Tariffs, Tumbles, And Tactical Trades: Navigating The Market’s High-Stakes Reset

Image Source: Unsplash

MARKETS

Tariff Turmoil Takes Its Toll: S&P 500 Dips, Then Rips on Short-Covering Rally

Last week was pure chaos on Wall Street as tariff mayhem sent U.S. equities into a downward spiral before a short-covering rally ignited a sharp rebound. The S&P 500 plunged 2.3%, briefly entering correction territory (down over 10% from its peak) while breaking below the 200-day moving average for the first time since October 2023.

The 25% steel and aluminum levies that took effect last week have only intensified stagflation fears, yanking growth projections lower while keeping inflation pressures stubbornly alive. But what’s proving even more destructive than the tariffs themselves is Washington’s “rip the Band-Aid off” approach—an administration that appears perfectly willing to endure short-term market and economic carnage in pursuit of its long-term trade and hedge-cutter approach to government spending agendas.

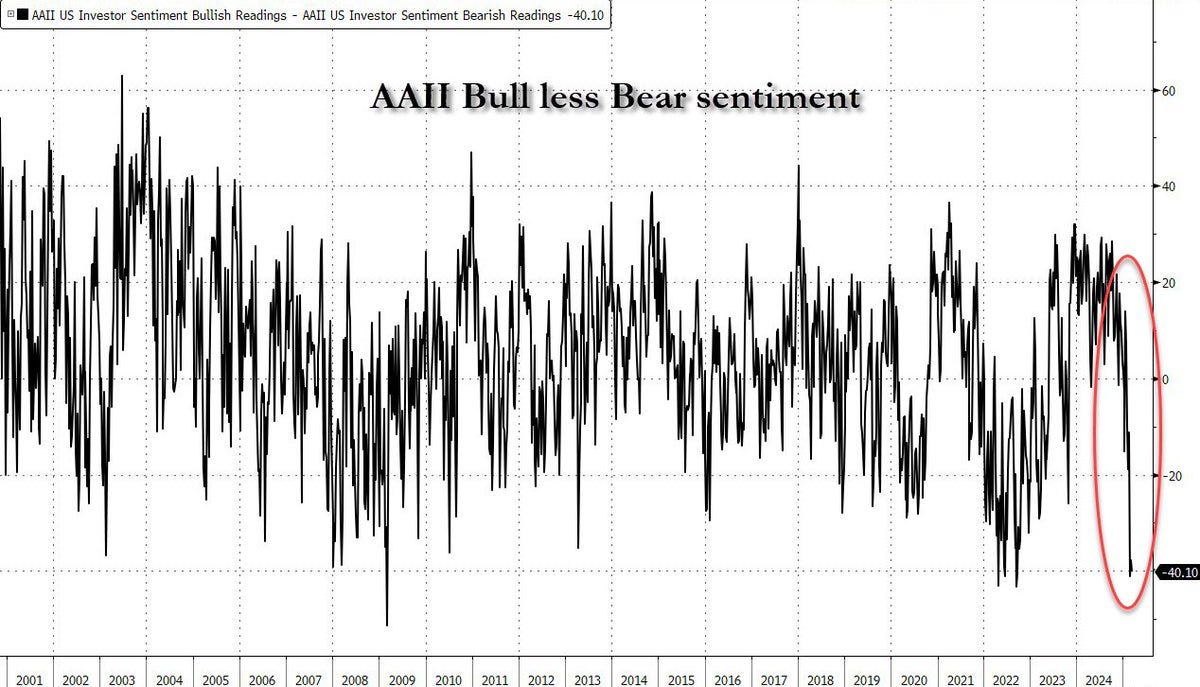

With valuations already looking frothy pre-selloff, the market had a glass jaw. Investor sentiment is in freefall, with AAII’s bearish sentiment spiking to 60%, levels only seen in 1990, 2009, and 2022—each of which marked major market troughs. And for contrarian traders, that’s the kind of doomsday pricing that eventually forces a snapback rally.

