Ray Dalio Says Sell: But Not Yet

Image Source: Pexels

Ray Dalio is considered by many investment professionals to be a market maven. This is because of the wild success of his hedge fund, Bridgewater, with assets under management of $136 billion, as well as several best-selling economics/finance books he has written. In recent times, Ray Dalio has repeatedly emphasized that markets are in a bubble characterized by unsustainable valuations, excessive leverage, wealth concentration in a few assets (e.g., “the AI beta chase”), and euphoric sentiment. While he paints a disturbingly bearish picture, he also warns that markets may have more room to the upside. In his opinion, the conditions are not ripe for the “pricking” of the bubble that would generate widespread selling.

Ray Dalio cites three conditions or triggers to watch for to gauge when the bubble may pop. They are as follows:

- Tightening Monetary Policy: Easy money sustains market froth. While policy is not easy today, rate cuts are making it easier on the margin.

- Fiscal Policy Shifts: The imposition of new taxes, especially on the wealthy, could arise due to wealth inequality debates. The odds of such action grow if the Democrats win the House or Senate in the midterm elections. Tariffs are another policy to follow.

- Liquidity Crises or Debt Coverage Needs: Sudden demand for cash due to margin calls or debt maturities. Keep an eye on liquidity and gauge how quickly and effectively the Fed is willing to reduce liquidity stress.

Ray Dalio’s views balance optimism about near-term gains with caution about longer term systemic risks. Furthermore, he believes gold is a good diversification asset to manage the road ahead. His most current longer term macroviews are expressed in his recent book, How Countries Go Broke.

What To Watch Today

Earnings

(Click on image to enlarge)

Economy

(Click on image to enlarge)

Market Trading Update

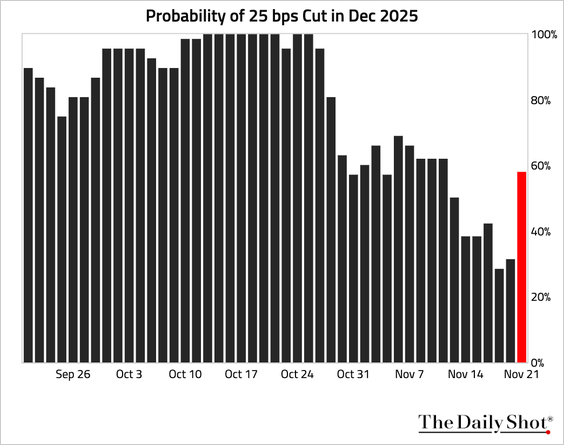

Yesterday, we went through the technical backdrop of the market. Today, we are going to get a deluge of economic reports that have been backlogged due to the Government shutdown. While most of this data is relatively old, it will nonetheless be focused on as it relates to the Fed’s next monetary policy move. As of Monday, the odds of a rate cut in December had risen to about 60% providing some support to the market last Friday.

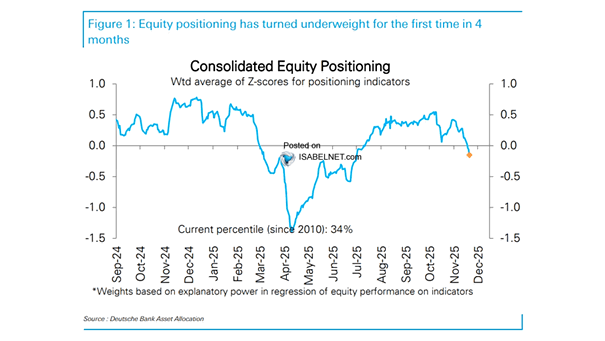

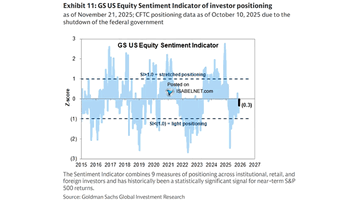

However, given that this is a light trading week due to the Thanksgiving holiday, the deluge of data will likely add to recent market volatility. Nonetheless, we remain focused on the seasonally strong period from today into year-end. With corporate buybacks in full swing and bullish sentiment remaining stable, the recent correction has alleviated much of the previous overbought condition. That leaves investment managers who are underweight in equities in a better position to increase their equity allocations and improve performance heading into the year-end reporting period. As shown in the two charts below, both consolidating equity positioning and equity sentiment have moved into negative territory.

That negative positioning is a decent setup for a short-term, tradeable bounce.

Trade accordingly.

A Full Rotation Has Occurred

Just a couple of months ago, it would have been unfathomable to think that two of the worst-performing sectors at the time would lead the way while two of the leading sectors would be the most oversold. With the recent sell-off, that is exactly the sector rotation that has occurred. Healthcare and energy stocks are now the most overbought sectors on a relative and absolute basis, while technology and discretionary stocks are the most oversold. Note, however, that only the scores on the healthcare sector are extreme; thus, the current market trends favoring yesterday’s underperforming stocks may continue, albeit with healthcare slipping back. This is yet another example of the consistent rotation between sectors. It also leads us to ask which sectors may pull up from the rear and lead tomorrow.

The second table, courtesy of SimpleVisor, shows that healthcare stocks have been outperforming the market for a while, but outperformance for the energy and staples sectors is relatively new. If the market remains weak, might those be the sectors to outperform in the coming weeks?

(Click on image to enlarge)

(Click on image to enlarge)

Market Bubbles: A Rational Guide To An Irrational Market

We’re hearing it everywhere: AI is in a bubble. The surge in capital, the parabolic stock charts, and the bold claims from CEOs all have a familiar rhythm. Nvidia’s valuation has soared, along with AI-related startups raising billions with little to no revenue. Investment in data centers, chips, and infrastructure is happening at a scale not seen since the internet boom of the 1990s, which immediately reminds investors of what happened next. The question isn’t whether AI is important; it’s whether the price of that importance is being inflated beyond reason. That is the nature of market bubbles.

Voices in the market are split. Some, like Jared Bernstein, former Biden CEA chairman, said:

“We point out that the share of the economy devoted to AI investment is nearly a third greater than the share of the economy devoted to internet related investments back during the dotcom bubble. So, we think there are enough analogies there to make the call.”

Others argue this is not a bubble, at least not yet.

“Macro bubbles” – asset price distortions with large economy-wide consequences – have generally involved not just overvalued asset prices but also dramatic impacts on spending and capital flows that have been both clues that a bubble is under way and forces that serve to undermine it.

The 1990s was a classic example. Alongside soaring equity prices, investment spending boomed, leverage rose, capital poured in, and profitability and balance sheet strength declined, while credit spreads and equity volatility moved higher. The macro and market imbalances that we saw then, particularly from 1998 onward, are not generally visible yet.” – Goldman Sachs

This split is normal. Every major innovation cycle creates a divide between skeptics who see overvaluation and optimists who see a new era of growth. The challenge for investors is not to take sides, but to understand what bubbles do, why they’re so hard to identify in real time, and how to benefit from them without being destroyed by them.

Tweet of the Day

More By This Author:

Permanent Job Losers: A Worrying Facet Of Today’s Economy

Market Bubbles: A Rational Guide To An Irrational Market

The AI Trade: Opportunity Or Warning?

Disclaimer: Click here to read the full disclaimer.