Weekly Waves: EUR/USD, Bitcoin And US30 - Monday, Nov. 21

Our weekly Elliott Wave analysis reviews the EUR/USD weekly chart, the US30 weekly chart, and the Bitcoin weekly chart.

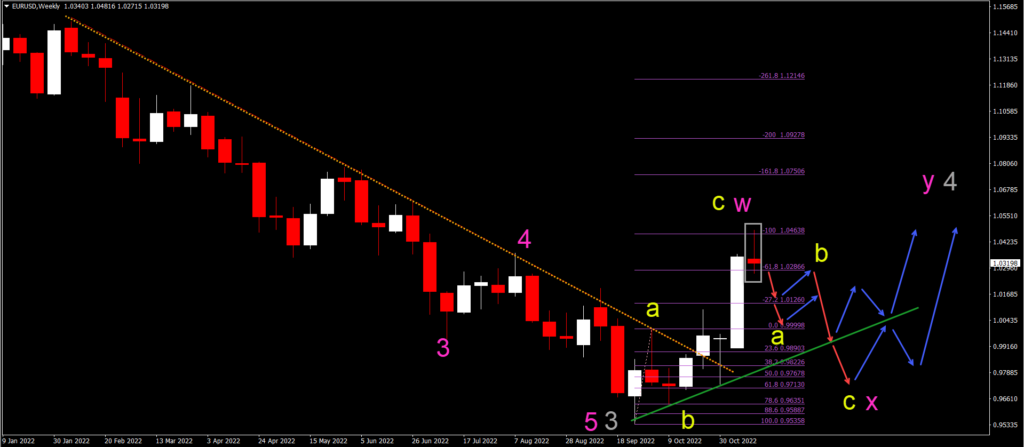

EUR/USD Bearish Pinbar Candlestick Pattern

The EUR/USD is showing a bearish pin bar on the weekly chart, which is a major bearish reversal candlestick pattern:

- The EUR/USD bearish pin bar is indicating that the bulls are running out of steam. A reversal is now expected after the price action has hit the -100% Fibonacci target.

- The bullish price swing could have completed an ABC (yellow) correction.

- The ABC (yellow) is probably part of a larger and more complex WXY (pink) correction.

- A breakout below the weekly candle low should price action lower (red arrow).

- A bearish decline could confirm an ABC (yellow) within wave X (pink).

(Click on image to enlarge)

Bitcoin Bearish Breakout Below 78.6% Fib

Bitcoin (BTC/USD) has respected most of the Fibonacci retracement levels. Recently price action has broken below the 78.6% Fibonacci:

- The BTC/USD breaks below the 78.6% Fibonacci retracement level indicating a likely further decline toward the 88.6% Fibonacci level.

- The bearish breakout could either see an immediate continuation (red arrow) if it breaks below the weekly candle low (green line).

- Or price action could make a bullish retracement first toward the resistance zone (orange lines) before making another bearish swing (red arrows).

- A bullish bounce (blue arrows) is expected at the 88.6% Fibonacci support level.

- Price action could either be completing a wave C (yellow) within wave 2 (gray) or a wave W (pink) of a larger WXY (pink) in wave 2 (gray).

(Click on image to enlarge)

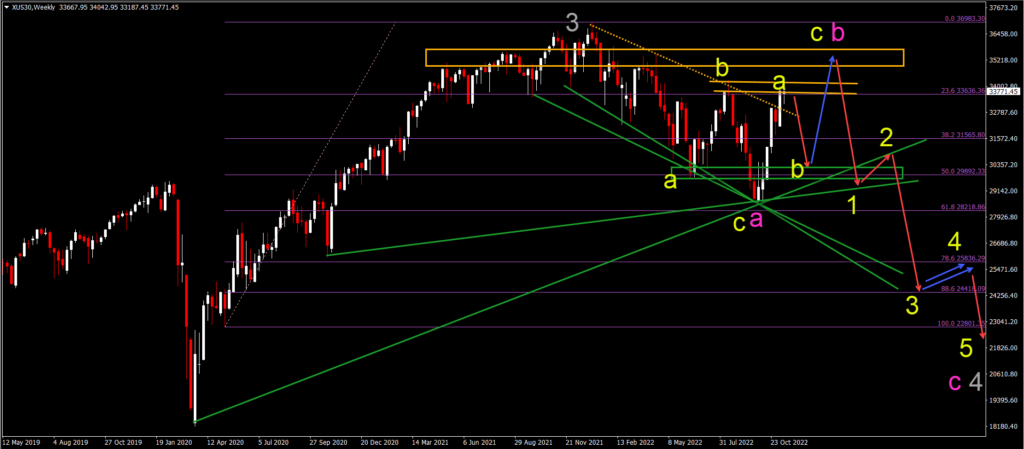

US30 Bullish Revival Faces Massive Resistance

US30 made a strong bullish bounce at the 61.8% Fibonacci support:

- The US30 bullish bounce has now reached a strong resistance zone (orange lines).

- A bearish bounce at the resistance is expected (red arrow) to test the support and inverted head and shoulders level (green box).

- A bullish bounce there could confirm a bullish ABC (yellow) within wave B (pink).

- A larger bearish reversal (red arrows) is expected at the resistance zone (orange box).

- A bearish 5 wave pattern (yellow) could emerge and take price action below the support trend line (green).

(Click on image to enlarge)

More By This Author:

Impact Of Lower Inflations On USD MajorsKey Market Insights November 8

What’s Next After BoE Hiked Rates by 0.75%?

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more