Tesla Reports Dismal Quarter, Missing Across The Board While Burning $10MM In Cash Every Day

Following much confusion about its business model (especially after Tesla announced via Twitter on Tuesday night that it is changing its auto line up yet again, with its flagship Model S and Model X SUV now returning with standard range versions which were canceled in January, while once again lowering prices), and growing fears about flagging end-user demand for its products after the company reported dismal Q1 deliveries with just 12,100 combined model S and X deliveries the lowest total since 2015, investors - especially the shorts who have been piling into Tesla recently, with short interest as a percentage of free float at almost 24% of shares outstanding as of yesterday's close - were keenly waiting for what Tesla would report for its Q1 earnings and how it would guide for the immediate future.

And they waited... and waited... because while traditionally Tesla had reported earnings shortly after 4 pm Eastern, and specifically, these were the last 9 times the earnings release was published:

- 4:19ET

- 4:29ET

- 4:14ET

- 4:11ET

- 4:13ET

- 4:18ET

- 4:12ET

- 4:09ET

- 4:18ET

... this time Tesla waited until well past an hour after the usual release time, or 5:13 pm to be specific, to publish the report, so that investors would have just 17 minutes to read and digest what would be an ugly quarter, and formulate questions ahead of the 5:30 pm earnings call.

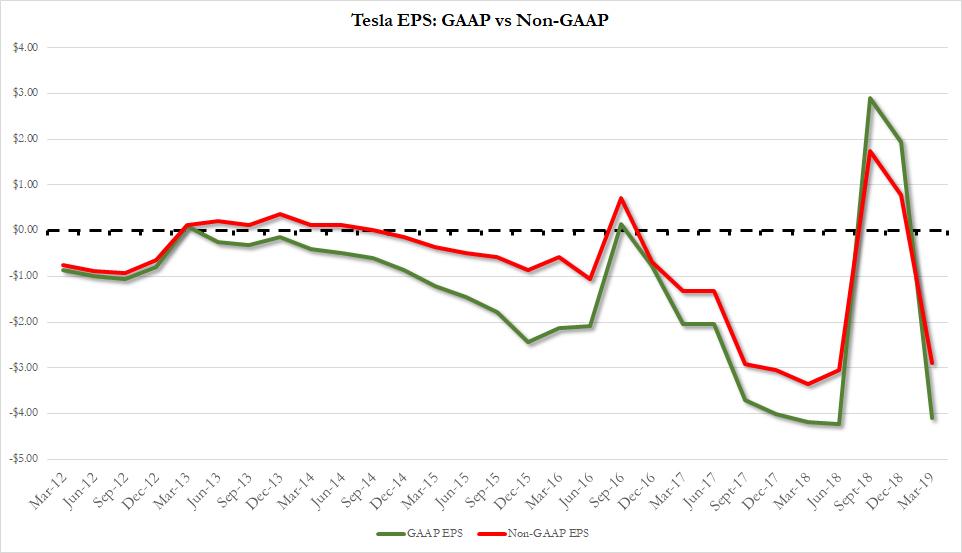

And sure enough, the earnings were indeed a disaster with the company reporting a loss of $2.90 in the quarter, more than double the estimated $1.30 share, on dismal revenue of just $4.54 billion, also far worse than the $4.84 billion expected. The EPS, charted, was clearly a disaster.

Here are some of the other key highlights via Bloomberg:

- Reaffirms Guidance of 360k to 400k Deliveries in 2019

- Says May Produce 500k Vehicles Globally in 2019

- Targets 25% Adj Gross Margin on Model S, Model X, Model 3

- 1Q Cash & Cash Equivalents $2.20B

- Says Expects Order Rate to Improve Throughout Year

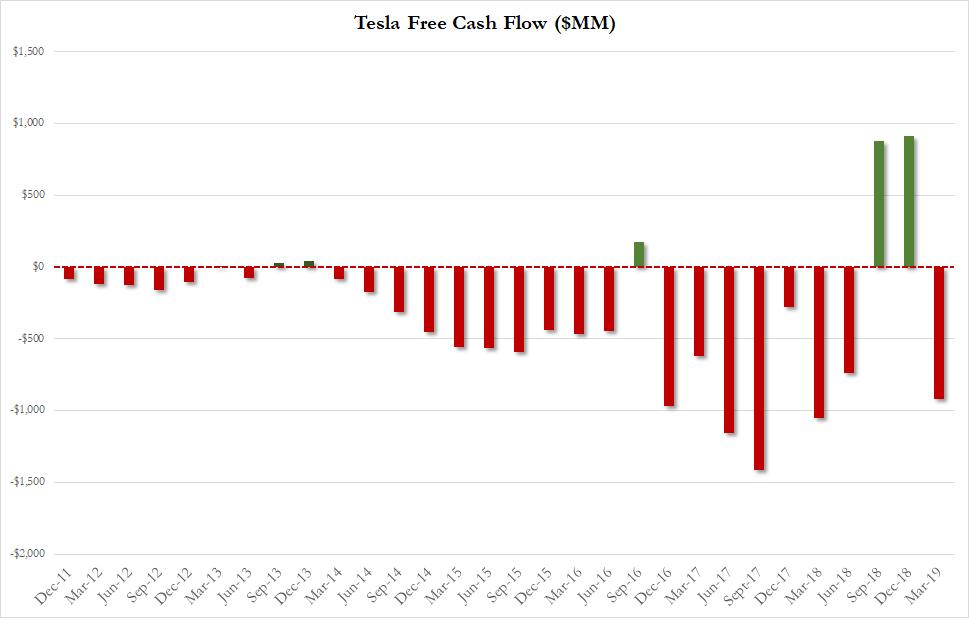

Speaking of the company's liquidity situation, TSLA's cash declined by what may be a record $1.6 billion, with free cash flow (cash from operations less capex), coming it at a whopping $920 million, meaning that TSLA burned $10 million in cash every day.

What is curious is that Tesla's cash burn would actually have been far worse because while the company reported Q1 capital expenditure of $279.9 million, the estimate was for nearly double that or $508.2 million, suggesting the company once again mothballed various expansion projects to mitigate the cash burn.

Going back to core ops, Tesla reaffirmed its guidance from last quarter for 360,000 to 400,000 deliveries in 2019, though it notes "aggressive" internal goals of 500,000 production if the Shanghai factory comes online in time. Of course, since these projections are virtually impossible to hit after the disastrous Q1 deliveries, expect Tesla to cut guidance just ahead of the next earnings release, or the one right after.

Amusingly, for Q2 Tesla says it will deliver between 90,000 and 100,000 vehicles. It's biggest quarter so far was Q4 with 90,700 delivered. This is a reaffirmation of demand, at least from the company's point of view. Needless to say, Tesla will really need to step up the pace in the back half of the year to meet the low end of this full year guidance, which they reaffirmed for 360,000 to 400,000 deliveries. Most likely, it will require slashing the price drastically.

Commenting on the results, Musk said in the letter that "as a result of Q1 pricing actions taken on Model S and Model X, we incurred net $121 million loss for increases in the assumed forecasted return rates for cars sold under our Residual Value Guarantee and Buy Back Guarantee programs, as well as inventory write-downs for used and service loaner inventory." Hardly a glowing endorsement for the residual value of second-hand Teslas. Here is what Musk said:

"As a result of the pricing actions, we adjusted our sales return reserve for cars sold with a Resale Value Guarantee or Buy Back Guarantee. This one-time adjustment had a negative revenue impact of $501 million with a corresponding decrease in automotive cost of goods sold impact of $409 million resulting in a $92 million reduction in gross profit."