(Click on image to enlarge)

And right on cue, the market found its lifeline—an averted government shutdown, sparking a 2% S&P 500 rally on Friday. But let’s call it what it was: a mechanical short squeeze. Given the market’s heavy short gamma exposure (thanks to options positioning), a move higher was always going to force traders to chase the rip, amplifying momentum in the process. That’s likely why the University of Michigan’s ugly consumer sentiment report—which otherwise could’ve sunk the rally—barely made a dent in price action.

VIX Collapses from 30 to 22—Time to Fade the Fear Trade?

The VIX has collapsed from ~30 to ~22 in just three days, a sharp reversal that signals markets have aggressively unwound their fear-driven hedges. While this rapid reset suggests that the most intense selling pressure may be behind us, it’s far from a green light for equities. With tariffs looming and economic uncertainty still a moving target, it’s hard to believe the market has fully priced in the broader slowdown. The reality is that the "known unknowns"—from trade war fallout to policy missteps—still cast a long shadow over risk appetite, making any rally vulnerable to fresh shocks.

For now, judging purely by Friday’s price action, the tariff trainwreck has shifted gears—at least temporarily—into bargain-hunting mode, rummaging through the wreckage for opportunities. But don’t mistake this for smooth sailing. Keep a close watch on the VIX, as it remains the market’s pain gauge, dictating whether this bounce has real legs or is just another fleeting relief rally in a broader downtrend.

What’s clear is that the nerve center for trade war jitters has rapidly shifted. Equities have now overtaken FX and bond yields as the most sensitive asset class to tariff headlines. While currencies and Treasuries barely flinched last week, stocks were thrown into a full-blown rollercoaster ride, with wild swings amplifying the uncertainty. This is where the real tariff battle is fought—right on the equity tape.

China’s Markets Surge as the ‘Xi Put’ Sparks a Risk-On Frenzy

Chinese equities are thumbing their nose at global risk-off sentiment, with a powerful rally propelling the country’s main index into positive territory for the year. This stands in stark contrast to Wall Street, where markets remain bogged down by tariff turmoil, political brinkmanship, and tighter financial conditions.

Beijing’s latest stimulus blitz—dubbed the "Xi Put"—sent a jolt through Chinese markets. The CSI 300 index roared 2.4% higher on Friday, wiping out mid-January losses and pushing year-to-date gains to 1.8%. Meanwhile, Hong Kong’s Hang Seng has gone parabolic, surging nearly 20% as capital flows flood back into the region. In comparison, the S&P 500 remains in the trenches, down 4.1% as U.S. equities struggle under the weight of slowing growth and a higher-for-longer Fed narrative.

This latest policy play from Beijing zeroes in on internal demand as the engine for economic resilience. The strategy includes consumer subsidies for trade-ins on household goods, incentives for new consumption channels to drive spending, and private-sector innovation support to boost domestic industry. The broader message? China is doubling down on self-sufficiency, attempting to insulate itself from U.S. trade aggression and external economic shocks.

For global investors, the divergence in market dynamics is forcing a rethink on risk exposure. While U.S. stocks remain hostage to trade-induced volatility, China is riding a fresh wave of optimism. The key question: Is this a sustainable shift—or just another short-lived policy sugar rush?

One month into Trump's aggressive trade policies, the numbers speak for themselves. The total market capitalization in Chinese businesses via Hong Kong has soared 20%, while U.S. businesses have collectively shed 5% in value. The stark contrast underscores a crucial reality—China entered this trade war prepared, while the U.S. administration appears to be improvising on the fly.

Somehow, amidst this market chaos, we’re expected to "trust the Whitehouse plan." But the scoreboard tells a different story. Chinese policymakers have countered with a well-orchestrated mix of fiscal stimulus, capital market reforms, and strategic industrial policies—all aimed at cushioning the impact of tariffs and reinforcing domestic economic resilience. Meanwhile, U.S. businesses are reeling from the uncertainty, with tariff-driven cost pressures, declining confidence, and fading fiscal support creating a perfect storm for equities.

In global markets, the perception gap is widening—China is seen as adapting and strategizing, while the U.S. response seems reactionary and ad hoc. If this trend continues, the long-term repercussions could extend far beyond stock market valuations.

Right now, the key difference in market regimes comes down to the reaction to bad economic data. In the U.S., bad news is simply bad news. With no visible Trump put and the Fed in no rush to ease, weak economic data is not enough to trigger a reflexive risk-on response. Market stateside are stuck waiting for either deeper pain or clearer policy signals before positioning decisively.

