QBTS: An Attractive "Pure-Play" In Quantum Computing

Image Source: Unsplash

Training large Artificial Intelligence (AI) models eats through millions in power and compute. That means demand is exploding for silicon carbide chips, thermal cooling systems, high-efficiency power converters — the unsexy but essential backbone of the AI revolution. One stock I like is D-Wave Quantum Inc. (QBTS)

Big Tech needs infrastructure. And infrastructure needs everything the microcap market’s quietly producing. Institutions can’t touch these small-cap players. They’re too nimble, too off-the-radar. Which means you can.

D-Wave Quantum Inc. (QBTS)

Price: $37.06 (as of Nov. 2, 2025)

Current P/E Ratio: N/A

Market Cap: $9.54 billion

So, let’s talk about QBTS. Imagine being early on the next tech revolution — before Wall Street understands it. D-Wave Quantum isn’t just dabbling in quantum computing; they’re commercializing it.

Unlike hype-heavy startups stuck in research mode, D-Wave already delivers real quantum systems, software, and cloud services to paying enterprise clients. That makes them the only publicly traded pure-play with actual traction in applied quantum tech.

Based in Palo Alto, they’re not in the business of someday — they’re building the now. For investors looking to front-run a once-in-a-generation leap in computing, D-Wave offers a rare and explosive gateway. Here are the bullish investment case details:

- Extremely high cash-to-assets ratio of 97.1% indicates strong liquidity.

- High current ratio (42.99) and quick ratio (42.86) reinforce its robust short-term financial health.

- Net gearing of -113.4% shows more cash than debt.

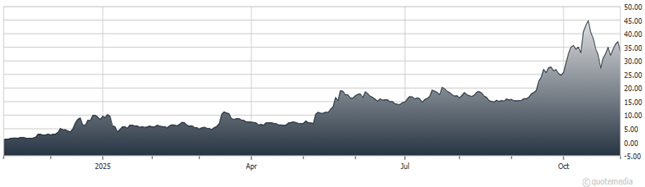

- Six-month share price increase of +287%; one-year growth of +2,828% highlights explosive investor interest.

- Revenue grew from $8.83 million in 2023 to $22.3 million in 2024, and is projected to hit $38.3 million in 2026 (CAGR: 14.4%).

- Three-month price up +109%.

- Trading +39.2% above 50-day moving average and +144% above 200-day MA.

- Analysts forecast a net loss narrowing over time, suggesting potential improvement.

Recommended Action: Buy QBTS.

More By This Author:

AAPL: The Big Tech Stock Wall Street Keeps Getting Wrong

Silver: No, The Bull Market Is Not Over

VIX: Are Volatility Markets Hinting At Trouble For Stocks?