Spotify’s Stock Growth Engine Is Running But Is Wall Street Missing This Profit Lever?

Image Source: Pexels

Spotify Technology (NYSE: SPOT) isn’t just a music streaming app anymore, it’s becoming a full-scale AI-powered audio platform. With over 696 million monthly users and features like audiobooks, personalized playlists, and AI-driven DJs, Spotify is building one of the most engaging ecosystems in digital media. And behind the scenes, its growth engine is running at full speed.

In Q2 2025, Spotify added 8 million Premium subscribers and 18 million total users, easily beating expectations. Free cash flow reached a record €700 million, and gross margins hit new highs. Revenue climbed 10% year-over-year, though currency headwinds caused a slight miss.

Despite the strong user and cash flow growth, the market reacted cautiously. Shares dropped more than 10%, largely due to short-term concerns around advertising revenue and one-off expenses related to stock-based pay.

But here’s what Wall Street might be missing: Spotify’s untapped profit lever – pricing power. While most eyes are on its underperforming ad segment, the company is quietly raising subscription prices across major markets outside North America. This move could add hundreds of millions in annual earnings, without increasing operating costs.

At the same time, Spotify is increasing the value of each user. AI features are deepening engagement, while audiobooks and podcasts are expanding the platform beyond music. The more users engage, the more Spotify learns and the more personalized (and sticky) the experience becomes. That’s a powerful feedback loop in the attention economy.

Sure, there are challenges where monetization is slower in fast growing regions, FX pressures continue, and the ad division is in transition. But with strong cash flow, growing verticals, and a data driven approach to retention, Spotify may be better positioned than its share price suggests.

So the question now is: Has Wall Street underestimated just how much pricing power and platform depth can reshape Spotify’s future? Let’s explore that through the IDDA Framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in Spotify, ask yourself:

Do you want exposure to a platform that dominates global audio streaming and is rapidly expanding into podcasts, audiobooks, and AI-powered personalization?

Are you looking to invest in a company that’s turning data from 696 million users into proprietary AI advantages that deepen engagement and reduce churn?

Do you believe network effects and user retention are the new competitive moats – and Spotify is quietly building one of the strongest in the digital consumer space?

Spotify isn’t just a music platform, it’s becoming an intelligent audio ecosystem. From integrating AI-powered DJs and personalized playlists to launching audiobook subscriptions and expanding globally, Spotify is using its scale to compound user time, loyalty, and value. Its long-term strategy is clear: deepen its platform through personalization, diversify revenue beyond music, and turn engagement into monetization – one vertical at a time.

Financially, Spotify is showing strong signs of operating leverage. Free cash flow hit a record €700M in Q2, and gross margins are expanding, even as the company invests in AI, user experience, and international growth. With over 400K audiobook titles and growing podcast distribution, Spotify is building sticky, high-margin verticals that reduce its reliance on music royalties and increase switching costs for users.

But it’s not all smooth listening. The company still faces challenges with ad monetization, especially following leadership changes and inventory shifts in its podcast business. Currency fluctuations continue to affect reported revenue and ARPU, and while long-term margins are improving, short-term profit swings may frustrate investors looking for consistent bottom-line results.

For long-term investors who believe in the power of personalized content, network-driven growth, and the rise of voice and audio in daily digital life, Spotify presents a compelling growth story. But for others, especially those focused on near-term earnings or hesitant about platform execution risks, Spotify’s journey may feel more like a slow build than a breakout.

Spotify’s edge isn’t in owning content, it’s in knowing what you’ll want to hear before you do. And that insight, powered by AI and scale, may be its most valuable asset of all.

IDDA Point 3: Fundamentals

Subscriber Growth – Spotify added 8 million new Premium subscribers in Q2—3 million more than expected. Total monthly users reached 696 million, up 11% from last year, and Premium subscribers hit 276 million, up 12%. Growth was helped by:

- Audiobooks included in Premium in parts of Europe

- New “Audiobooks+” subscriptions

- AI powered DJ, now in over 60 markets, boosting engagement

Revenue & Currency Impact – Revenue grew 10% year over year to €4.2 billion, but missed expectations due to currency effects. A stronger Euro hurt reported numbers. Without this, revenue would’ve been up 15%. Premium revenue rose 12%, but ARPU (average revenue per user) fell 1% due to currency. Fast growing regions also tend to generate less revenue per user.

Profit Margins – Spotify’s gross margin hit a record 31.5%, but operating profit was affected by a €116 million one-off payroll tax from stock price gains. This pushed EBIT margin down to 9.7%. Still, management expects margins to keep improving throughout 2025.

