What If JPMorgan Stock Is Making The Biggest Quiet Move In Finance… And You’re Missing It?

Image Source: Pexels

JPMorgan Chase (JPM) isn’t just the biggest bank in the U.S. It’s also one of the most quietly powerful players in global finance. With over $4 trillion in assets, JPM touches everything from mortgages and wealth management to crypto and AI.

But lately, it’s doing more than just banking.

It’s reportedly in advanced talks to take over the Apple Card program from Goldman Sachs. It’s pushing back on fintechs like Plaid by charging them to access customer data. And it’s even accepting crypto ETFs as collateral for loans.

These aren’t random moves. They’re calculated plays that could reshape JPMorgan’s role in consumer finance, digital payments, and the future of money.

So what does this mean for your portfolio?

Let’s break it down using the IDDA framework.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess JPMorgan’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong earnings and diversified revenue

JPMorgan reported solid Q2 2025 earnings with $13.2 billion in profit, up 5% from last year. Revenue hit a record $44.5 billion. Growth came from consumer banking, credit cards, and its investment banking rebound.

Credit rating upgrade by S&P

S&P Global raised JPM’s long-term credit rating to A from A-. They cited strong capital levels, risk management, and long-term profitability. This upgrade puts JPM in a stronger position compared to most peers.

Capital position remains solid

Its CET1 ratio is around 15 percent, well above regulatory minimums. Deposits are growing. JPM has room to absorb shocks, make acquisitions, or return capital to shareholders.

Massive investment in AI and tech

JPM is spending over $17 billion on tech in 2025. They’re using AI for trading, fraud detection, and risk management. This gives them long-term edge over smaller banks and old-school competitors.

Credit card risk if Apple deal closes

JPMorgan is in talks to take over the Apple Card, but it comes with risk. Around 34 percent of Apple Card users are subprime borrowers. That’s double JPM’s current exposure in cards. If the deal goes through, default risk could rise.

Fintech fees could spark regulatory pushback

JPM is starting to charge fintechs for access to customer data. That may bring short-term gains, but also political scrutiny. If regulators step in, it could limit future revenue from these changes.

Global asset management growth

JPMorgan Asset Management is expanding through strategic partnerships in Europe and the Middle East. That brings in new clients without competing on cost or chasing risky assets.

Fundamental risk: Low to medium

JPMorgan is financially strong and making bold moves, but increased exposure to consumer credit and regulatory heat could add pressure over time.

IDDA Point 4: Sentimental

Overall sentiment is bullish for JPMorgan.

Strengths

Analysts and institutional investors continue to favor JPM as a safe, high-quality pick in an uncertain market. Zacks upgraded it to Strong Buy, and S&P gave it a credit rating boost.

CEO Jamie Dimon is seen as one of the most trusted leaders in banking. His strong public stance against overregulation resonates with investors who want banks to stay agile and profitable.

The market sees JPM’s fintech and tech investments as long-term catalysts. The push into AI, crypto-backed loans, and treasury APIs is making JPM look more like a fintech giant than a traditional bank.

The Apple Card talks, even if not final, are generating optimism. Investors see it as a potential growth channel in consumer finance.

Risks

JPMorgan’s decision to charge fintechs for customer data access is controversial. It may trigger legal or political backlash, especially with open banking advocates pushing for more data freedom.

If the Apple Card deal closes, the increased exposure to subprime credit could worry investors. Many still remember the 2008 crisis and are cautious when banks lean too far into consumer risk.

Broader sentiment toward banks remains shaky. Rising interest rates, regulatory uncertainty, and the threat of recession make investors nervous about traditional finance.

Sentimental risk: Medium

Investors respect JPM’s strength and strategy, but there’s growing tension around its aggressive positioning in fintech and consumer credit.

