3 Clues Applied Digital Stock Might Be The Sleeper Giant No One’s Watching

Image Source: Unsplash

Everyone’s talking about Nvidia, OpenAI, and the chipmakers fueling the AI revolution.

But what if the next big winner… isn’t building the AI? What if it’s quietly powering the infrastructure behind it?

Let’s talk about Applied Digital Stock (APLD) — and 3 clues that this low-key data center stock might be turning into an AI giant while no one’s paying attention.

What does Applied Digital do?

Applied Digital builds and runs data centers made for power-hungry tasks like AI, crypto mining, and high-performance computing. They don’t build chips or train models. They rent out space, power, and cooling to the companies that do.

Think of them as the landlords of the digital world — and demand for space in their buildings is heating up fast.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

$7‑11 Billion AI Lease with CoreWeave

Applied Digital’s new 15‑year lease with CoreWeave initially covered 250 MW and may expand an extra 150 MW, potentially delivering up to $11 billion in contracted revenue. That’s serious long‑term cash flow from one key tenant.

41 % Revenue Growth in Q4, But Revenue Missed Forecast

In fiscal Q4 2025 (ended May 31), revenue rose 41 % year‑over‑year to $38 million. But analysts predicted around $42 million, so APLD fell short.

Earnings Beat Despite Loss

Adjusted net loss was $0.03 per share, a big beat over the expected −0.14. Adjusted EBITDA turned positive at $1 million. So losses narrowed and outlook looks cleaner.

Net Loss & Debt Are Still Big

GAAP net loss was $26.6 million (−$0.12 per share), and full‑year loss hit $161 million. Total debt is about $688 million versus ~$121 million cash. That’s a heavy load.

New Capital Bolsters Growth Plans

Since quarter‑end the company raised $269 million via share offerings. That helps fund building out its Polaris Forge campus and supports expansion plans.

AI Infrastructure Shift is Real

Applied is winding down its cloud and crypto hosting services to fully focus on AI and HPC infrastructure. The new data centers are being built fast in North Dakota.

Industry Tailwinds Are Strong

Big cloud players are pouring money into AI infrastructure. As demand for computing power grows, Applied’s hosting business stands to benefit directly.

Fundamental Risk: Medium

Revenue is growing and earnings beat expectations, but losses and debt are still high. Execution matters. If build‑outs delay or demand cools, it could hurt. But the path looks clear so far.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Applied Digital Stock (APLD).

Strengths

CoreWeave deal triggered a sharp spike in investor optimism. Shares jumped over 40 percent intraday when the $7 billion lease was announced. That kind of reaction shows Wall Street sees APLD as more than just a small data center player.

The company’s association with Nvidia, both through CoreWeave and early investments, adds credibility and buzz. Investors often follow the big names, and Nvidia’s indirect backing increases confidence.

Analysts are turning more positive. Craig-Hallum raised their price target to $18 and called APLD “undervalued” considering its growth pipeline and signed contracts.

AI infrastructure is a hot theme. As more media outlets cover the arms race to secure computing power, companies like APLD get pulled into the narrative, even if they’re not front-page names.

CEO Wes Cummins has made confident public statements about reaching $1 billion in annual operating income within a few years. That goal is ambitious, but the clarity and directness seem to inspire trust rather than fear.

Risks

Some investors still see APLD as a risky, overleveraged crypto host. The company’s pivot to AI is real, but it takes time to shift perception.

Revenue miss in the latest quarter added a note of caution. Even with an EPS beat, some headlines pointed to “disappointing top-line results.”

Heavy use of debt and equity raises makes some investors nervous. There’s a concern that more dilution or financing may be needed if buildouts cost more than expected.

Applied Digital is still not profitable. That matters to institutional investors who prefer companies with a path to earnings, especially in high-rate environments.

Sentimental Risk: Medium

The vibe is mostly optimistic thanks to the CoreWeave deal and big-name backing, but there’s still hesitation from investors who remember APLD’s crypto roots or are worried about debt and execution.