Contrast this with China and the EU, where markets remain firmly in a "Bad News is Good News" regime. Here, economic weakness is met with expectations of immediate government stimulus and central bank easing, sparking bullish price action even in the face of deteriorating fundamentals. The assumption is that policymakers will step in aggressively, ensuring that economic pain is short-lived.

The "Bad News is Good News" Illusion Won't Last

Hate to be the bearer of bad news, but here’s the thing—"Bad News is Good News" regimes are inherently short-lived.

China and Europe have been riding the sugar high of stimulus-fueled rallies, but let’s not kid ourselves—those taps are running dry. The ECB has fired off its fiscal bazooka, and Beijing has been propping up its markets with every lever available. But the real question is: What happens when the stimulus music stops?

The answer is simple. Markets will have to reprice.

Reality is knocking: Tariffs are incoming, and global growth is slowing. In a world where "bad news" no longer guarantees "good news" (i.e., more stimulus), the sugar rush rally we’re seeing could unwind just as fast as it started.

So while the FOMO crowd chases laggards and cheerleads momentum, the smart money is already preparing for the pivot. The trade? Be tactical, stay nimble, and recognize that when reality catches up, it won’t be pretty if you are caught on the wrong side of the rotation

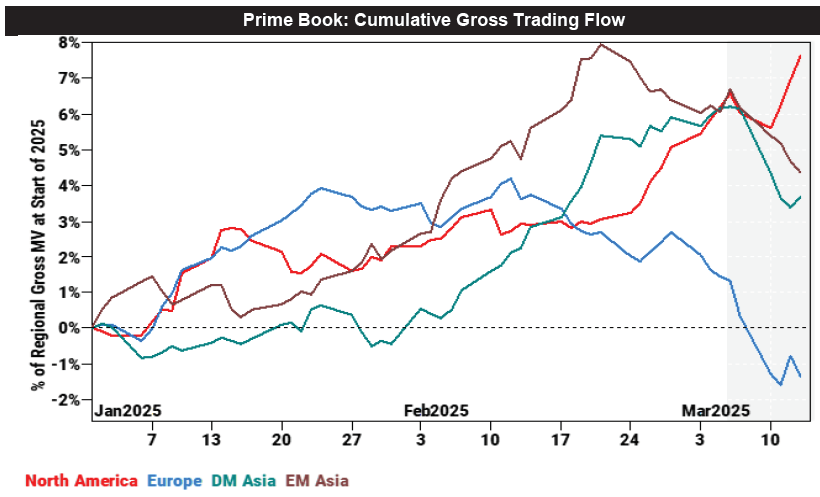

Hedge Funds Are Buying the Dip—What Do They Know That We Don’t?

One of the more intriguing market dynamics in recent weeks has been hedge funds aggressively piling into U.S. stocks during the selloff, while simultaneously dumping European equities during their melt-up. That raises an obvious question—what do they see that the rest of us don’t?

(Click on image to enlarge)

The answer isn’t all that complicated. In Europe, the good news is already priced in. The ECB has fired off its stimulus bazooka, fiscal spending has ramped up, and markets have surged. But with reciprocal tariffs looming, and relations between Washington and Brussels at their frostiest in years, the runway for further upside is looking increasingly limited.

Meanwhile, in the U.S., the real game-changer wasn’t tariffs or inflation expectations—it was spending cuts instead of stimulus. Trump’s second-term economic playbook has flipped expectations on their head. Instead of a pro-growth fiscal boost, we’re seeing tightening and trade protectionism, forcing markets into a painful adjustment phase.

But positioning extremes create opportunity. This isn’t a market for blind dip-buying—it’s a market for calculated entries. Smart money is playing the long game:

✔️ Low leverage to withstand volatility.

✔️ Staggered entries to manage risk.

✔️ Patience to ride out the tariff turbulence.

The strategy? Survive the chaos, position ahead of the inevitable Fed cuts, and capitalize on the Trump tax-and-deregulation bounce once the dust settles. The road won’t be smooth, but that’s where the real money is made.

KEY NEWS RELEASES

What Could Move Markets on Monday?