IDDA POINT 5 – TECHNICAL

Monthly Chart

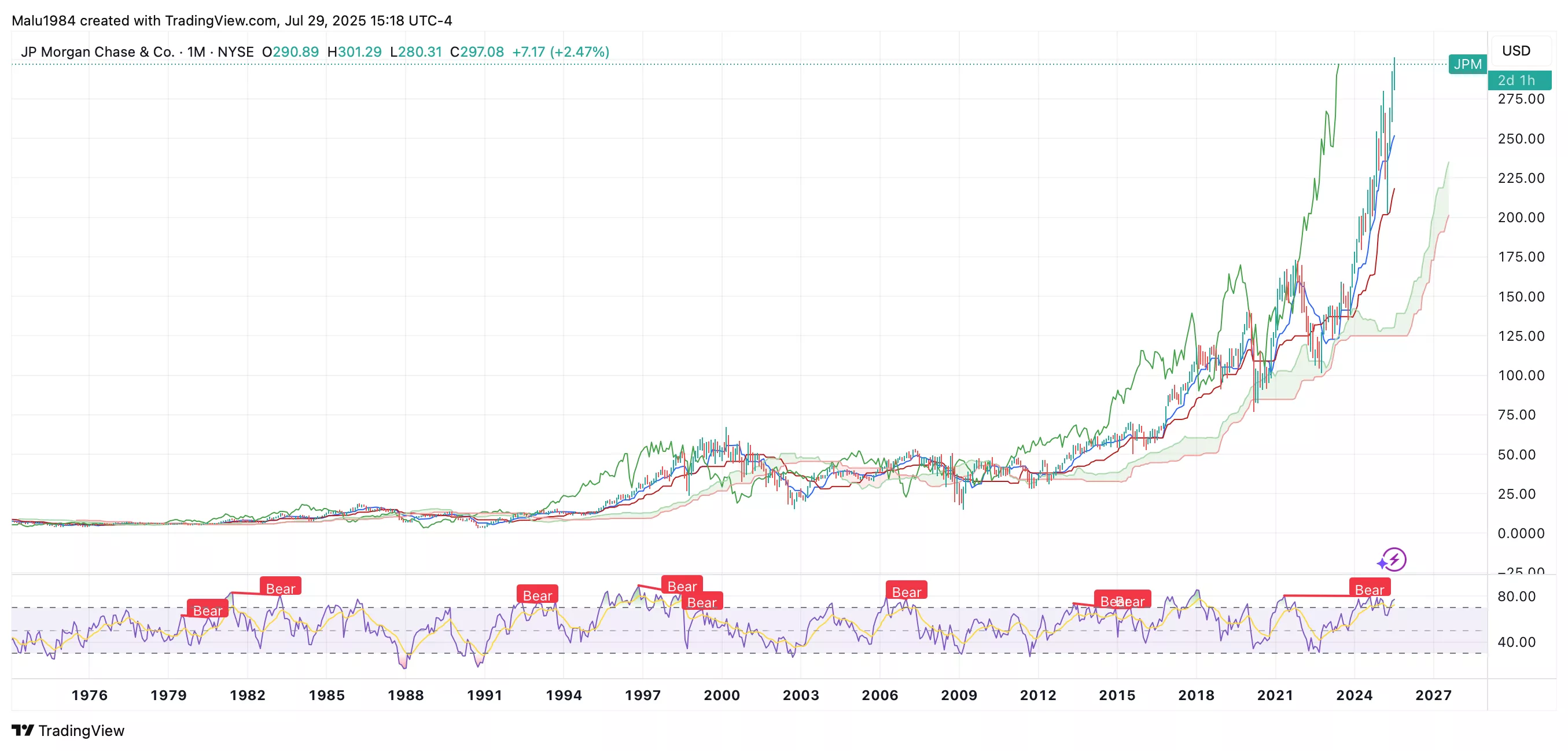

Price is well above the Ichimoku cloud.

The cloud is green, showing long-term bullish momentum.

Conversion line is above the baseline, another bullish signal.

Candles continue to push higher without signs of weakness.

RSI is at 77, which puts it deep in overbought territory.

(Click on image to enlarge)

Weekly Chart

Weekly candles are also above a strong green Ichimoku cloud.

Conversion is above baseline, forming a golden cross, which is a bullish signal.

Overall trend remains upward with no major resistance yet.

RSI is at 70, also overbought. A short-term pullback could happen before the next leg up.

(Click on image to enlarge)

JPMorgan is in a clear uptrend across both charts. Momentum is strong, but RSI levels suggest the stock is overheated. Investors may want to wait for a small pullback before jumping in. The long-term chart still supports continued growth over time. This stock is suitable for long-term investors.

Buy Limit (BL) levels:

$272.28 – High Risk

$255.26 – Moderate Risk

$241.58 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Medium

The trend is strong and clearly bullish, but RSI shows the stock is overbought on both the weekly and monthly charts. A short-term pullback is likely, which adds some entry timing risk for new investors.

Summary: Final Thoughts

JPMorgan is showing strength across the board. Fundamentally, it’s profitable, well-capitalized, and expanding into areas like AI, crypto, and global asset management. It’s also negotiating big moves, like taking over Apple’s credit card program. These plays could reshape how JPMorgan makes money in the years ahead.

But there are risks. If the Apple Card deal goes through, JPM may take on more subprime credit exposure. And its bold move to charge fintechs for customer data could backfire if regulators step in.

Sentiment is mostly bullish. Investors trust Jamie Dimon’s leadership, and Wall Street views JPM as a high-quality stock in a choppy market. But there’s caution around banks in general, and JPM is starting to act less like a bank and more like a tech company—which not everyone understands yet.

Technically, the stock is on a strong uptrend. But both weekly and monthly RSI levels are overbought. That means a pullback could be coming soon.

Overall outlook: Bullish

Overall risk: Medium

JPMorgan is making bold, strategic moves that could drive long-term growth—but timing your entry matters, and regulatory heat is something to watch.

More By This Author:

Beneath The Surface Of SoundHound Stock: 3 Growth Drivers Most Investors Are MissingAlphabet’s Q2 2025 Earnings Beat Expectations But This One Detail On Google Could Matter More

QuantumScape Stock Before And After Earnings: Buy The Dip Or Stay Away In 2025?