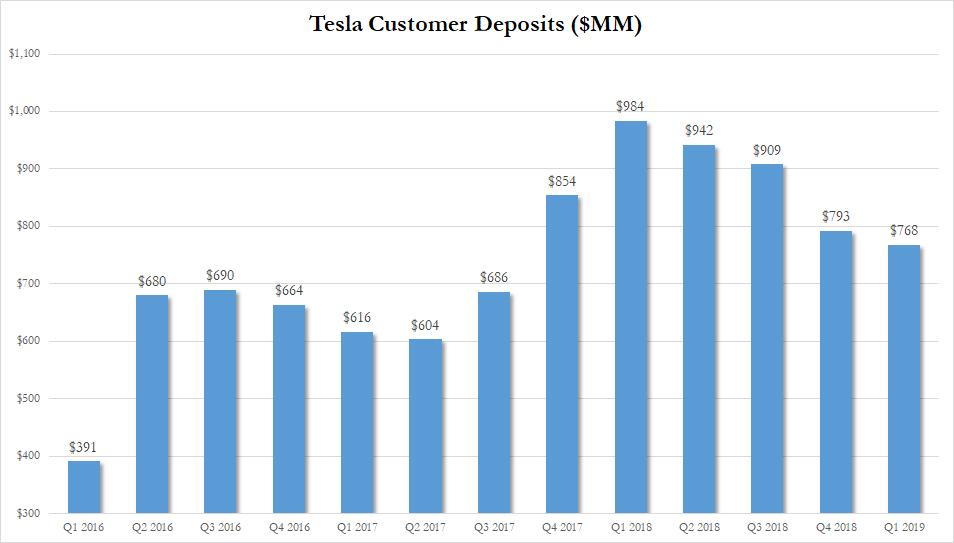

Looking at the all-important demand number, Tesla's customer deposits slumped once again, dropping to $768 million from $793 million in Q4, the lowest number since Q3 2017. While the number was clearly disappointing it wasn't disastrous and suggested that clients are still willing to wait for products.

(Click on image to enlarge)

Looking ahead, Tesla made the following optimistic forecasts:

- The company now expected to Return to Profitability in 3Q

- Tesla Sees Significantly Reducing Loss in 2Q, although it wasn't clear how or why.

- 2019 Capex Expected to Be About $2.0 to $2.5B, meaning that it is expected to ramp up to about $600-700 million per quarter.

- Tesla Sees Capex Sufficient to Develop Main Projects

And here some critical math (or maybe meth): after reporting just $280MM in CapEx, far below the $510MM expected, Tesla is now projecting to burn on average about $650MM in CapEx in the remaining 3 quarters, which would soak up virtually all of the remaining $2.2 billion in unrestricted cash (which plunged from $3.7 billion as of Dec. 31).

While it was previously reported, deliveries of Model S and Model X declined to 12,100 vehicles in the first quarter, Tesla said, compared to a two-year run rate of roughly 25,000 units per quarter. It explained the drop as follows: "This decline was mainly caused by weaker Q1 demand due to seasonality, pull-forward of sales into Q4 2018 in the U.S. due to the first scheduled reduction of the federal EV tax credit in Q1 and discontinuation of our 75 kWh battery pack."

The letter also repeated the blame for low Q1 sales of 63,000 cars on a supplier and long shipping lines to buyers in Europe and China. On Models S and X, Tesla admitted that sales were pulled ahead late last year as buyers piled in as tax credits started to wane in the fourth quarter.

Tesla also reported gross margins of only 20.2%, which is up only slightly from a year ago when production was lower and down from the fourth quarter when it was 24.7%.

Looking at its non-core businesses, notably the solar race, Tesla has given up even more market-share, installing just 47 megawatts last quarter. That's less than half of what U.S. market leader Sunrun did in 4Q. It's also less than what Vivint Solar deployed in 4Q according to Bloomberg which notes that "it's a remarkable drop for a unit that Tesla spent $2.6 billion to buy in late 2016. At its height, predecessor SolarCity installed more than 200 megawatts in a quarter."

For those expecting the company to return to the elusive profitability, Musk said this won't happen until Q3 at the earliest, despite guidance for a record quarter of sales including carry-through of deliveries delayed in Q1. What is curious is that despite projecting a whopping 100,000 in Q2 deliveries, Tesla does not expect to be profitable next quarter. The math just does not make sense.

It wasn't all bad news, and Musk delivered some good news from China, where Tesla said that the Model 3 line in Shanghai is expected to be: "at least 50% cheaper per unit of capacity than our Model 3-related lines in Fremont and at Gigafactory."

I've been a believer in #Tesla for a long time. But #Musk has gone off the deepend and the company is losing money like crazy. I'm thinking it's time to dump $TSLA.