AAPL: The Big Tech Stock Wall Street Keeps Getting Wrong

Image Source: Unsplash

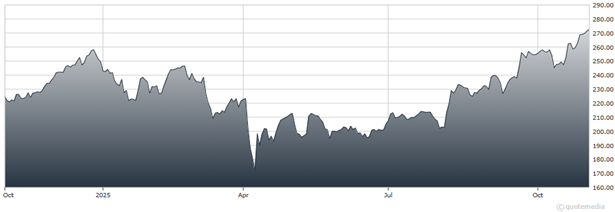

Last week, Apple (AAPL) hit $270, a 57% run higher. And its latest earnings have me grinning ear to ear. Not because the numbers were good…but because they were “Apple good.”

Apple Inc. (AAPL)

Let’s review:

- Revenue: $102.5 billion, up 8% year over year

- Net income: $27.5 billion, or $1.85 per share (vs. $1.64 adjusted a year ago)

- Gross margin: 47.2% — up again

- iPhone: $49 billion, a record September quarter

- Services: $28.7 billion — an all-time high

Wall Street’s spreadsheet gang still doesn’t get it. Good! That means an even better opportunity to pick up more shares on the “cheap” before they do.

Apple is still one of the most underrecognized AI choices on the planet, if not the most underappreciated, in my humble opinion.

There are only two things you’ve got to get right as an investor, especially when it comes to a stock like Apple. First, you’ve got to buy the world’s best companies when nobody wants ‘em and sell when others can’t resist buying. And second, keep risk as low as possible at all times by using tactics that keep the odds in your favor.

If you have no idea what I’ve just said or how to go about doing it, know that’s a totally fixable problem. You’re not alone – every investor starts somewhere. I did, too.

More By This Author:

Silver: No, The Bull Market Is Not OverVIX: Are Volatility Markets Hinting At Trouble For Stocks?

HLT: A Hotel Stock To Buy Amid Rising Room Demand And Higher Fees