Sentiment Back To Bullish

Sentiment saw a huge rebound this week based on the latest AAII survey. With the S&P 500 taking out early March highs late last week, bullish sentiment jumped 10.8 percentage points to 33.3%. Although there was a higher level of bullish sentiment as recently as February 16th, this week’s increase was the largest WoW jump since June of last year. Even though a double-digit jump in bullish sentiment sounds significant, S&P 500 performance has been unremarkable following similar instances historically.

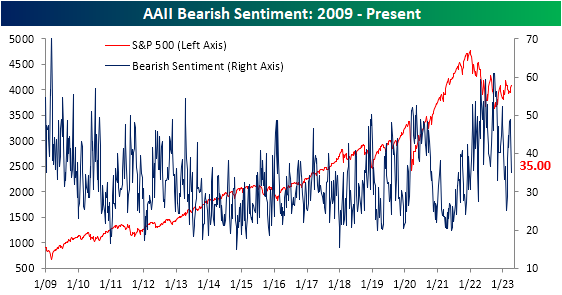

The rise in bullish sentiment borrowed almost entirely from those reporting as bearish. Bearish sentiment fell 10.6 percentage points down to 35%. That is the lowest reading since mid-February and the first double-digit drop since November.

The huge shift in favor of bulls this week resulted in the bull-bear spread narrowing to -1.7 points. That is the least negative reading in the spread since February when the bull-bear spread had broken a record streak of bearish readings.

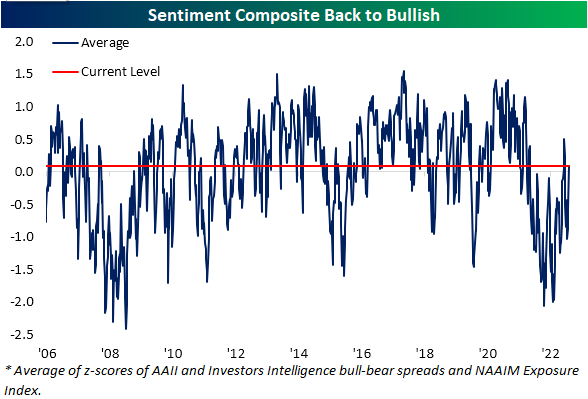

As we noted last week, the AAII survey has been a holdout in showing more optimistic sentiment readings. Whereas other sentiment surveys like the NAAIM exposure index and the Investors Intelligence survey had essentially returned to historical averages, the AAII survey saw firmly bearish sentiment readings with a bull-bear spread of 1.6 standard deviations from its historical average as of last week. Given the quick turnaround this week, the AAII survey is no longer weighing on our Sentiment Composite as it moved back into positive territory indicating bullish sentiment for only the fourth week since the start of 2022.

More By This Author:

Gold Back At 52-Week Highs

The Last Shall Be First And The First Shall Be Last

Sentiment Still Bearish…Or Is It?

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more