The Last Shall Be First And The First Shall Be Last

Taking a closer look, in the chart below we’ve broken up the S&P 500 into deciles (10 groups of 50 stocks each) based on how stocks performed in 2022. Decile 1 contains the 50 stocks that performed the best in 2022, decile 2 contains the 50 next best, and so on and so forth until you get to decile 10, which contains the 50 stocks that did the worst in 2022. As shown below, the three deciles containing the 150 best performing stocks in 2022 all averaged declines in Q1. On the flip side, the stocks in the decile containing the worst performers in 2022 averaged a huge gain of 16.8% in Q1 2023. Q1 really was a mirror of what we saw in 2022. Investors that looked at their portfolios at the end of 2022 and decided to shift out of the year’s losers and into the year’s winners only ended up feeling more pain in Q1. The correct approach would have been to shift out of last year’s winners and into last year’s losers.

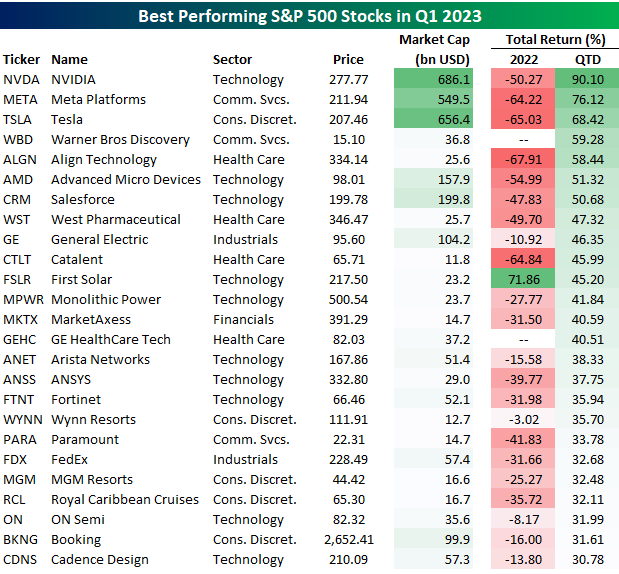

With Q1 2023 now in the books, below is a table of the S&P 500 stocks that gained the most over the first three months of the year. NVIDIA (NVDA) came out on top with a gain of 90.1%, followed by Meta (META) at +76.1% and Tesla (TSLA) at +68.4%.Other notables on the list of winners include Salesforce (CRM), General Electric (GE), First Solar (FSLR), GE HealthCare (GEHC), Arista Networks (ANET), Wynn Resorts (WYNN), FedEx (FDX), and Royal Caribbean (RCL).

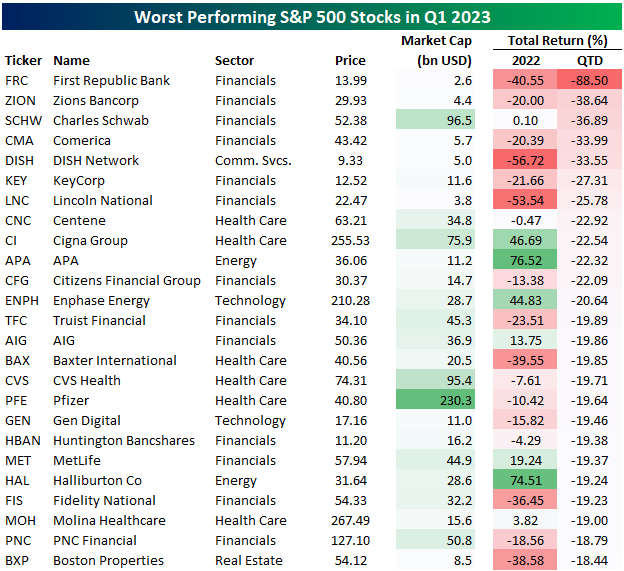

The list of the first quarter’s biggest losers in the S&P 500 is made up of plenty of banks that got caught up in the deposit flight that ultimately took down SVB (SIVB) and Signature Bank (SBNY) — which were both in the S&P 500 as well before their abrupt removal in mid-March.

More By This Author:

Silver And Gold Analysis

Silver Forecast: Metal Heading To $25?

Copper Outlook: Metal Sets For Potential Rally

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more