Microsoft Stock Is Surging After Earnings But If You Miss This AI Signal, You Might Miss The Bigger Opportunity

Image Source: Pixabay

Microsoft (Nasdaq: MSFT) is no longer just known for software, it’s now a full-scale leader in AI and cloud computing. From Windows to Azure, GitHub to Copilot, the company is adding AI across its products while expanding its infrastructure to support the next wave of enterprise demand.

In Q4 FY 2025, Microsoft posted impressive results with 18.1% revenue growth and 23.7% EPS growth year-over-year, both beating analyst expectations. Azure revenue rose by 39%, its highest in two years, and commercial bookings surpassed $100 billion. Still, despite these strong numbers, investor mood is shifting from excitement to caution.

The stock reached all-time highs after earnings, but with profit margins expected to flatten and spending slowing down, some analysts believe the good news may already be priced in.

The key story? Microsoft isn’t just growing its cloud business, it’s changing how work gets done through AI. Tools like Copilot, Fabric, and Foundry are being adopted quickly.

Copilot now has over 100 million monthly users, and GitHub Copilot’s enterprise use grew 75% in just one quarter. Altogether, Microsoft’s AI tools now reach more than 800 million users, showing the company isn’t simply joining the AI race – it’s leading it.

Azure remains at the heart of this growth. With scalable, cloud based platforms and strong AI integration, Microsoft is locking in big enterprise clients. Contracts worth $10 million and even $100 million are growing, proving the company isn’t just innovating, it’s earning. At the same time, Fabric has become its fastest-growing database product, and Foundry is seeing strong adoption among Fortune 500 companies.

What makes Microsoft stand out is how well it delivers at scale. While other companies fight to lead in AI, Microsoft is quietly building real-world solutions for business. Its approach isn’t flashy, it’s focused and steady. Even though spending is expected to ease in FY 2026, Microsoft still plans to invest around $30 billion in just the first half of the year to keep up with AI and cloud demand.

Of course, there are risks ahead. Profit margins may have already peaked, and the company’s heavy investment cycle is beginning to slow. While momentum is strong for now, any earnings miss or market pullback could trigger volatility.

So, is Microsoft still worth buying at these levels? Let’s explore further using the IDDA Framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in Microsoft, ask yourself:

Do you want exposure to a company at the core of enterprise AI, cloud infrastructure, and productivity software?

Are you looking to invest in a business that’s embedding AI into the tools used by millions of businesses and developers worldwide?

Do you believe the future of work and technology will be built on platforms like Azure, GitHub, and Microsoft 365?

Microsoft isn’t just talking about AI, it’s building it into the core of how businesses work. From Copilot in Microsoft 365 to platforms like Fabric and Foundry, it’s embedding AI into tools used daily by major enterprises.

After years of heavy investment in cloud and infrastructure, Microsoft is now focused on optimizing and scaling efficiently. Azure is growing fast, and the company is turning AI adoption into steady, recurring revenue.

Rather than chasing hype, Microsoft is doubling down on where it leads, integrating AI deeply, executing with discipline, and strengthening long-term customer relationships.

That said, Microsoft’s stock isn’t without risk. Its growth history is strong, but its valuation is rich, and competition in AI and cloud is heating up. The stock experienced a sharp pullback in 2022, consolidation in 2024, and another brief pullback in 2025, but each time, it rebounded and reached new highs.

This pattern speaks to Microsoft’s long-term strength, but short term volatility can still be uncomfortable for risk averse investors. If you’re focused on near term gains, timing may matter. But if you’re building for the future, Microsoft offers one of the most reliable platforms to compound with.

Microsoft’s disciplined approach, enterprise reach, and expanding AI ecosystem make it one of the most strategically positioned companies in Big Tech. Whether it belongs in your portfolio depends on your belief in the future of intelligent infrastructure, and your comfort riding out short-term market swings for long-term returns.

IDDA Point 3: Fundamentals

Microsoft continues to stand out as one of the most profitable and high quality companies in the software and cloud industry. Its asset light business model, combined with strong growth in artificial intelligence tools like Copilot, Fabric, and Foundry, positions it well for long-term success. Over the past 10 years, Microsoft’s operating margins have increased from 30% to around 45%, helping to fuel its strong stock performance. Compared to competitors like Amazon, Microsoft has delivered better returns with lower volatility.

In the fourth quarter of fiscal year 2025, Microsoft reported impressive results. Revenue came in at $76.4 billion, up 18.1% from the previous year, and earnings per share rose to $3.65, up 23.7%. Both figures beat analyst expectations. Operating margins expanded to 44.9%, and the company issued strong guidance for fiscal year 2026. Management expects another year of double digit growth in both revenue and operating income, with stable margins and a reduction in capital spending after a heavy investment period in 2025.

