So, Are We All Switching To Bing?

By: Steve Sosnick Chief Strategist at Interactive Brokers

Microsoft (MSFT) has been one of the clear market winners over the past few weeks, with its performance spurred by the current investor interest in artificial intelligence (AI). MSFT’s $10 billion investment in ChatGPT has been a huge boon to the software behemoth. As I write this, the stock is up over 9% since the deal was confirmed on January 27th, and up over 18% since the deal was first reported on January 10th.

In market capitalization terms, the deal has been spectacularly successful. It has already paid for itself by more than 35X since it was first discussed publicly and over 17X since it became official! For perspective, the S&P 500 (SPX) is up 0.02% and 4.9%, respectively, over the time periods referenced above, with the NASDAQ 100 (NDX) up 2% and 11% over those same timeframes. Considering MSFT’s high weight in both of those indices (currently #2 and #1, respectively), there is a bit of a feedback effect. One can attribute a portion of the markets’ overall success to the lift in MSFT.

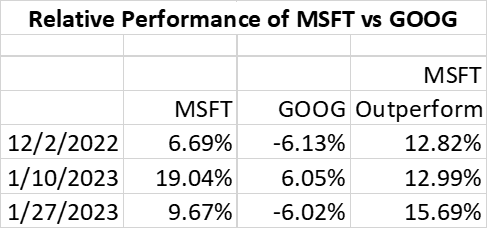

The stock market is not a zero-sum game, so there is not necessarily a loser even as MSFT wins. But in relative terms there is a clear loser – Alphabet (GOOG, GOOGL). When ChatGPT first came to the public’s attention late last year, it was described in both financial and mainstream media as a possible “Google killer”. Overall the relevant time periods since ChatGPT came into widespread public attention, MSFT has been outperforming GOOG – usually by a substantial amount – as evidenced in the table below:

Source: Interactive Brokers

Let’s stipulate that ChatGPT is indeed all it’s hyped up to be. I can’t verify whether it’s a game-changer or simply a buzzy first mover, so I’ll look on the positive side. Even if it dramatically improves the search results offered by Bing, will that be enough for Microsoft to overtake Google in search? And if so, how long might that take? Google’s dominance in search is almost unbelievable, as the following chart demonstrates. Note the tiny sliver that represents Bing:

Source: The Economist

There are very few brands with enough power to make them synonymous with the product in question. Do you ever hear the term, “let me Bing that?”Of course not. And I actually use Bing with Microsoft Edge on this PC. It is quite possible that Google eventually fades from prominence; I was going to use “Xerox” as an example for copying even though I haven’t copied on a Xerox machine in ages.

The upside for a resurgent Bing can indeed be substantial. In theory, it could provide a key competitor for the huge pool of advertising dollars devoted to search. But the time period over when that might occur is probably quite a bit longer than what seems to be getting priced into MSFT stock right now.

Fundamentally, traders are paying much more for MSFT than they are for GOOG. The PEG (Price/Earnings/Growth) ratio for MSFT is just over 2. For GOOG it is just under 1. Bear in mind that both of these are enormous companies. One is being priced for high growth, the other like a value stock. It is entirely possible that Bing can make a meaningful dent into Google’s search business, bringing increased ad dollars and real growth to MSFT’s bottom line. But that is far from a foregone conclusion, the timeframe of such a shift is unclear and could take years, and the shift may not even be as meaningful to MSFT’s bottom line as bullish investors hope.

Last week we wrote about “secret words” that traders want to hear. I confess that I wanted to add “AI” to the list, but ran out of time. Let’s be clear, “AI” is now a hot buzzword, and could remain one for some time. It is providing a powerful, momentum-based boost to one of the world’s largest companies. That is catnip for traders but could provide an opportunity for investors to move from one highly valued company to another one with a more pedestrian valuation.

More By This Author:

My State Of The Markets Address

Bond Yields Surge Higher, Buoyed By Fed Tightening And Inflation Expectations

Higher For Longer?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more