Copper Outlook: Metal Sets For Potential Rally

Image Source: Pixabay

Thanks to a depreciating US dollar and improved risk sentiment across financial markets, we have seen a strong recovery in many risk-sensitive asset prices. Among the major commodities, we have already seen the likes of crude and silver make back decent ground. Copper could be the next metal to stage a rally.

Chinese equities vs. Copper

Copper is often seen as a proxy for Chinese economy. Whenever China’s economy is growing, industrial demand for copper tends to rise. One of the ways to gauge the strength of the world’s second largest economy is to look at its stock market. As the chart below shows, the China’s A50 index has broken its downtrend. We have also seen solid gains in Hong Kong. The chart also shows how closely copper prices tend to follow the Chinese stock market. They go hand in hand. Thus, the bullish breakout in the Chinese equity market is an additional sign of strength for the copper outlook.

Source: StoneX and TradingView.com

Key data to watch for copper this week

We have important economic data coming up from both China and the US on Friday, which could pave the way for a sharp move in the dollar, and thus impact buck-denominated commodities like gold, silver and copper.

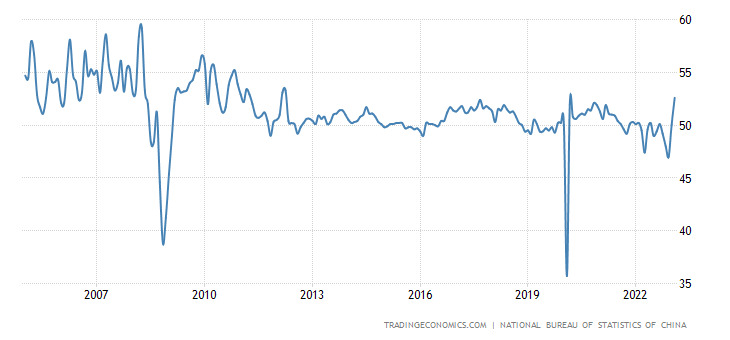

China PMIs

Friday, March 31

02:30 GMT

Both the Chinese manufacturing and non- manufacturing PMIs will be released at the same time on Friday. For copper, it is the former which will be of greater importance. The manufacturing PMI jumped to 52.6 last month from 50.1 in January. This was the highest reading in for several years. Even before the pandemic hit, China’s manufacturing PMI was struggling to move away from the boom/bust level of 50.0. The fact we had such a strong number for February was due to pent up demand, as business conditions continued to pick up following the re-opening of the economy. For March, the PMI is expected to remain in the positive, but the ease back to 51.6. Any reading above this level could provide fresh impetus for copper and Chinese equities.

Source: StoneX and Trading Economics

US Core PCE Price Index

Friday, March 31

13:30 GMT

This will arguably be the most important macro-pointer for the dollar, and dollar-denominated assets, in what has been a lighter week for scheduled data releases. Following the Fed’s policy decision last week, the market will be paying close attention to incoming inflation data in order to figure out whether more rate hikes will follow, or the Fed will hit the pause button. The Core PCE price index is the Fed’ preferred measure of inflation, so the market won’t take any surprise readings lightly. Generally speaking, the weaker the inflation reading, the positive the reaction for risk assets are likely to be.

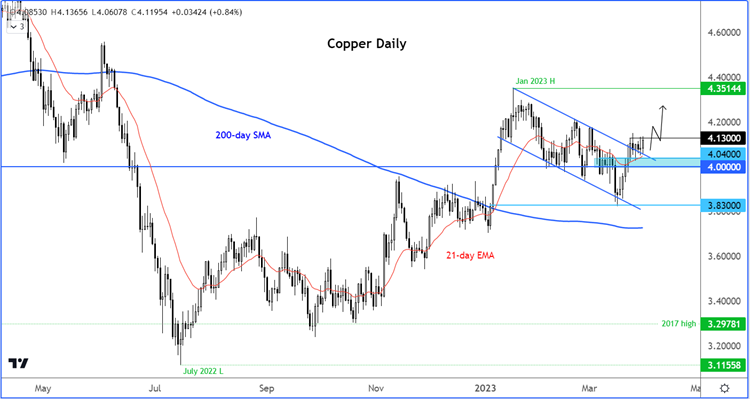

Copper Technical Analysis

The price of copper has been stuck inside a consolidation pattern for a while now. But the recent recovery has lifted the metal above the 21-day exponential average and is now on the verge of a bullish breakout from the long-term bull flag pattern. A clean break above 4.1000 area could see copper rise above the bull flag at 4.3515 in the days or weeks ahead.

However, the validity of the above bullish copper forecast would become weaker, if support in the range between 4.000 to 4.0400 breaks first. Should that happen, then, at best, the wait for a bullish breakout will continue at least a little bit longer. At worst, we could see a full-blown bearish reversal.

Source: StoneX and TradingView.com

More By This Author:

EUR/USD Forecast: Bullish Trend Intact As Key Data Eyed

Technical Tuesday: EUR/USD, FTSE, Nasdaq And Copper

Currency Pair Of The Week: USD/JPY

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more