Cash Flow & Financial Strength – Free cash flow hit a record €700 million for the quarter, up 43% from last year. Over the past 12 months, Spotify has generated $2.8 billion in FCF. It has strong liquidity, with €8.4 billion in cash and investments.

AI & User Experience – Spotify is using AI to improve the user experience. Engagement with its AI DJ has doubled, and AI-generated playlists are keeping users listening longer. These features make the platform more personal and sticky.

New Business Growth – Spotify is expanding beyond music into audiobooks and podcasts. It now offers over 400,000 audiobook titles and has launched new add on subscriptions in several countries. This helps improve margins and keeps users on the platform longer.

Pricing Power & Buybacks – A price increase from €10.99 to €11.99 in most markets outside North America is expected to boost profit by €370 million annually. This could add €11 billion to Spotify’s market value. The company also increased its share buyback limit by $1 billion, though only $100 million has been used so far.

Outlook & Long Term Potential – For Q3, Spotify expects 710 million users, 281 million Premum subs, and €4.2 billion in revenue (still impacted by currency). Long term, Spotify is aiming for 14 to 16% annual revenue growth, with revenue reaching up to €74 billion by 2035. If margins improve as planned, Spotify’s value could grow to $300–350 billion, offering around 10% yearly returns for long term investors.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Strong Subscriber Growth – Spotify added 8M Premium subs in Q2, beating expectations and showing strong user engagement across new features like AI DJ and audiobooks.

Record Free Cash Flow – €700M in Q2 FCF (up 43% YoY) and €2.8B over the last 12 months highlight solid cash generation and financial health.

AI & Product Innovation – AI-driven features like personalized DJs and playlists are boosting engagement, while expansion into audiobooks and podcasts increases platform stickiness and potential margins.

Risks

Currency Headwinds Impacting Revenue – A strong Euro hurt reported revenue and ARPU; without FX drag, results would’ve looked stronger, showing sensitivity to global currency swings.

Ad Monetization Struggles – Execution issues in Spotify’s ad business, leadership changes, and reduced ad inventory are weighing on short-term revenue potential.

Slower ARPU Growth – Premium ARPU declined 1% YoY due to weak monetization in fast-growing regions, raising concerns about revenue efficiency as user numbers grow.Despite a 10% drop in the stock after Q2 earnings, market reaction seems driven more by short-term concerns like currency headwinds and ad monetization struggles than fundamental weakness.

Investor sentiment remains cautiously optimistic, as management emphasized long term thinking, strong subscriber retention, and continued AI innovation to enhance user experience.

Leadership changes in the ad division signal a push for better execution, while pricing power, loyal users, and product expansion into audiobooks and podcasts support confidence in Spotify’s future growth.

Overall, sentiment is neutral to slightly bullish, with many seeing the dip as a long-term opportunity rather than a red flag.