Markets will open the week with a series of key data releases and policy events that could set the tone for global risk sentiment. Here’s what traders and investors will be watching closely:

1. China’s February ‘Data Dump’

China is set to release a broad set of economic indicators for February, providing a crucial look into the world’s second-largest economy amid ongoing growth concerns. Key data points include:

- House Prices: The property sector remains a focal point as policymakers attempt to stabilize housing demand while managing a prolonged downturn in real estate. Any signs of further weakness could renew concerns over financial contagion.

- Industrial Production: A gauge of manufacturing strength, particularly in the wake of softening global demand and supply chain adjustments.

- Fixed Asset Investment: This includes infrastructure, property, and factory spending, offering insights into Beijing’s policy-driven stimulus efforts.

- Retail Sales: A major indicator of domestic consumption, closely watched as policymakers aim to transition China toward a more consumer-driven economy.

- Unemployment Rate: A critical measure of economic stability, with a particular focus on youth unemployment, which has been a growing concern.

2. China Policymakers' News Conference on Stimulus Measures

Alongside the economic data, Chinese policymakers are expected to hold a press conference to discuss measures aimed at boosting consumption. Markets will be watching for any concrete stimulus announcements, particularly regarding:

- Consumer incentives

- Potential tax cuts or rebates

- Further credit easing or targeted subsidies

With investors still skeptical about the strength of China’s economic recovery, any signs of policy under-delivery could weigh on sentiment, while bold stimulus measures could fuel a relief rally in China-exposed assets.

3. India Wholesale Price Inflation (February)

India’s Wholesale Price Index (WPI) inflation will be released, offering insights into the cost pressures in the supply chain. While India has seen relatively moderate inflation compared to other emerging markets, the data will be watched for any signals of rising input costs that could spill over into consumer price inflation (CPI) and prompt policy adjustments from the Reserve Bank of India (RBI).

4. U.S. Retail Sales (February)

The U.S. will release its February retail sales report, a critical barometer for consumer spending, which makes up roughly two-thirds of U.S. GDP. Key factors in play:

- Consumer Resilience vs. Fed Policy: A strong print could reinforce the higher-for-longer Fed narrative, potentially pushing Treasury yields higher and weighing on rate-sensitive stocks.

- Impact of Disinflation & Job Market Trends: If sales soften, it could indicate that higher borrowing costs and fading excess savings are finally slowing demand, which might reignite rate cut expectations.

- Sector Breakdowns: Investors will analyze which segments (autos, restaurants, e-commerce, etc.) show strength or weakness, providing clues on where consumers are shifting their spending habits.

Market Implications

- China’s data and policy response could set the tone for Asian equities, commodity markets, and risk-sensitive currencies like the Australian dollar.

- India’s inflation data could impact the Indian rupee and bond markets, influencing RBI’s rate outlook.

- U.S. retail sales will be crucial for shaping expectations around Federal Reserve policy, with potential knock-on effects for stocks, the dollar, and bond yields.

With macroeconomic uncertainty still high, Monday’s data-heavy session could drive significant market swings, setting the stage for the week ahead.

THOUGHT FOR THE DAY

For the past 15–17 years, ever since the 2008 financial crisis, we’ve heard endless talk about markets being artificially inflated by central banks, how nothing makes sense anymore, and how everything is distorted beyond recognition. Yet, despite all the noise, one simple truth remains—flows, narratives, and belief drive markets.

Had you ignored the doomsayers and bought equities in 2008 or 2009, you’d be sitting on life-changing gains today. The lesson? Markets don’t need to be rational to be rewarding.

So here’s the real question: If you bought stocks today, stuffed them under your mattress, and labeled them "Retirement – Open in 2045", would you look back at this week’s S&P 500 levels with nostalgic longing?

Would today’s fear and uncertainty seem trivial in hindsight—just another moment in a long-term bull market?

History favors the bold—and the patient. If there’s one market truth that has stood the test of time, it’s that buying the dip has always paid off.

More By This Author:

The Weekender: Shutdown Fears Recede, But The Macro Minefield Remains Treacherous

Catching Falling Knives: A Risky Game In A Market Still Seeking A Floor

This Market Is A Trader’s Playground, Not An Investor’s Paradise