Should You Be Around Tesla Stock After It Has Shed 60% Off Its Value In 2022?

Tesla fans have endured a tumultuous journey this year. With stock down 60% and the P/E ratio at its lowest point, one can’t help but wonder if this is simply a hiccup on the road or an indication of a lasting downward shift.

To get a better sense of the company’s future, it is important to think ahead and calculate a company’s stock value by predicting its total earnings over the course of its existence, converting them into today’s currency.

Let’s embark on a journey through time and into the future, where we will venture to the year 2032! Our mission? To accurately forecast Tesla’s sales and profits, to value their future self and then convert that value into present-day currency. Buckle up and let’s take off!

What to Expect from the Electric Vehicle Market in 2023?

It’s anyone’s guess what the global passenger car sales will look like in 2032, but forecasting with a modest starting point could prove useful. Analysts at Oxford Economics predict the world economy will grow by 1.3% in 2021, so I’ll use that as the benchmark for estimating sales for the coming decade. Taking into consideration that global growth could hover around 2%, LMC Automotive Group projects that car sales could potentially reach 85 million by 2022.

If auto sales mimic the progress of the global economy, then in 2032, the automobile industry is predicted to sell a whopping 103 million vehicles.

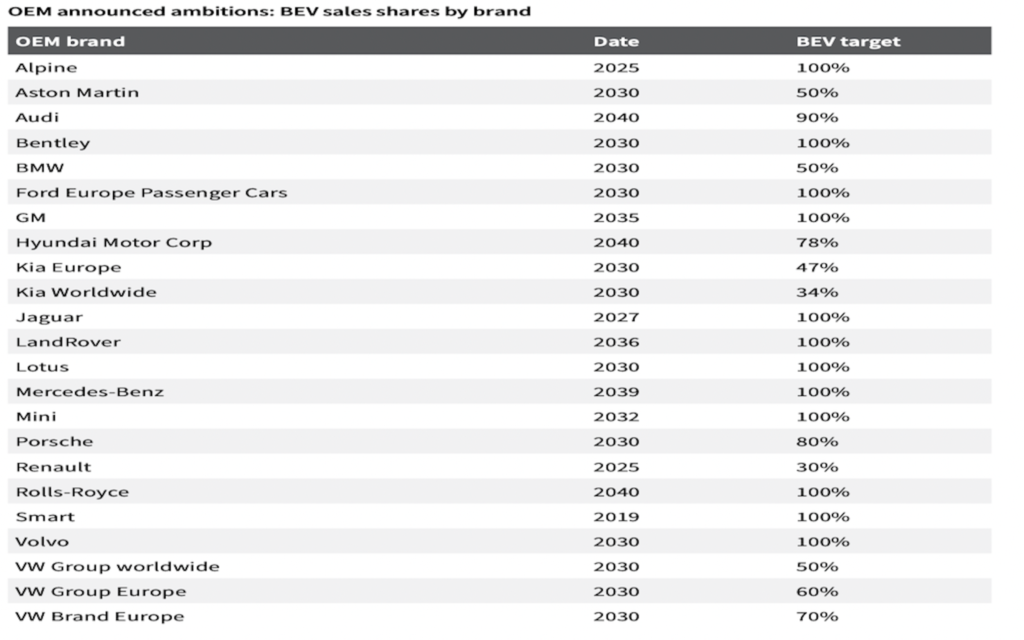

Analysts at IHS Markit estimate that in 2030, one out of every four vehicles sold will be electric, however, many carmakers have much higher aspirations in terms of EV sales. If auto sales continue to keep pace with economic growth, by 2032 over 103 million vehicles will be sold worldwide.

(Click on image to enlarge)

We are a bit more optimistic about the future of EV though with 30% of 2032’s cars to be electric.

What About Tesla Market Share by That Time?

Tesla’s market share may be dominant in the US, but it’s set to take a plunge in 2025 to 25%. Although their high-priced cars may be less popular abroad, my forecast is that their market share will remain at 20% by 2032. This is quite a tricky situation, as Tesla’s share varies geographically.