Sentimental Risk: Medium

IDDA Point 5: Technical

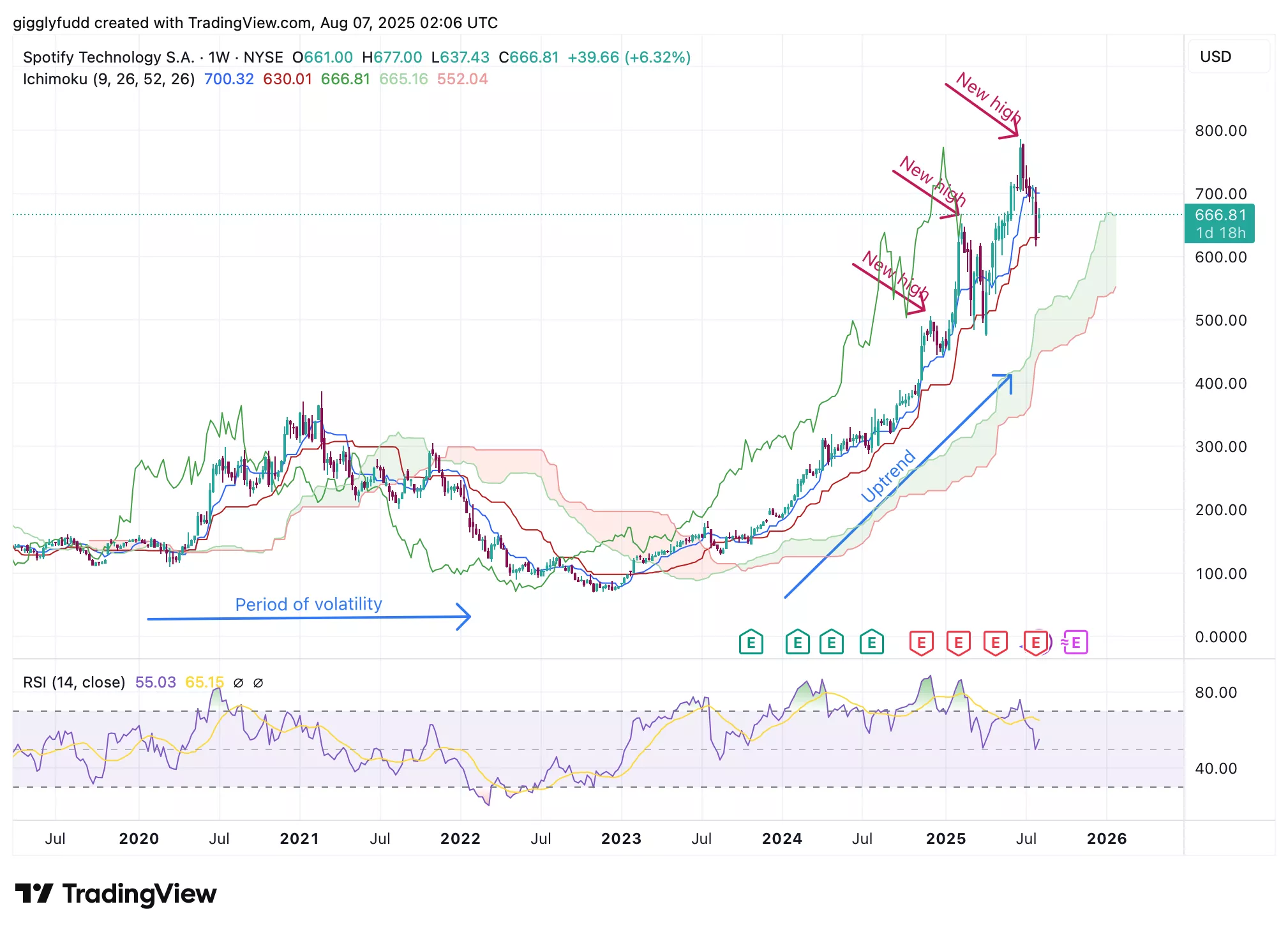

On the weekly chart:

Bullish and wide Ichimoku cloud reinforces the upward momentum

Upward trend, with each high surpassing the previous high

Candlesticks, along with the Kijun, Tenkan, and Chikou lines, are positioned above the cloud, supporting continued bullish sentiment

On the weekly chart, we can see that after a period of volatility, Spotify’s stock began climbing from 2023 and has continued its upward trend. Since December 2024, each new high (marked by the red arrow)has surpassed the previous one, with healthy pullbacks along the way. This ongoing trend is supported by the wide, bullish Ichimoku cloud and the fact that candlesticks remain positioned above the cloud.

(Click on image to enlarge)