Azure was a major highlight of the quarter, growing 39% year-over-year, its fastest growth in two years. Annual Azure revenue topped $75 billion, a 34% increase from the prior year. Demand from large enterprise clients is also rising, with commercial bookings exceeding $100 billion, up 37%. Microsoft expects Azure to grow another 37% in the first quarter of FY 2026, showing strong momentum.

Microsoft’s AI products are also growing quickly. Fabric revenue jumped 55% year-over-year and now serves over 25,000 customers. Foundry has over 14,000 users, including 80% of Fortune 500 companies, and processed over 500 trillion tokens last year. Copilot now has over 100 million monthly active users, while GitHub Copilot has more than 20 million users, with enterprise adoption rising 75% quarter-over-quarter. In total, Microsoft’s AI tools now serve over 800 million monthly users, showing how its AI investments are gaining traction fast.

Fundamental Risk: Low- Medium

IDDA Point 4: Sentimental

Strengths

Explosive Azure Growth: Azure revenue grew 39% YoY in Q4, its strongest in eight quarters, showing strong momentum and customer demand.

AI Adoption Gaining Traction: Microsoft’s AI tools (Copilot, Fabric, Foundry) now serve over 800 million monthly users, including heavy enterprise adoption across Fortune 100 and 500 companies.

Strong Financial Performance: Microsoft beat revenue and EPS estimates in Q4, maintains high operating margins, and projects double digit growth in FY 2026.

Risks

Margin Pressure Ahead

: Cloud competition and rising infrastructure costs could cap future margin expansion – key to Microsoft’s valuation growth in the past.

High Market Expectations

: With the stock at all time highs and much optimism already priced in, there’s a risk of underperformance if growth slows or sentiment shifts.

Spending Slowdown May Signal Slower Growth:

Microsoft is planning to slow down its spending on building and expanding its cloud and AI systems in 2026. While this could make the company more efficient, it may also be a sign that the rapid growth phase is starting to level off, which could lead to slower revenue growth in the future.

Investor sentiment around Microsoft is very positive, thanks to its strong Q4 results, fast growing Azure segment, and rising use of AI tools like Copilot, Fabric, and Foundry. The stock hit all time highs and has strong momentum, with many seeing Microsoft as a clear leader in the AI space. Management confidence and big-name customer adoption have added to the excitement.

However, some investors are starting to be more cautious. With the stock already priced for the best-case scenario and limited upside based on valuation models, many are shifting from a “buy” to a “hold” view, expecting smaller returns unless there’s a pullback or stronger growth ahead.

