Silver: No, The Bull Market Is Not Over

Image Source: Pixabay

I’ve been expecting and warning for months that this would come. As I mentioned in a recent letter, I think there’s still more downside risk, even if we get a bounce higher first.

That said, silver and silver stocks are becoming more attractive. I’m not ready to pull the trigger on much quite yet, but I will say when I think the odds favor a return to higher prices.

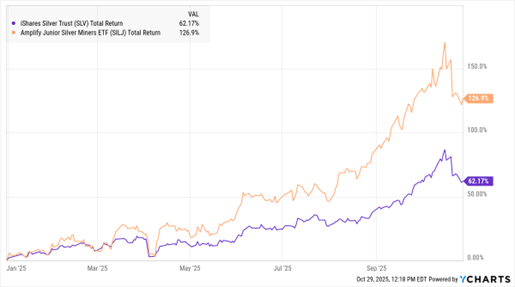

Data by YCharts

I’m actually both relieved and excited by the weakness we’re seeing in silver and silver stocks. That’s because this correction should fix what became an overbought condition. I plan to use this opportunity to add some new names in the coming weeks and months.

Many of these had simply become too expensive. But once we reach more oversold conditions, several names will be priced irresistibly. I plan to take advantage of the volatility that inevitably returns in the silver sector.

So, while we wait for silver prices to stabilize, it’s worth considering just how high silver could ultimately go. Our senior analyst, Ted Butler, has taken on that task to examine just what we might expect from silver and why. The conclusions in his piece “How High Can Silver Fly?” might surprise you!

More By This Author:

VIX: Are Volatility Markets Hinting At Trouble For Stocks?

HLT: A Hotel Stock To Buy Amid Rising Room Demand And Higher Fees

Intel: Turnaround Story On Track Thanks In Part To Uncle Sam