Sentiment Still Bearish…Or Is It?

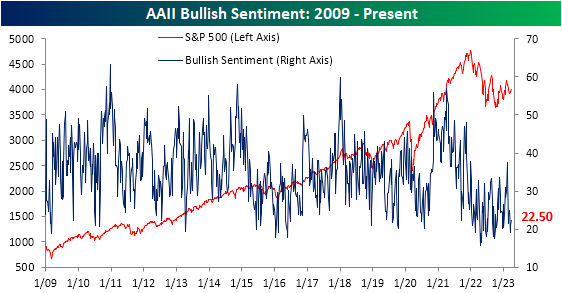

The S&P 500 has made a pressback up towards the high end of the past month’s range this week, but sentiment has yet to reflect the moves higher in price. The past several weeks have seen the AAII sentiment survey come in a relatively tight range between the high of 24.8% on March 9th and a low of 19.2% the following week. That is in spite of the recent updates to monetary policy and turbulence in the banking industry. Today’s reading was smack dab in the middle of that recent range at 22.5%.

Given there have not been any major developments with regard to sentiment, the record streak of below-average (37.55%) bullish sentiment readings has grown to 71 weeks.

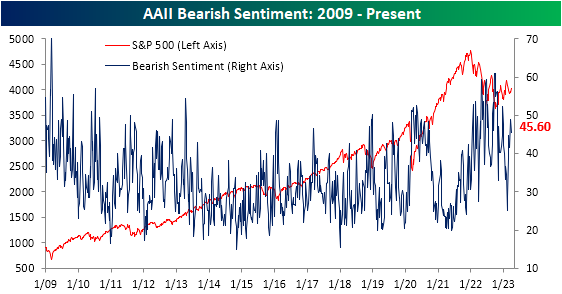

While bullish sentiment was modestly higher this week rising 1.6 percentage points, bearish sentiment shed 3.3 percentage points to fall to 45.6%. That is only the lowest reading in three weeks as bearish sentiment has sat above 40% for all of March.

The predominant sentiment reading continues to be bearish. The bull-bear spread has been negative for six weeks in a row following the end of the record streak of negative readings in the bull-bear spread in February.

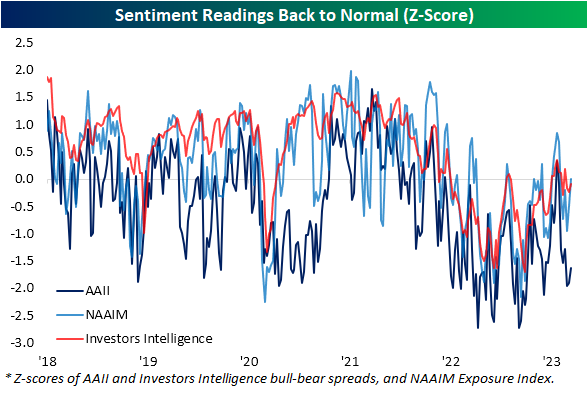

Taking into account other sentiment surveys, the AAII reading stands out as far more pessimistic at the moment. In the chart below, we show the readings of the AAII bull-bear spread paired with the same spread in the Investors Intelligence survey and the NAAIM Exposure index. Whereas the latter two surveys have basically seen readings return back to their historical averages, the AAII survey sits 1.6 standard deviations below its historical average. In other words, overall sentiment might not be as pessimistic as the AAII survey would imply.

More By This Author:

Claims Spend Another Week Below 200K

Pending Home Sales Better But Still Weak

Home Prices Fall Nationwide, Except For Miami

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more