If Tesla continues to grow at 17% annually, it would ship a whopping 6.2 million vehicles in 2032 – a remarkable increase from the 1.3 million cars estimated to be sold this year. To me, this appears to be a totally plausible feat!

Tesla’s Projected Profit in 2032

The prices of the most recent Tesla models range widely, but if we take a rough estimate by dividing third-quarter revenues ($19 billion) by the amount of cars delivered (344,000), it’s around $55,000 on average. It’s uncertain if prices will change in the future, so for now, we’ll assume that they stay the same. That would mean Tesla making an impressive $341 billion in sales in the year 2032.

Tesla’s EBITDA margin of 22% of sales in the last quarter was a significant achievement. Moving forward, the future of this margin will hinge on two key elements: the degree to which competitors are able to erode it, and whether Tesla can leverage cost savings to boost production.

If these two forces manage to balance each other out, it’s reasonable to assume that Tesla’s margin will remain roughly the same in a decade’s time.

If everything goes according to plan, Tesla will generate a staggering $75 billion in 2032 EBITDA – that’s an impressive $341 billion in revenue multiplied by an EBITDA margin of 22%.

What’s the Future Present Value of Tesla Now

Today, Tesla’s shares are exchanging hands for around 19x enterprise – or company-wide – value in comparison to EBITDA: a popular metric used for this kind of assessment. Multiplying 19x to our predicted 2032 EBITDA of $75 billion would yield a $1.4 trillion valuation, about triple what it’s worth right now.

In ten years, we need to convert that $1.4 trillion future value into present-day currency. Discounting does the opposite of compounding – if we wish to figure out the value of something today after ten years, we multiply it by an interest rate. To convert a future value to the present, we divide it by an interest rate multiple times.

Your choice of interest (discount) rate is completely up to you – but it’s typical to begin with a risk-free rate, like the yield of a government bond, and add a bit extra to that for a risk buffer (known as an Equity Risk Premium, or ERP). You can decide how much of a risk buffer you want, but we usually use a total discount rate of 8%. That would mean a 4% government bond yield and a 4% ERP.

What is it in Today’s Money?

My valuation for Tesla today is around $670 billion – 32% higher than today’s level – after dividing $1.4 trillion by 8% ten times and adding the firm’s cash on its books of $19 billion.

Before we click the ‘buy’ button, we must remind ourselves that there is a big chance of error with these predictions. The biggest hazards we detect come from my expectations regarding the market share and profit margin. If Tesla’s market share just amounts to 10% by 2032, my estimation of its value will be cut in half, to $335 billion – that’s 34% lower than its current value. Similarly, the 22% EBITDA margin I’m counting on is notably higher than that of Tesla’s rivals. For example, Ford had a 12% EBITDA margin in 2021. Not to mention the valuation multiple wechose.

In ten years, if the company’s expansion isn’t as rapid as it is now, that 19x EBITDA figure may be overly ambitious.

Tesla has been at the center of heated controversy, from questionable accounting techniques to internal issues. To add to that, nobody knows what Elon Musk is up to and his excessive use of Twitter isn’t doing the company any favors in the eyes of its shareholders.

What Are the Opportunities Here?

Despite the potential dangers that the future holds, conducting valuations can give us a glimpse into what investors are thinking. And judging by our educated guesses, it doesn’t seem that they are brimming with optimism right now.

Are you a Tesla fan? If so, then you may feel that the assumptions we’ve made in the analysis are too conservative, making you even more optimistic about its stock.

Tesla is sure to have a bright future ahead of it that goes beyond cars!

But if you’re not a fan, then you could argue that our assumptions are far too optimistic.

Nevertheless, the calculations are sound, so why not try tweaking the figures and see what you get?

No matter what else may be said, the dramatic decrease of the company’s share price this year brings home the reality that investors now have a more sensible outlook toward its future.

More By This Author:

Goldman’s Forecast For The Next 50 Years Ahead

S&P 500 Is Up As the Market Gets Drunk On A “Soft Landing” Scenario

Weekly Waves: EUR/USD, GBP/USD And Gas

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more