Goldman’s Forecast For The Next 50 Years Ahead

It’s been almost two decades since Jim O’Neil, the Goldman Sachs (GS) economist, created the term “BRIC” to identify Brazil, Russia, India, and China as emerging economic giants. Goldman Sachs recently unveiled its report that extends coverage to 104 countries and its predictions for world growth until 2075.

To save you the hassle of going through the hefty report, I have studied the banking giant’s expectations and can give you an insight into the world’s anticipated transformation over the next fifty years and the greatest potential investment opportunities.

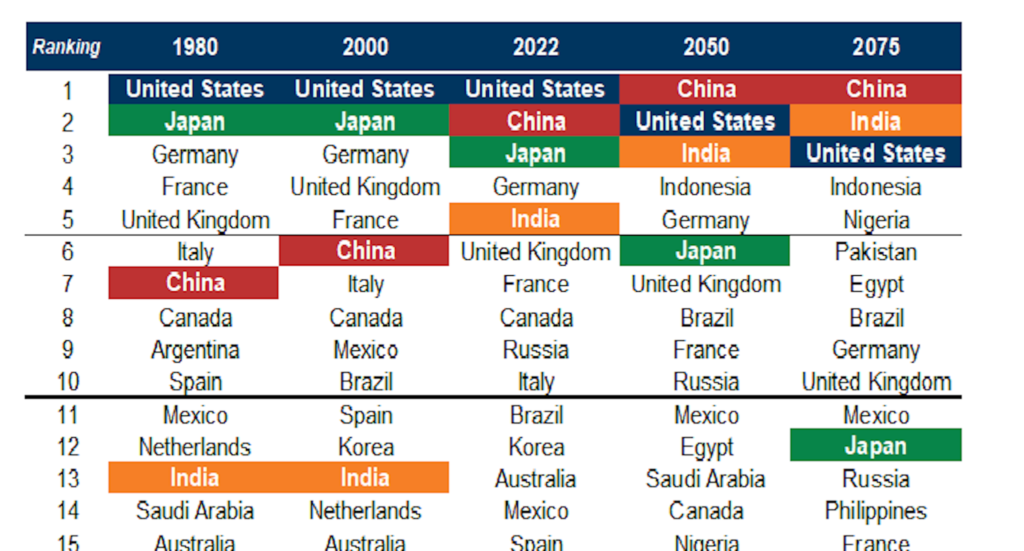

Let’s kick things off with some country-specific predictions. Goldman Sachs is certain that China, the US, India, and Germany will stay in the top five global economies by 2050. Indonesia is anticipated to be included in that group of five, with Japan dropping out. Fast-forward to 2075, and Goldman predicts that Germany and Japan will slip down the list, leaving room for Nigeria to make it into the top five.

Demographics could very likely be the cause of Japan’s dip – the current population of 125 million is anticipated to decrease to a mere 86 million by 2075. Although the worldwide population growth is projected to reach a high of 10 billion, a maturing population such as Japan’s comes with its own unique challenges and opportunities.

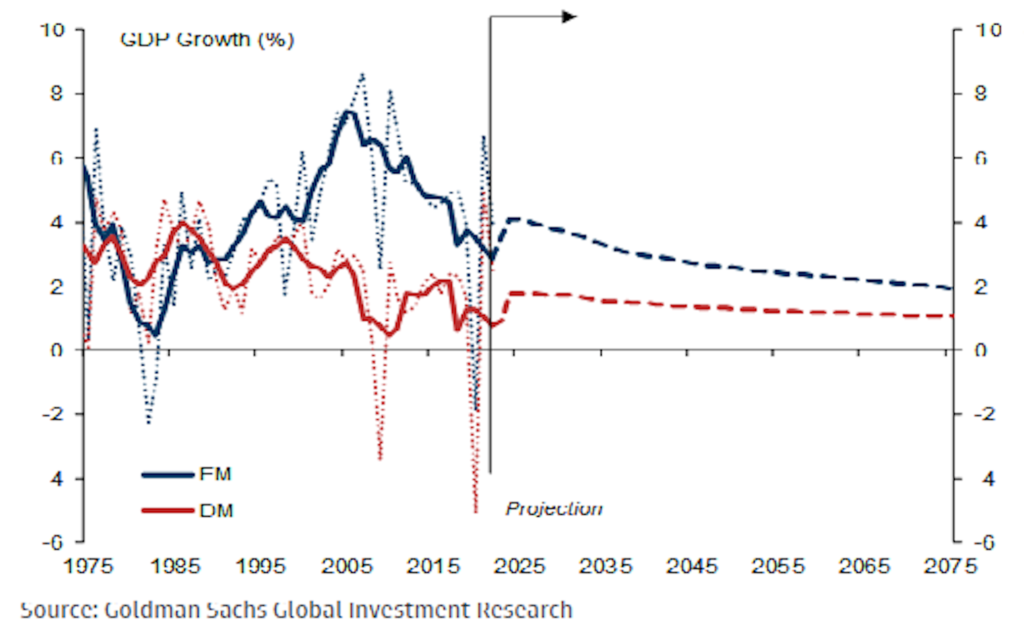

For the past two decades, global economies have been flourishing with an average growth rate of over 3%. But now, Goldman Sachs asserts that the peak potential of global expansion has passed. Their prediction? By 2024 to 2029, economic growth will slow to an average of 2.8%, eventually dropping to below 2% by 2075. Surprisingly, the report suggests that emerging markets, largely driven by Asia, will still expand at a faster rate than developed markets. (The two dotted lines in the graph illustrate this.)

The bank has its doubts that the US economy and dollar will repeat the extraordinary success seen in the past ten years, and actually predicts the US dollar will experience a drop in value in the next decade.

More By This Author:

S&P 500 Is Up As the Market Gets Drunk On A “Soft Landing” ScenarioWeekly Waves: EUR/USD, GBP/USD And Gas

Weekly Waves: EUR/USD, Bitcoin And US30 - Monday, Nov. 21

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

more