Lithium Americas: A Few Bullet Points On The Latest Share Price Debacle

Image Source: Pixabay

Lithium Americas Corp. (NYSE: LAC) is not an easy stock to love, especially right now.

And yet, I added some to our Investor's Edge Growth & Value Portfolio - and to some of my personal portfolios as well.

Why?

There are many reasons for Lithium Americas' fall from grace. It is down 53% since the beginning of the year, so someone must know something, right? As recently as just two months ago, the company's shares sold for $7.34.

Seeking Alpha

There are numerous reasons for this precipitous decline.

Firstly, the company has no earnings. Indeed, it has no revenue from which it might create some earnings. There is as yet no product being mined. So all they have is a massive deposit of something likely to be, once it is extracted, processed, and sold to those who desperately need it, of great value. But they do not have the money to develop it.

Doesn't sound too promising, does it?

It gets worse. Even those companies producing lithium at rock-bottom prices that "used to be" making great returns have taken continuing hits.

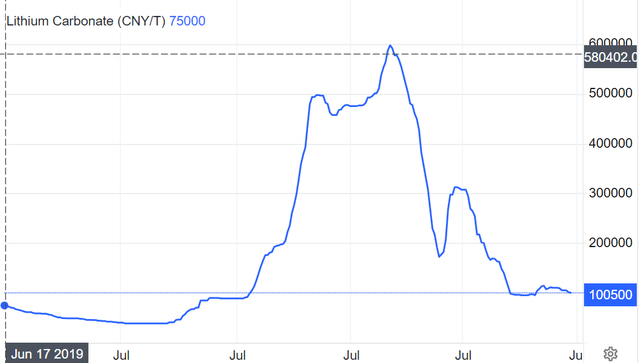

Trading Economics

The euphoria that was building back in 2021-2022 that EVs and BESS (Battery Energy Storage Systems) projected a need for massive amounts of lithium. This sent lithium prices into the stratosphere. The chart above is in Chinese Yuan. The USD is roughly 7 to 1 in conversion. ¥100,000 equals, as of today's mid-point price, $13,786. Whether this is in Yuan, Rand, Dollars, or Zlotys, the chart is still the same. In the 4th quarter of 2022, a ton, or a pound, or 1000 tons of lithium carbonate was worth *6 times* what it is worth today.

With prices so depressed, how could a company that won't even be in production for another year and a half or so hope to stay alive? Which is why many investors are shying away from LAC. Their logic is that they can throw darts at anything with the words "Artificial Intelligence" and make money, so why wait for a possible catalyst in lithium?

There are other minor issues, but the two above - depressed prices for lithium and the fact that LAC, in particular, doesn't seem to have the do-re-mi to develop their property - are the big reasons why LAC has had such a headlong plunge.

And Yet, I Buy?

What is it with me and LAC? Let go of your losers and let the winners ride, right? No.

Here is why I am willing to buy a small amount every time LAC strikes a new low (giving me ample opportunity to purchase!) I keep these facts in mind:

1. Thacker Pass is a game-changer. Thacker alone will likely be the biggest clay lithium find in history. But there is more - Thacker does not even scratch the surface of the rest of the LAC holdings in the McDermitt Caldera region.

2. The world is not about to stop using lithium. Prices are down for now, but that will change. All the "alternatives" that have been promised for years have failed to prove themselves. In fact, if anything, the solid lithium battery solution may turn out to be the best.

3. Forget the fact that the US is not buying EVs - in a country this big, we need better infrastructure for that to happen.

But lithium-ion batteries for smartphones, laptops, power tools, and energy storage systems are going gangbusters.

Ditto for tablets, smartwatches, cameras, and uses in the defense and aerospace industry.

Then there are medical devices and pharmaceuticals, lubricants, ceramics, and heat-resistant glass, with EVs still being sold albeit at a so-so rate.

4. Thacker Pass is expensive. LAC has stated all along that they believe it will take $3 billion to bring it to production. But they only have a couple of hundred millions in the bank. Does this mean they go bankrupt and someone else picks up the pieces?

Unlike Solyndra and the other follies way back in the Obama administration, a real company, General Motors, that needs to ensure lithium supply, is investing in LAC. They have already invested $320 million in the Thacker Pass project. GM has a second tranche to invest $330 million. They could, however, back out, lose that US lithium source, and write off the first $320 million.

5. Thacker Pass is expensive: $3 billion. But the US Dept of Energy, probably stung by previous wastes of US citizens' money, seems to have done the same deep due diligence that GM has done and has prepared a $2.26 billion loan offer. Between GM, the Dept of Energy, and the cash they have, the $3 billion can be reached.

This is no gift or grant. It is a loan that carries interest computed, as of today, at $290 million. This means the US taxpayer is getting better than 10% on our investment.

6. US Politics. While the current administration is very much in favor of this loan and the relief it brings to the domestic supply concerns of such an important element, who knows what a different administration might decide? Could the loan be rescinded or canceled?

While this property is 100% in the USA, it is owned by a company headquartered in our best ally and closest friend, Canada. Some sort of pique might arise that could make this a political football.

Still, with American workers on site, American companies doing the heavy-duty work, and the US deciding what might be exported and what must not be exported, it would seem crazy to destroy this goose laying golden American eggs.

Of course, we are talking about politicians here. It is almost easier to figure out what your teenager will do next than what some politicians will do.

More By This Author:

Should You Sell In May And Go Away?

Boeing: 1, 2, 3 Strikes, You're Out

Why Lithium Stocks Are Plunging Like Niagara

Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives.

Disclaimer: Unless you are a client of my portfolio ...

more