S&P 500: Is The Bottom Finally In Or More Weakness Ahead?

Watch the video extracted from the WLGC session before the market opens on 10 Sep 2024 to find out the following:

-

Could the current technical rebound lead to a sustained rally, or is it just a short-lived bounce?

-

How would the recent increase in supply and volatility impact the S&P 500?

-

The key area the S&P 500 needs to commit to flip to an upward bias.

-

And a lot more...

Market Environment

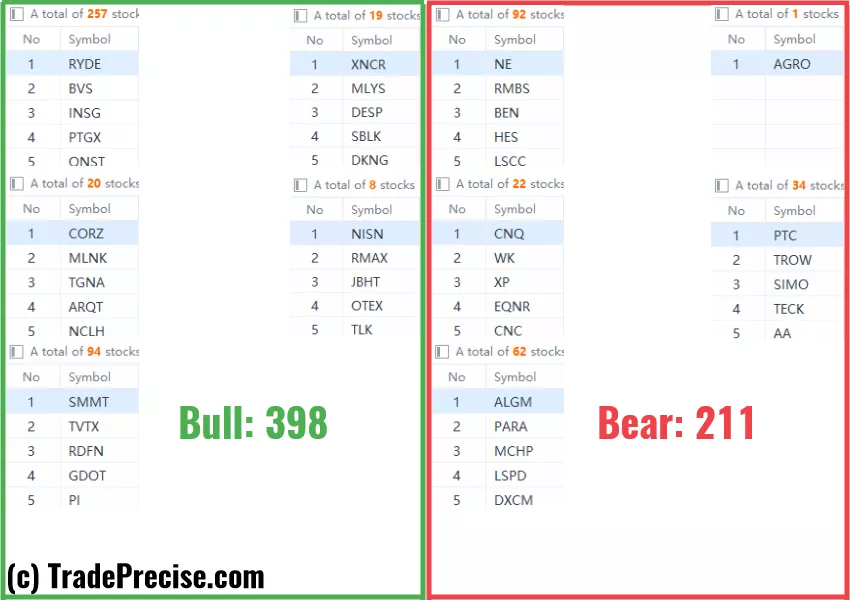

The bullish vs. bearish setup is 398 to 211 from the screenshot of my stock screener below.

(Click on image to enlarge)

3 Stocks Ready To Soar

9 “low-hanging fruits” trade entries setups & 14 actionable setups were discussed during the live session before the market open (BMO).

As the market broke down from the bullish flag pattern last Tuesday and dropped continuously for 4 sessions, a handful of the stocks manifest relative strength.

These are the stocks I am paying attention to and looking for triggers from the setups, such as CAVA, DHI, TRU.

(Click on image to enlarge)

(Click on image to enlarge)

More By This Author:

The Bear Case: Bull Flag Failure!

Is The S&P 500 On The Verge Of A Breakout?

Why Low Volume In S&P 500 Could Be Signaling A Hidden Opportunity?

Disclaimer: The information in this presentation is solely for educational purpose and should not be taken as investment advice.