Sentimental Risk: Medium – High

IDDA Point 4: Technical

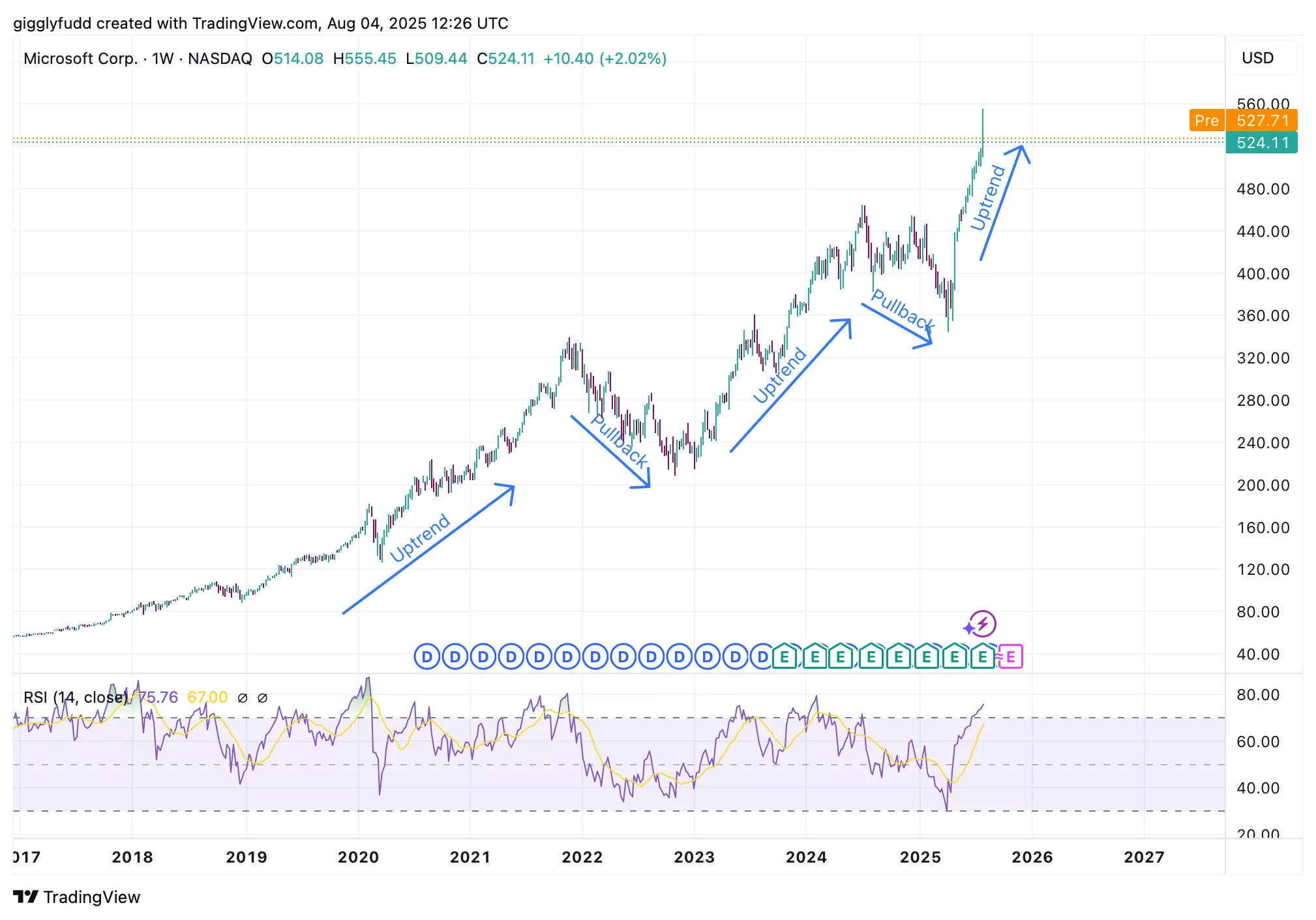

On the weekly chart:

Strong long-term uptrend with healthy short-term pullbacks

RSI above 75 signals overbought conditions, reinforcing strong bullish momentum

On the weekly chart, MSFT is in a strong long-term uptrend with healthy pullbacks followed by sharp recoveries. After each dip, the stock has gone on to make new highs, with the latest breakout in 2025 pushing it near $555. The RSI is above 75, showing it’s overbought in the short term, but this is common in strong bullish trends. Overall, the chart signals solid long term strength, even if a short term pause occurs.

(Click on image to enlarge)

On the daily chart:

The future Ichimoku cloud is bullish and wide, signalling ongoing upward momentum since May 2025

Current pattern is an uptrend, reinforcing the bullish momentum

RSI is overbought at 68.54, suggesting a potential pullback in the near term

On the daily chart, the stock had been consolidating through 2024 and briefly downtrended at the start of 2025. Microsoft surged in May 2025 after a strong earnings report beat expectations, with Azure growing 33% and AI tools like Copilot, Fabric, and Foundry gaining traction.

Record enterprise demand and bullish guidance boosted investor confidence, pushing the stock sharply higher. Following its recent earnings release, Microsoft surged again, reaching a new high of $555, and now appears to be in the early stages of a pullback.

(Click on image to enlarge)

Investors looking to get in MSFT can consider these Buy Limit Entries:

527.91 (High Risk – FOMO entry)

506.95 (High Risk)

474.96 (Medium Risk)

449.82 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

566.95 (Short term)

607.39 (Medium term)

638.21 (Long term)

Hold (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your

- CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Microsoft (MSFT)

Microsoft (MSFT) beat Q4 FY25 expectations with 18.1% revenue and 23.7% EPS growth, driven by explosive 39% growth in Azure and strong traction across its AI tools like Copilot, Fabric, and Foundry. Commercial bookings crossed $100 billion, and its AI ecosystem now serves over 800 million users, proving Microsoft is monetizing AI at enterprise scale. However, with margins expected to level off, CapEx slowing, and the stock trading near all time highs, some investors are questioning whether future growth is already priced in.

That said, Microsoft’s strength lies in disciplined execution and real-world AI adoption, not just hype. While some competitors race for headlines, Microsoft continues to deepen its AI stack and cloud reach with enterprise clients. The stock may look overbought in the short term, but technically it remains in a strong uptrend, and pullbacks could offer entry opportunities for long term believers. As AI infrastructure shifts from concept to business critical, Microsoft is building the foundation others will rely on.

Key Takeaway: Buy on Pullbacks or Hold with Confidence

Microsoft remains one of the most strategically positioned companies in Big Tech. While short term upside may be limited due to valuation, the long term growth story is intact. For patient investors, early signs of a pullback could be a chance to accumulate shares in a company that’s not just chasing AI but leading it.

Overall Stock Risk: Medium

More By This Author:

Wall Street Is Focused On Meta Stock Numbers But This Quiet AI Move Could Unlock Bigger Gains

Apple Stock Beat Earnings Expectations But This One AI & Innovation Disconnect Could Define Its Future (Or Not)

What If JPMorgan Stock Is Making The Biggest Quiet Move In Finance… And You’re Missing It?