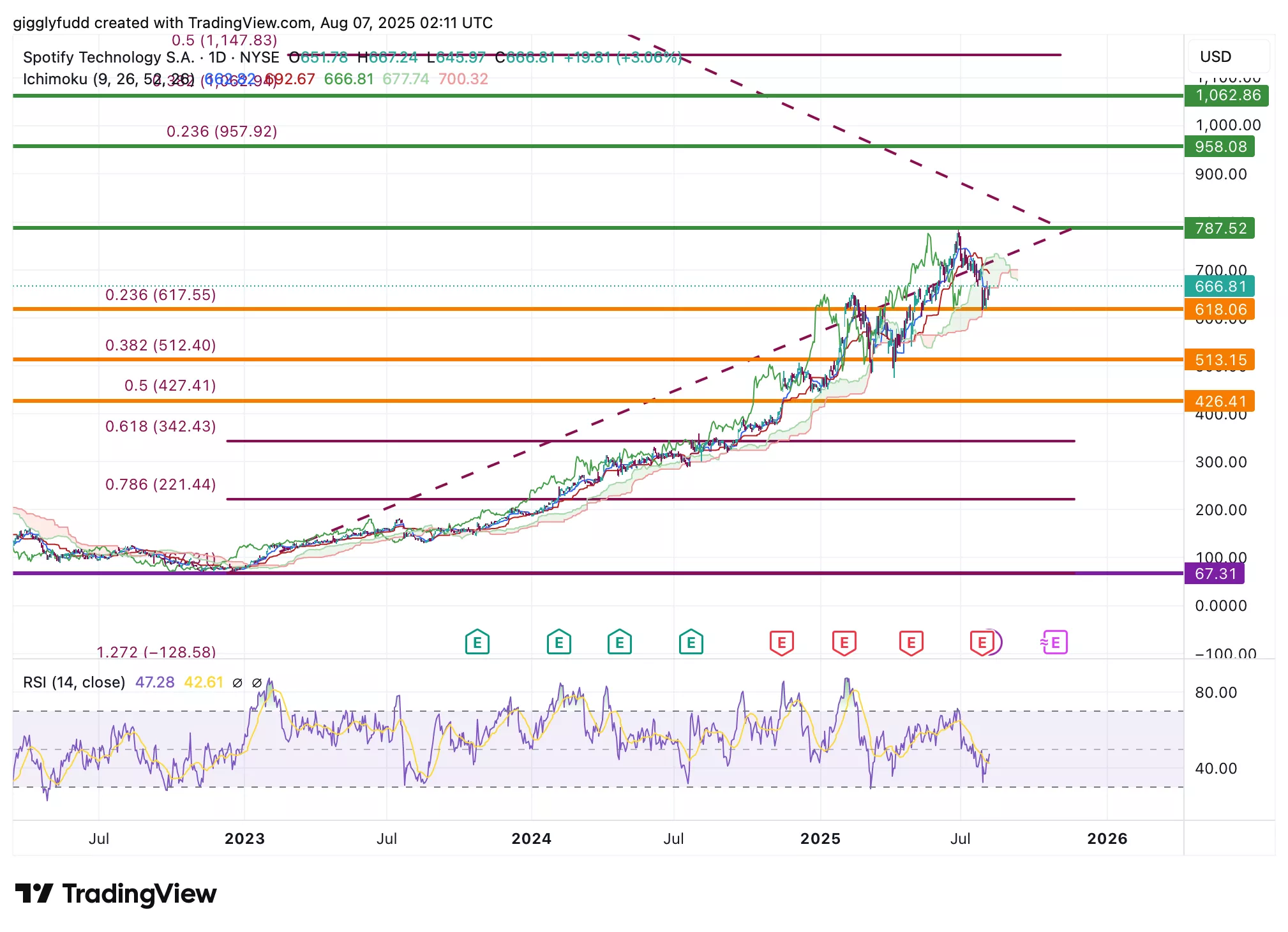

On the daily chart:

Current trend is downward and appears to be a healthy pullback

Future Ichimoku cloud is bearish but small and flat, suggesting only short term downward momentum

Candlesticks are positioned below the cloud, which is acting as a resistance zone

The daily chart shows a short-term downward trend, which appears to be a healthy pullback from the recent high of 785, similar to previous dips before the stock moved higher. While the Ichimoku cloud is currently bearish, its small and flat shape suggests this pullback may be temporary. Candlesticks are currently positioned below the cloud, which is acting as a resistance zone.

(Click on image to enlarge)

Investors looking to get in SPOT can consider these Buy Limit Entries:

666.81 (High Risk – FOMO entry)

618.06 (High Risk)

513.15 (Medium Risk

426.41 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

787.52 (Short term)

958.08 (Medium term)

1062.86 (Long term)

Hold (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Spotify (SPOT)

Spotify’s growth engine is clearly in motion. The platform added 8 million Premium subscribers in Q2, beat expectations on user growth, and reported record free cash flow of €700 million. Its global user base is expanding, margins are improving, and its shift into audiobooks, podcasts, and AI powered personalization is deepening platform stickiness.

But despite this momentum, Wall Street may be overlooking Spotify’s biggest profit driver: its pricing power. The planned subscription price hike across most non-North American markets could meaningfully lift EBIT, adding an estimated €370 million each year, yet the market remains more fixated on short term ad challenges than this long-term potential. On top of that, with only €100 million of its $1 billion buyback program used so far, Spotify still has significant room to return more value to shareholders.

Yes, there are real risks – slower ARPU growth in lower-monetizing regions, ongoing FX headwinds, and an ad division in transition. But the bigger picture shows a company intentionally building margin expanding verticals and leveraging AI to increase engagement per user.

Technically, the stock remains in an uptrend long term on the weekly chart, with current pullbacks showing signs of healthy consolidation. For investors who can look past short term noise, Spotify’s expanding monetization levers, particularly pricing power, may be what ultimately rewrites its valuation story.

Key Takeaway: Buy on Pullbacks or Accumulate Cautiously

Spotify’s long-term strategy is playing out, but the market may be underestimating how pricing power and platform diversification can reshape its profitability. This dip could offer a compelling entry point for long-term investors before Wall Street catches on.

Overall Stock Risk: Medium

More By This Author:

The Sell-Off In Adobe Stock Looks Scary… Is This A Red Flag Or A Hidden Green Light?

3 Clues Applied Digital Stock Might Be The Sleeper Giant No One’s Watching

Microsoft Stock Is Surging After Earnings But If You Miss This AI Signal, You Might Miss The Bigger Opportunity