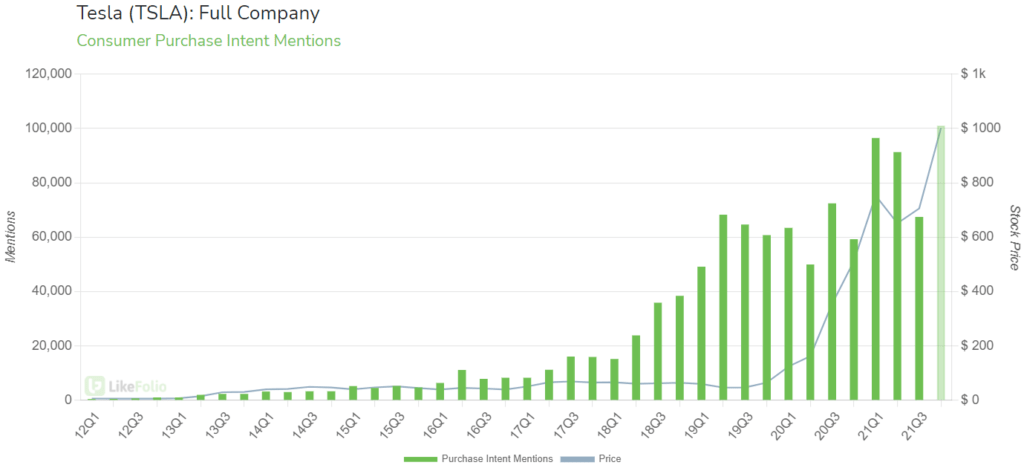

According to Likefolio, consumer purchase intent mentions for Tesla specifically this quarter are on pace to be the highest ever.

(Click on image to enlarge)

The Bottom Line

As of Monday's close, Tesla was down about 28% from its all-time-high in November. Despite that, our system's gauges of options market sentiment were bullish on it on Monday, and Likefolio's gauges of social data suggest customers are buying a lot of Tesla's vehicles now. Taken together, that seems auspicious for Tesla shares over the next several months. As always, we suggest those who buy Tesla or any of our other top names consider hedging in the event we end up being wrong, or the market goes against us.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more

Thank you for an interesting and informative post.

Thanks, Scott. Nice week for Tesla so far, incidentally.