IDDA Point 5 – Technical

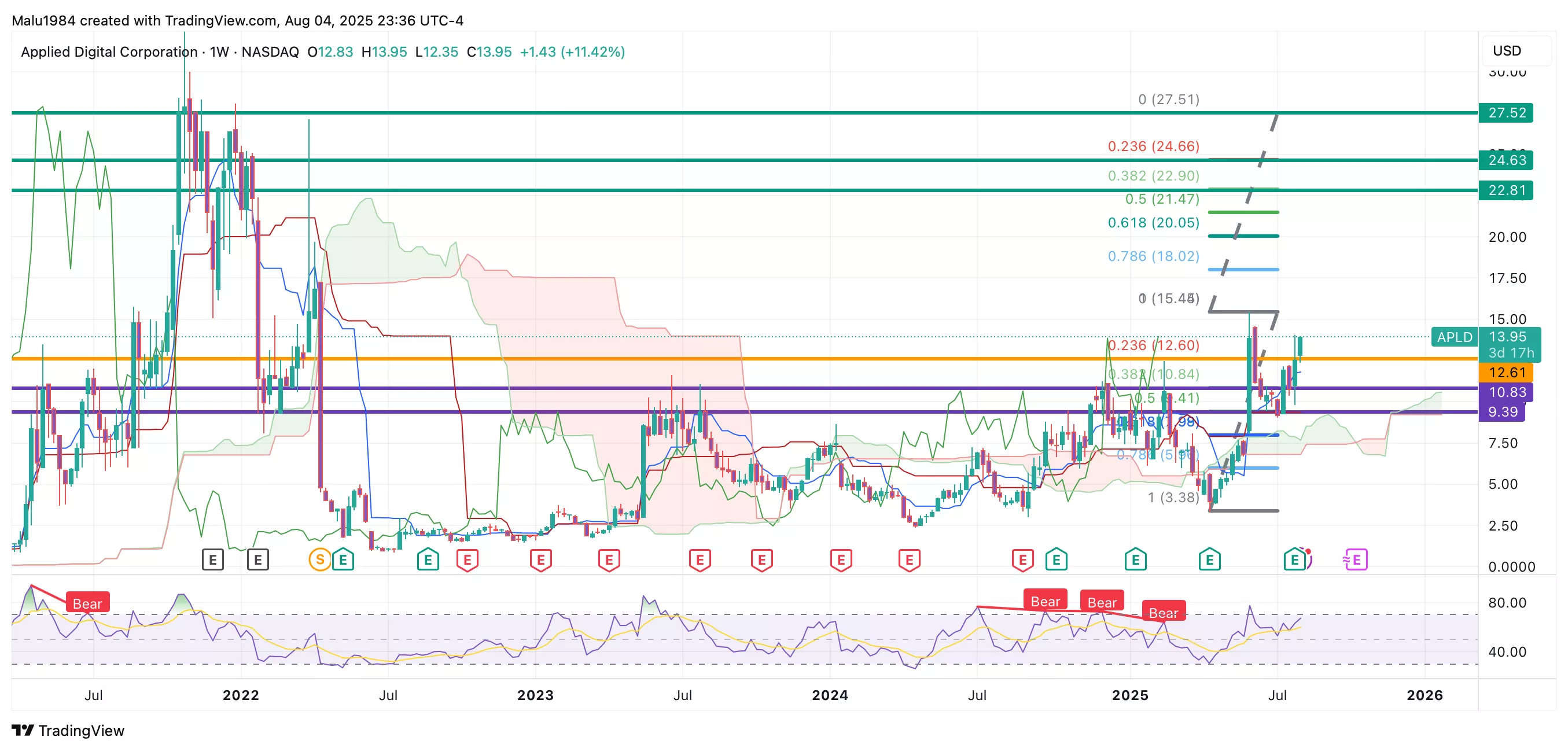

Weekly Chart

Price is trading above the Ichimoku Cloud, showing strong bullish momentum.

The cloud is green, which suggests the trend is still upward.

The conversion line (Tenkan-sen) is above the baseline (Kijun-sen), a classic bullish signal.

RSI is at 67, signaling strong momentum but getting close to overbought territory.

Overall, the technical outlook is bullish. The chart shows clear strength with aligned bullish signals. With RSI climbing toward overbought levels, some short-term consolidation wouldn’t be surprising, especially if volume slows or news fades. This stock is showing solid conditions for both long-term investors and swing traders looking to ride momentum.

(Click on image to enlarge)

Buy Limit (BL) levels:

$12.61 – High Risk

$10.83 – Moderate Risk

$9.39 – Low Risk

Profit Taking (PT) levels:

$22.81 – High Risk

$24.63 – Moderate Risk

$27.52 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

The trend is clearly bullish, and key signals like Ichimoku and RSI support continued upside. But because RSI is approaching overbought and the stock has moved up quickly, there’s a moderate chance of short-term pullbacks or consolidation. Traders should watch for shifts in volume or sentiment, but the overall structure remains strong.

Summary: Final Thoughts

Applied Digital is no longer just a crypto host riding trends. It’s turning into a serious AI infrastructure player, with billion-dollar leases, support from Nvidia-backed CoreWeave, and long-term backing from Macquarie. Revenue is growing fast, and the company is making a clear pivot toward high-performance data centers.

Still, the company is not profitable yet and carries a heavy debt load. That means execution needs to be nearly flawless. Investor sentiment is warming up, but not everyone is convinced — some are still watching to see if this pivot truly delivers.

On the chart, technical signals are strong. The stock is in a bullish setup with momentum on its side. That makes it attractive for both long-term investors and swing traders. But with RSI near overbought, short-term corrections are possible.

Overall Risk: Medium

This is a growth story with real momentum — but not without financial pressure and execution risk. For investors who believe in the infrastructure behind AI, Applied Digital might be worth keeping on your radar.

More By This Author:

Microsoft Stock Is Surging After Earnings But If You Miss This AI Signal, You Might Miss The Bigger Opportunity

Wall Street Is Focused On Meta Stock Numbers But This Quiet AI Move Could Unlock Bigger Gains

Apple Stock Beat Earnings Expectations But This One AI & Innovation Disconnect Could Define Its Future (Or Not)