Stock Market Still Isn’t Bouncing

Image Source: Pexels

Stocks seeing a resurgence of selling.

I’m getting a sense that the street is continuing to de-leverage themselves from the Mag7 stocks at the expense of retail. You see, retail has made a killing since 2009 buying the dip. Sure there was that nasty bear market in 2022, but even that was quickly wiped away once it bottomed in October of that year.

And now, you are seeing a heavy amount of retail piling back into the market going back to late last week, thinking this is just another buy opportunity. Even though the market rallied the last two days, it wasn’t one of those soul-crushing, short covering rallies you are used to seeing when the market becomes grossly oversold.

Instead it looks like the street might be using retail to liquidate their over-leveraged positions in the Mag7 group, because that is the one area of the market that has notably underperformed over the last two days.

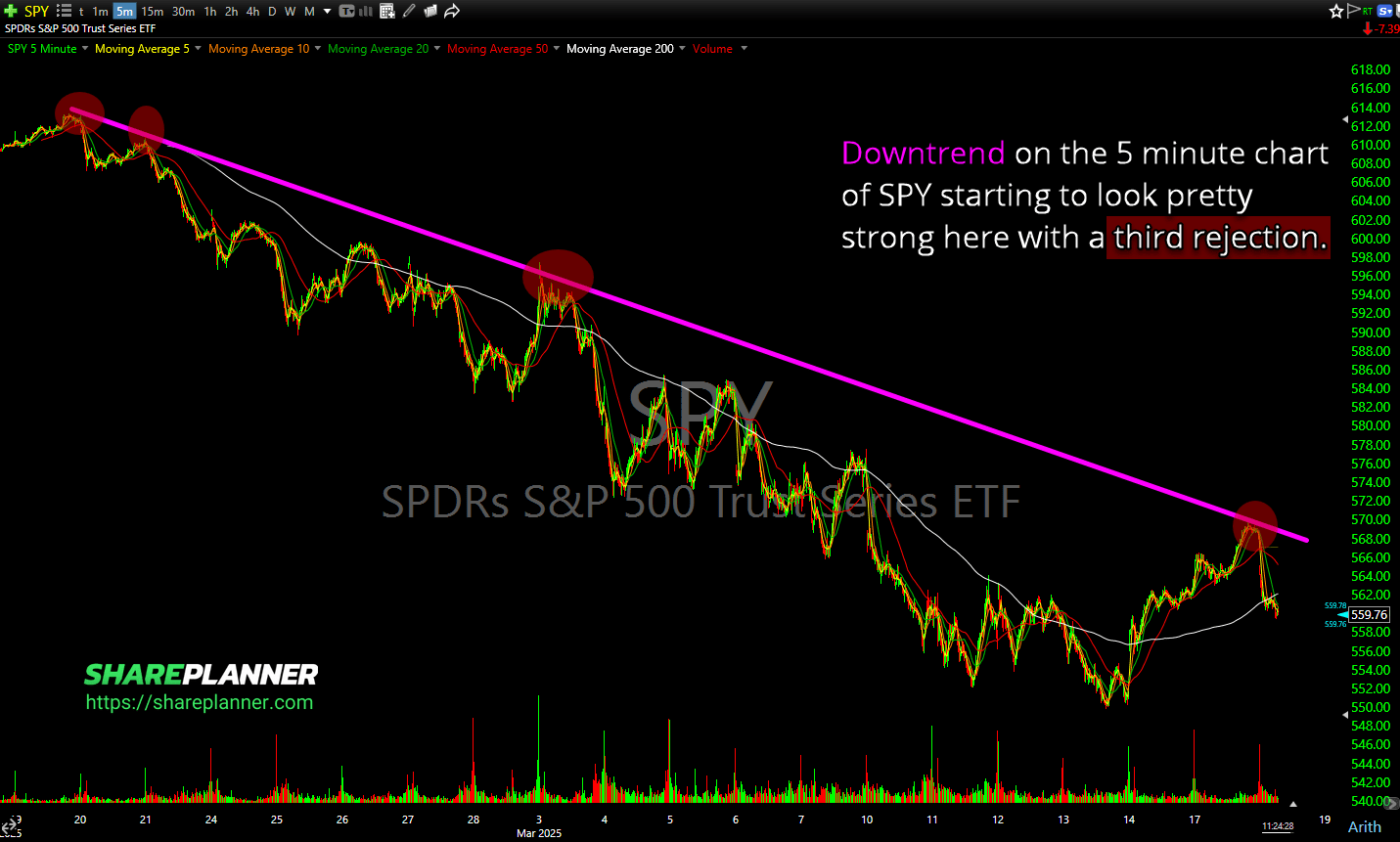

On SPY the selling has been steady and consistent with every rip being used as an opportunity to off load more positions

Just take a look at this chart on SPY:

(Click on image to enlarge)

While I still think this market is grossly oversold right now, there is still the lack of any sustained bounce. In fact, up until yesterday, there hadn’t been even a 2-day rally for almost an entire month on SPY.

Overall, I am back to cash, and continue to flip stocks for extremely small amounts of profit, as this market seems completely incapable of sustaining any kind of momentum, and unfortunately keeps pushing me back to the sidelines to wait for the next setup to emerge. .

More By This Author:

Is BABA Still A Buy?

Will WMT Stock Continue To Drop?

Stocks Keep Pressing Lower

Click here to download my Allocation Spreadsheet. Get all of my trades ...

more