Tesla: Learning From Experience

Photo Credit: Open Grid Scheduler

Prelude

There are two sides to the Tesla (TSLA) story. The first is the stock price, and the second is the underlying business. They seldom seem to reconcile. For a while, it seemed like Tesla’s stock price was in a bubble. To my best knowledge, both the fundamentals and realistic future expectations did not warrant the market value at the peak, near 1,000 USD. The stock price, at that point, was detached from the underlying business. And that opens the door to all types of distractions.

On the other hand, in terms of operating activities, the company is now generating plenty of cash, and the flash capital raise guaranteed fast cash with little dilution. Even during optimism peaks, I’ve always looked at the current ratio has a rough measure of the company ability to keep going for the next twelve months. Even when the company’s operations were glowing, I was always skeptical about its liquidity.

The carmaker

That said, the company has come a long way to become a serious car manufacturer. Yes, it might be disputable, but there is some supporting evidence. For starters, many argued that Tesla could never replicate the efficiency, and scale, of the likes of Ford (F), General Motors (GM), and Fiat Chrysler (FCAU). Nonetheless, Tesla has just matched the all-time maximum production volume of the old NUMMI factory (now Tesla’s Fremont production facility).

Additionally, the old behemoths are showing weaknesses in areas where they used to be strong. As an example, the launch execution of the new Explorer has been Ford’s nightmare.

A while ago, I wrote a piece toying with the idea that Tesla’s struggle to ramping-up production could make it stronger. That’s what happens when you have top-notch engineers facing adversities and focusing on overcoming them. They learn from their mistakes and develop long-lasting solutions. My feeling is that the Model Y ramp-up won’t be nearly as bad as the Model X was.

The factory is becoming smarter and cheaper

Most people following Tesla will remember the tent episode. It became an anecdote to the company’s thriftiness. However, as it happened many times before, it was just a manifestation of Musk’s drive to get his engineers to develop out-of-the-box solutions, usually, at a fraction of the normal cost.

(Source: Tesla 2019 Update)

As you can see, in the picture above, Tesla has been improving its factory layout at every iteration. According to the company, the Shanghai factory investment cost was roughly 65% less per unit of production capacity than the same production system in the US.

Basically, all of Musk’s companies tend to have a culture of learning from experience, and they also seem to be proactive in sharing experiences.

(Source: Teslarati)

Cyclicality associated with new launches will drop

The smarter and cheaper factory is helping in another critical point. The cyclicality associated with new product launches seems to be dropping. Here, I am taking a hint from the variability in the Gross Margin. I am not giving much attention to absolute values, which are always influenced by different accounting practices.

Table 1 – Gross Margin

(Source: Author’s calculations based on data from stockrow.com)

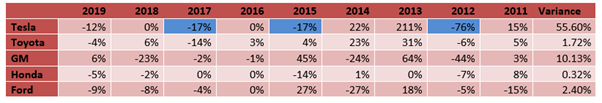

Table 2 – Percentage Change in Gross Margin and Variance

(Source: Author’s calculations based on data from stockrow.com and seekingalpha.com)

The first table is just to provide context. The second table is where the interesting information lies. The blue highlights correspond to the launch of the Model (2012), Model X (2015), and Model 3 (2017). We can see that these launches negatively impact the company’s gross margin. The Model S launch was the worst one on a relative basis. The company was coming from producing just a few thousand units of its Roadster. However, as you can observe with the naked eye, the figures have been stabilizing. Perhaps not surprisingly, the Japanese automakers in the table have the lowest variance.

Another way to look at this is by observing the evolution of the Net Property, Plant & Equipment figures. Here is the year-over-year evolution:

Table 3 – Percentage Change in Net Property, Plant & Equipment and Variance

(Source: Author’s calculations based on data from stockrow.com and seekingalpha.com)

Again, you can see that Tesla stands out with huge swings, but things have stabilized since 2016 (even though the Model 3 was launch in 2017). That is concrete evidence of the growing pains the company has endured. On the bright side, as the company gained scale, things seem to be leveling off. That might indicate that cyclicality associated with new launches will drop. Arguably, that is already happening with the launch of the production in China, having no discernible impact on CAPEX. However, since Tesla was trying to impress, by posting quarterly profits in 2019, I concede that the figures might be misleading. We will have to wait for 2020 to see where we stand in that regard.

Table 3 – Percentage Change in Net Property, Plant & Equipment and Variance

(Source: seekingalpha.com)

There are lots of new products and ideas in the pipeline

The previous analysis matters for two main reasons, first the launch of the Model 3, the first one to be mass-produced, was clumsy at best (just by looking at the CAPEX numbers you can guess the year of the rollout). And, investors really need evidence that the company has learned the lesson and is capable of mastering mass production. Second, the company has an exciting product pipeline, and it must be able to execute well.

The new products include the Model Y, a midsize SUV; the Cybertruck, a pickup truck; the Semi, a semi-truck; Roadster 2.0, an electric sportscar; and the new autonomy software/hardware. Assuming that all these products won’t launch at all once, then, I think that the company should be able to weather each launch better than they did the Model 3. And, each time they roll out a new model, they will learn valuable lessons for the next, hence smoothing the impact on the bottom-line.

However, the product with the potential to revolutionize the company’s financials is the full self-driving software. That might have the ability to create services that will disrupt the company’s gross margins. The company is becoming very efficient in producing hardware that will carry a very profitable software.

Disclosure: I am long Tesla.

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty ...

more

Excellent article.