S&P 500 Pullback Update: Are We Nearing The Light At The End Of The Tunnel?

Image Source: Unsplash

Watch the video extracted from the live session on 12 Sep 2023 below to find out the following:

- The demand and the support zone for short-term movement.

- At what point can we consider a reversal of the upswing

- Why and how a bullish case is likely to unfold

- What did the spike in the volume on Monday mean?

- And a lot more

Video Length: 00:05:45

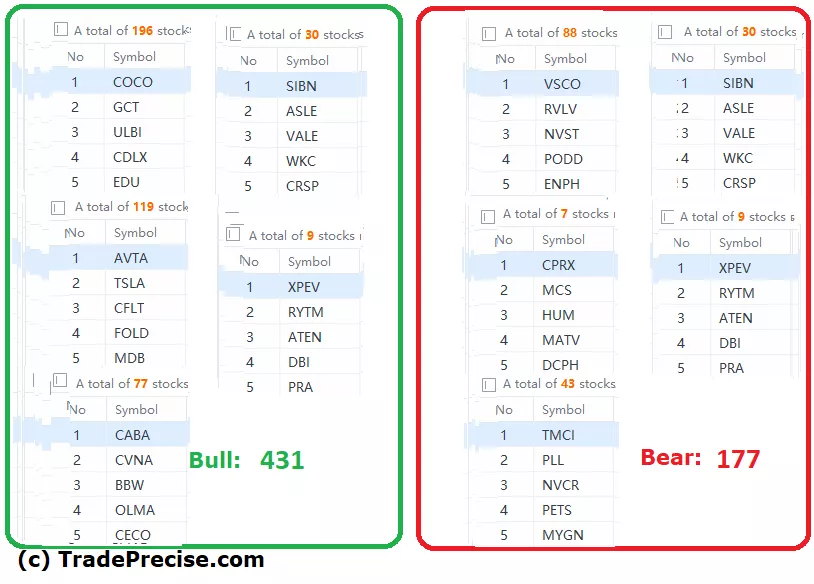

The bullish vs. bearish setup is 431 to 177 from the screenshot of my stock screener below pointing to a positive market environment.

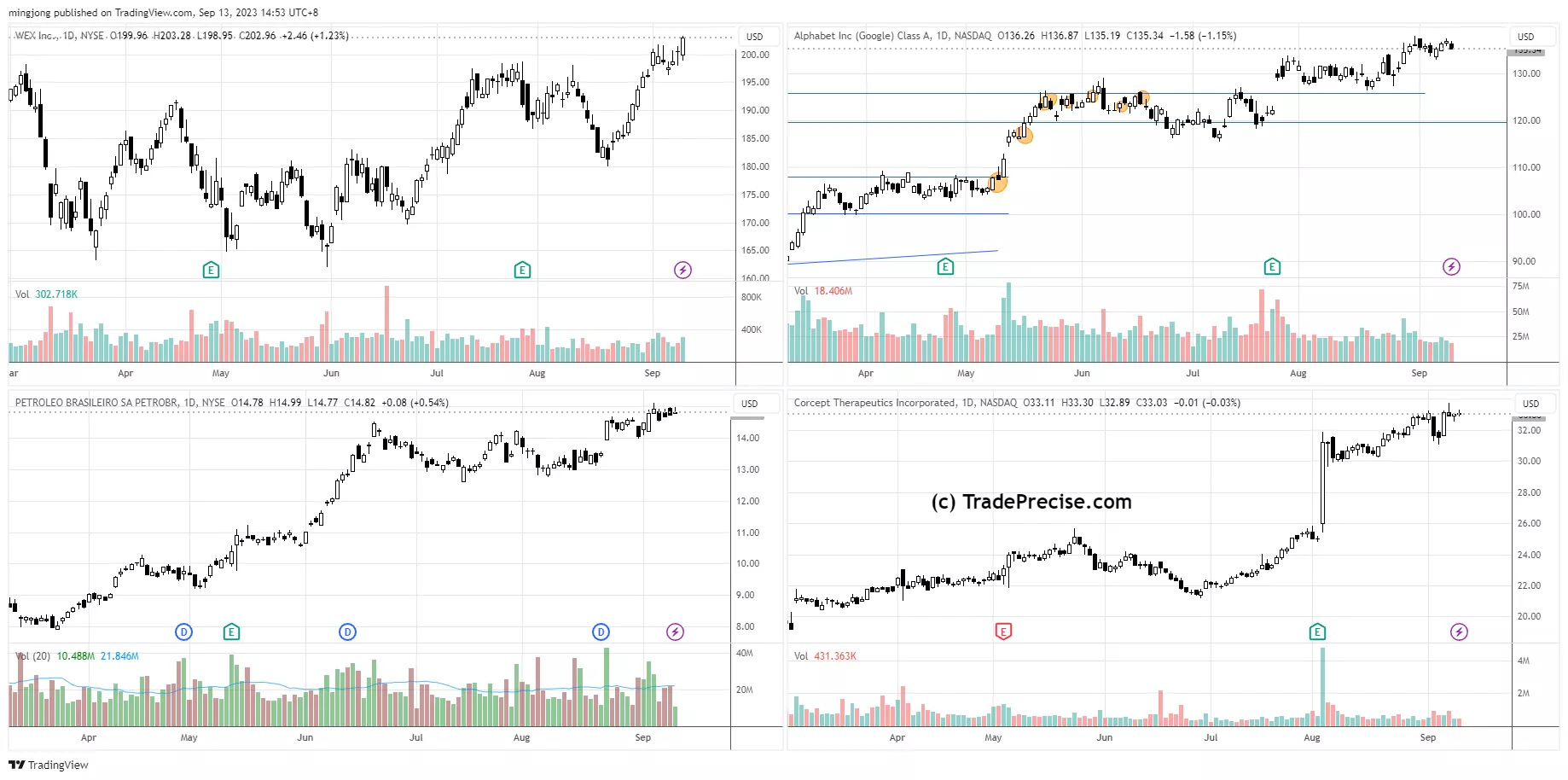

8 “low hanging fruits” (WEX, PBR, etc…) trade entries setup + 19 others (GOOGL, CORT, etc…) plus 15 “wait and hold” candidates have been discussed during the live session.

(Click on image to enlarge)

Supply absorption in crude oil last week as discussed yesterday followed by a breakout is constructive for oil and gas stocks. However, many of them have been extended since covered 2-3 weeks ago, which are now on the’ Wait and Hold” list.

More By This Author:

Spot The Hidden Supply And Derive The Strength Of The Market Structure

S&P 500’s Wild Card Month: Brace Yourself For The Unexpected

Is The Channel Oversold Bounce The Start Of The Epic Turnaround?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.