September: The Pause That Refreshes

Image source: Pixabay

No market goes straight up or straight down.

Nothing on the horizon indicates a bear market is imminent.

But a correction - or at least a pause -- might be in the cards.

I see nothing on the horizon to suggest a bear market is imminent. Yes, the market is priced for perfection - and may already be discounting a ¼ point lowering of the Fed funds rate. But perfection is a relative term. Investors look at a high P/E for the S&P and the Nasdaq and think, "It can't go any higher." But remember, the "P" (Price) might be higher than at any time in recent memory, but if the "E" (Earnings) increases even more, then the enthusiasm will be justified.

Markets don't die of old age. Never have. This is why the calls for an end to the bull are likely off base. However, like any living, breathing thing - like, say, a real-life bull - as it gets older, it gets winded more easily and must take more breaths before gaining the strength to charge ahead.

That may be what happens this September. Taking a breather would give us all the opportunity to take a step back and critically review our portfolios. We can shave a little here, add a little there, place sell-stops as appropriate, and take the time to analyze new names we are as yet unfamiliar with.

Sit by the seashore and watch as the tide comes in. Does it come in one smooth wave that covers the entire distance from low tide to high tide? Of course not! It comes in waves that increase the distance covered when incoming as well as when outgoing. It is the same in the stock markets. They move in waves.

Where do we go from here?

Who knows? We have a word for anyone who wants you to believe they can predict what the market will do tomorrow: charlatans. We have a word for anyone who believes anyone who says they can predict what the market will do tomorrow: stupid. (There are, of course, enough in each camp to keep the 3-Card Monte Society in clover for some time…)

All the intelligent investor can do is weigh the odds and make intelligent incremental moves that in the aggregate enhance their chances of protecting and growing their portfolio.

With that in mind, I believe a parabolic rise needs time to digest the gains. The way I protect against this digestive process is to place ever-tighter trailing stops on my most volatile positions as the market continues to move higher.

US markets in September may rise, or they may fall, just as is the case every month. But if they fall, it will not be preordained because it is at a certain moment in the calendar. There is no reason to be any more cautious than we are always at Investor's Edge.

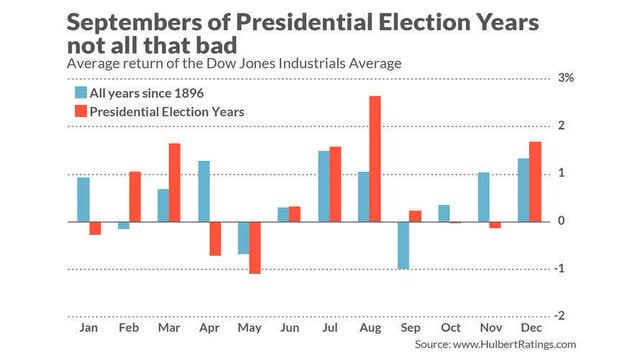

If you must believe in tea leaves or throwing bones into a circle, please be advised that there is one reason to believe this particular September might be even better than most. The chart below from Mark Hulbert provides a little more granularity into that hoary-old maxim about a weak September; the average move in September of most presidential election years is up.

The following chart from Mr. Hulbert's article illustrates this quite well:

Hulbert Ratings

The only thing to fear about the stock market in September is fear itself. This month is most likely to be influenced by the election run-up, corporate debt, housing affordability, mortgage, and other rates -- and investor overreaction in either direction. You know, just like every other month of the year.

More By This Author:

MLPX: The Energy Handwriting Is On The Wall, Buy Infrastructure

Lithium Americas: A Few Bullet Points On The Latest Share Price Debacle

Should You Sell In May And Go Away?

Disclaimer: Unless you are a client of my portfolio management firm, Stanford Wealth Management, I do not know your personal financial situation. Therefore, I offer my opinions above for your ...

more