VIX: Are Volatility Markets Hinting At Trouble For Stocks?

Image Source: Pixabay

Ever since the S&P 500 Index (SPX) dropped more than 200 points on Friday, Oct. 10 (including after-market trading on the NYSE), there has been a notable difference in the volatility market. Simply stated, the market has been increasingly more volatile, writes Lawrence McMillan, editor at Option Strategist.

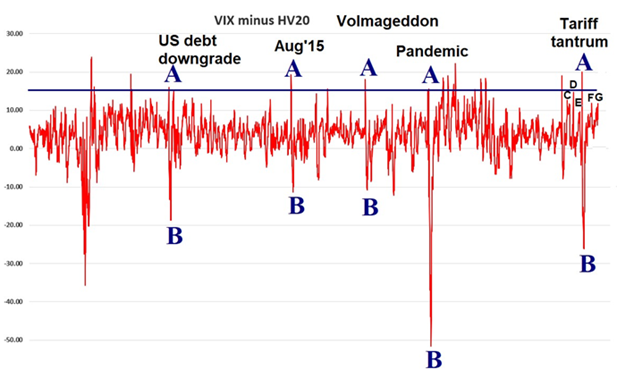

This includes not only intraday volatility, but also a substantial increase in longer-term volatility measures such as the 20-day historical volatility of SPX (HV20) or the CBOE Volatility Index (VIX) itself (a 30-day volatility estimate). Over the course of the ensuing week, there were large moves in volatility, including a historic VIX spike up and back down again.

Usually, when volatility begins to increase rapidly, that is a very bad sign for the market. But this time around, things seem to be different so far. Perhaps the first thing that got traders’ attention was the fact that VIX and SPX were both up together five days in a row.

We addressed that in a recent article and showed that it was a basically meaningless event. It had never happened before, but what had happened was that the SPX and VIX had simultaneously been up three days in a row a few times. There was no discernible pattern to what the market did after those occurrences.

Later, after the market threw another “tariff tantrum” on Friday, Oct. 10, both indices realized and implied volatility began to increase sharply. Increasing volatility – especially sharply increasing volatility – is normally bad for stocks.

Another thing that happened: the VIX exploded from 20.64 (close on Oct. 15) to 28.99 (peak on Oct. 17). That has happened before, but what made this event unusual is that by the close of trading on Oct. 17, the VIX was all the way back down to 20.78 – and it has only continued to drop since then.

While the VIX was doing its thing, the term structure – especially that of the VIX futures – responded dramatically as well. The front end of the term structure inverted, and October VIX futures traded more than two points above the price of November VIX futures. This also resulted in the VIX futures trading at large discounts to the VIX, in general. Both of those things are usually quite bearish for stocks.

About the Author

Lawrence McMillan speaks on option strategies at many seminars and colloquia in the US, Canada, and Europe. Prior to founding his own firm, he was a proprietary trader at two major brokerage firms—primarily Thomson McKinnon Securities, where he ran the equity arbitrage department for nine years.

Mr. McMillan is perhaps best known as the author of Options as a Strategic Investment, the bestselling work on stock and index options strategies, which has sold over 200,000 copies.

More By This Author:

HLT: A Hotel Stock To Buy Amid Rising Room Demand And Higher Fees

Intel: Turnaround Story On Track Thanks In Part To Uncle Sam

How Top Investing Experts Navigate Market Volatility