S&P 500 Is Up As The Market Gets Drunk On A “Soft Landing” Scenario

On Wednesday, the S&P 500 had a remarkable rally of 3%, capping off an already impressive 5% gain for November. And after its extraordinary 8% surge in October, the S&P 500 stands a mere 14% lower year-to-date. Despite the inflation soaring to 40-year highs and the Federal Reserve working to cool it down by increasing interest rates, this stands as an impressive feat. Nonetheless, it may be a sign of over-optimism…

What Spikes the Stock Market?

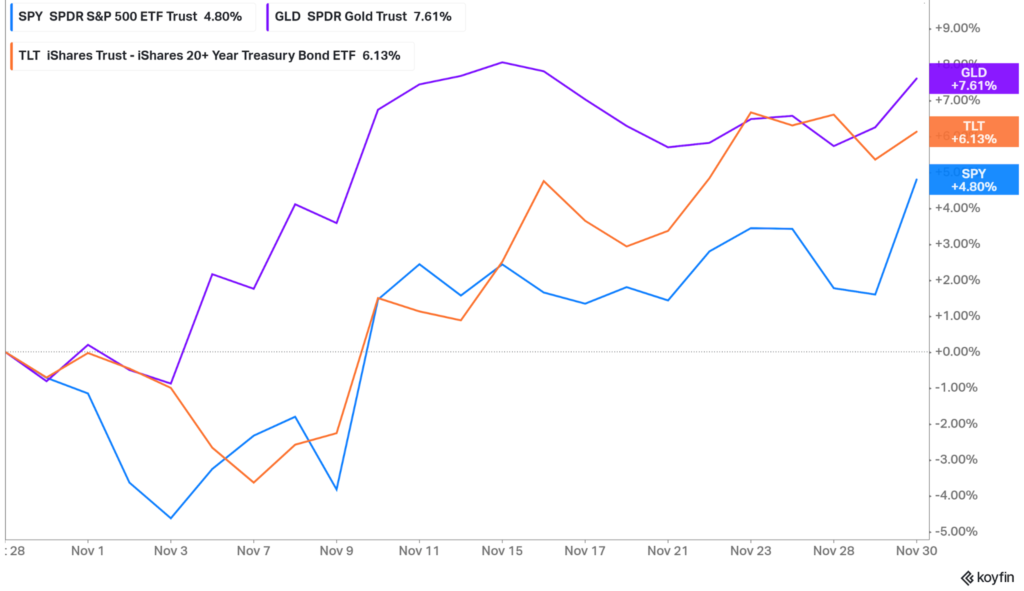

November was a great month for more than just stocks – bonds and gold also saw impressive rallies! Indeed, long-term US Treasury bonds (orange line) and gold (purple) saw even better performance than stocks.

The rally indicates that liquidity is improving: more capital is available in the economy and it is easier to access. Interest rates have been rising this year, which reduces the availability of capital and lowers the demand for all types of assets, both stocks, and bonds. All of this adds up to show that liquidity matters more than stocks!

As the Federal Reserve draws closer to what it considers the maximum interest rate level, and economic data suggest a gradual slowdown, investors are feeling increasingly optimistic about the possibility of a soft-landing – where the Fed curbs inflationary pressures without pushing the economy into a recession. If it can pull this off, liquidity conditions should improve, and previously beaten-down assets such as stocks and bonds should regain their strength.

Signs of a cooling US inflation and a decrease in demand for workers in October, along with Jerome Powell’s signal that the Federal Reserve is likely to implement a more moderate rate increase this month, are providing evidence for this outlook.

He noted that there is “a route to a smooth arrival”. But when you factor in the potential of China loosening its ‘no-Covid’ policy (which would provide a boost to both growth and inflation), along with some technical elements (like covering short positions and the low liquidity that’s fueling market rises), it’s clear why stocks – and other assets – have seen such an intense surge.

Is it Really The Time to Go Long Stocks?

Be wary – although investors are banking on a soft landing, that doesn’t guarantee one will happen. We’ve previously discussed the long and intricate delays between rising interest rates and their overall effect on the economy, leading to a heightened risk of the full consequences of those intense hikes not being felt yet.

Soft-landing scenarios, though rarely seen in the past, are incredibly intricate due to lead-lag effects and complex relationships between Fed policy and the economy. A successful soft-landing requires a delicate balance of not too much and not too little, but aggressive rate hikes generally lead to a recession – bad news for stocks and great news for Treasury bonds

Although the current state of stocks appears more positive, I would advise not to become too confident with their higher prices. The Federal Reserve will only initiate a genuine shift once inflation stabilizes within its desired range of 2%.

Unfortunately, we are far from that – and it will take more economic difficulty to get there. When that difficulty inevitably emerges – when the economic downturn is clearly underway – it will cause investor sentiment and fundamentals to deteriorate suddenly.

Now, the stock market seems more promising, yet we would advise against throwing your full resources into it.

What Are the Moves Here?

If you are into Stock (via CFD, perhaps), don’t go all in on Tech Stocks just now; diversify across value, commodity-dependant companies (like Exxon Mobile), and spread the risk across several goes (don’t just stick to the US).

To bet against the current spike, consider longs on GOLD, and don’t forget to keep some cash on hand in case the latest moves were indeed a respite from bigger drops to come. The economy is fragile as ever, and the geopolitical issues do not seem to subside yet.

More By This Author:

Weekly Waves: EUR/USD, GBP/USD And GasWeekly Waves: EUR/USD, Bitcoin And US30 - Monday, Nov. 21

Impact Of Lower Inflations On USD Majors

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more