Stocks Keep Pressing Lower

Image Source: Pexels

Traders are frustrated

A lot of traders starting to lose their minds with this stock market as it runs afoul of everything they’ve been conditioned to expect over the past two years, following the 2022 bear market.

At this point, we all know this market is oversold. EVERYONE!

Which is part of the reason why it probably isn’t bouncing, and continues to sink lower. Now granted I run the risk of saying this and as soon as I hit the publish button, and this market rips higher and puts in a generational bottom. But for now that is what we are dealing with.

I’ve also been fishing on some of the recent bounce attempts, but every single one of them failed to materialize.

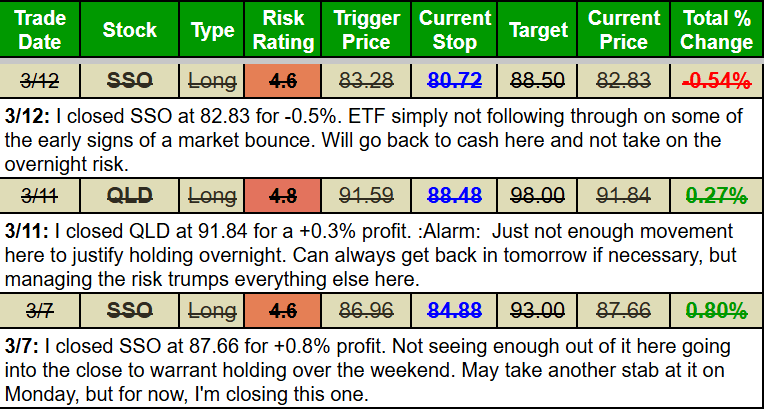

Here’s my trades from the past week. Slightly positive…barely positive

I’ve attempted a few attempts at a dead-cat bounce, but each time, those moves haven’t been sustained, and as a result, I’ve bailed on the play. And each time, I’ve been thankful to have gotten out as a result.

The key is, anytime I am expecting a market bounce, and I make an attempt to play it, I’m not going to take the overnight risk, unless the market can show me in the here-and-now that it is serious about rallying. If it isn’t, there’s always tomorrow, and if the market gaps higher (which it hasn’t been able to do and sustain), then I can always get back in.

But you can’t get married to your positions in this environment or you’re going to get smoked.

Also, the position size matters. I’m 100% cash in my swing trading, and I’m not going to go from 100% cash to 100% long anytime soon. If I get long I’ll do so incrementally, as the market shows that it is serious about bouncing, and as my existing positions gain profits, I’ll add more exposure.

Stay patient – capital preservation is everything here. Don’t force trades and don’t hold on to them if they aren’t performing!

More By This Author:

Palantir Setting Up For a Rally

Time To Buy AAPL?

Time To Buy Apple

Click here to download my Allocation Spreadsheet. Get all of my trades ...

more