PayPal Stock Turnaround Is Gaining Momentum – But One Big Risk Could Undo It

Image Source: Pexels

PayPal (Nasdaq: PYPL) is no stranger to the spotlight, but in 2025, the story looks very different. Once considered a fading fintech giant, its Q2 results suggest a turnaround is well underway. Earnings have beaten estimates for six consecutive quarters, transaction margins are expanding, and Venmo is quietly evolving into a real commerce platform.

Yet beneath the improving fundamentals lies a critical risk the market isn’t ignoring: PayPal is still losing share in its flagship branded checkout, lagging global e-commerce growth. If it can’t stabilize this trend, all the profitability wins and new initiatives may not be enough to convince investors the story has truly changed.

In this post, we’ll break down PayPal’s fundamentals, sentiment, and strategy using the IDDA framework and reveal the one risk that could decide whether PayPal reclaims its crown in digital payments or slides deeper into irrelevance.

IDDA Point 1 & 2: Capital & Intentional

Before investing in PayPal, ask yourself:

Do you want exposure to one of the largest global payment processors still handling over $1T in volume annually?

Do you believe PayPal’s disciplined cost strategy, margin expansion, and Venmo’s growth can offset checkout share losses?

Are you comfortable betting that PayPal can execute on new growth levers like PayPal World, Pay with Crypto, and AI-driven services?

PayPal’s strength lies in its scale, experience, and ongoing profitability. It continues to generate strong EPS and free cash flow (despite recent volatility), with management returning capital through buybacks.

Initiatives like PayPal World, which links its platform with major global wallets, could massively expand its reach, while Venmo’s evolution into a multi-channel app offers new monetization avenues.

But the risks remain clear. Branded checkout growth is lagging, competitors like Apple Pay and Shopify Pay control buyer journeys, and free cash flow swings raise doubts about the stability of returns. For investors, PayPal is no longer a default fintech winner, it’s an execution story.

For cautious investors, waiting for clearer stabilization in branded checkout may make sense. But for those willing to bet on PayPal’s scale, profitability, and new growth engines, the stock’s undervaluation could offer significant upside.

IDDA Point 3: Fundamentals

PayPal’s turnaround is showing progress, but Q2 results were mixed. The company has beaten profit expectations for six quarters in a row, thanks to tighter cost control and more efficient operations. Profit margins improved, showing PayPal is focusing on better-quality earnings rather than just chasing sales.

Growth in overall payment volumes was steady, rising about 5% from last year. However, this is still slower than the broader e-commerce market. PayPal’s branded checkout button, once its biggest strength, continues to lose ground to competitors like Apple Pay and Shopify Pay. On the other hand, its unbranded processing business has stabilized, and management expects it to return to growth soon.

Venmo remains a bright spot. It’s evolving from a simple peer-to-peer app into a full commerce platform, with features like in-app shopping and card-linked payments. This is helping PayPal reach younger consumers and open up new revenue streams.

The company’s finances remain solid. Debt levels are manageable and nearly balanced by the cash PayPal holds. The company doesn’t pay a dividend, which gives it flexibility. Instead, it’s focusing on rewarding shareholders through stock buybacks.

Looking ahead, management has raised its earnings outlook for the year, showing confidence in PayPal’s ability to grow profitably. New initiatives like PayPal World, Pay with Crypto, and AI powered tools could expand its reach. Still, with payment growth slower than the market, execution will be key to restoring investor confidence.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Huge growth runway as electronic payments continue to replace cash worldwide.

Scalable model supports margin improvement over time.

Deep experience in online payments positions PayPal well as e-commerce expands.

Risks

Rising competition as online and point-of-sale payments converge.

Risk of being shut out in markets where governments favor local players (e.g., Alipay, WeChat).

Venmo’s monetization potential may be more limited than expected.

Market sentiment on PayPal is cautious despite steady EPS beats and margin gains, the stock trades like a stagnating player due to share losses in branded checkout and volatile cash flow. Confidence in buybacks and growth remains shaky, but if management can stabilize checkout, keep PSP margins strong, and scale Venmo, sentiment could flip, unlocking upside of possibly toward $80 – 90. Failure to execute, however, risks a drop back to the mid-$50s.

Sentimental Risk: Medium – High

IDDA Point 5: Technical

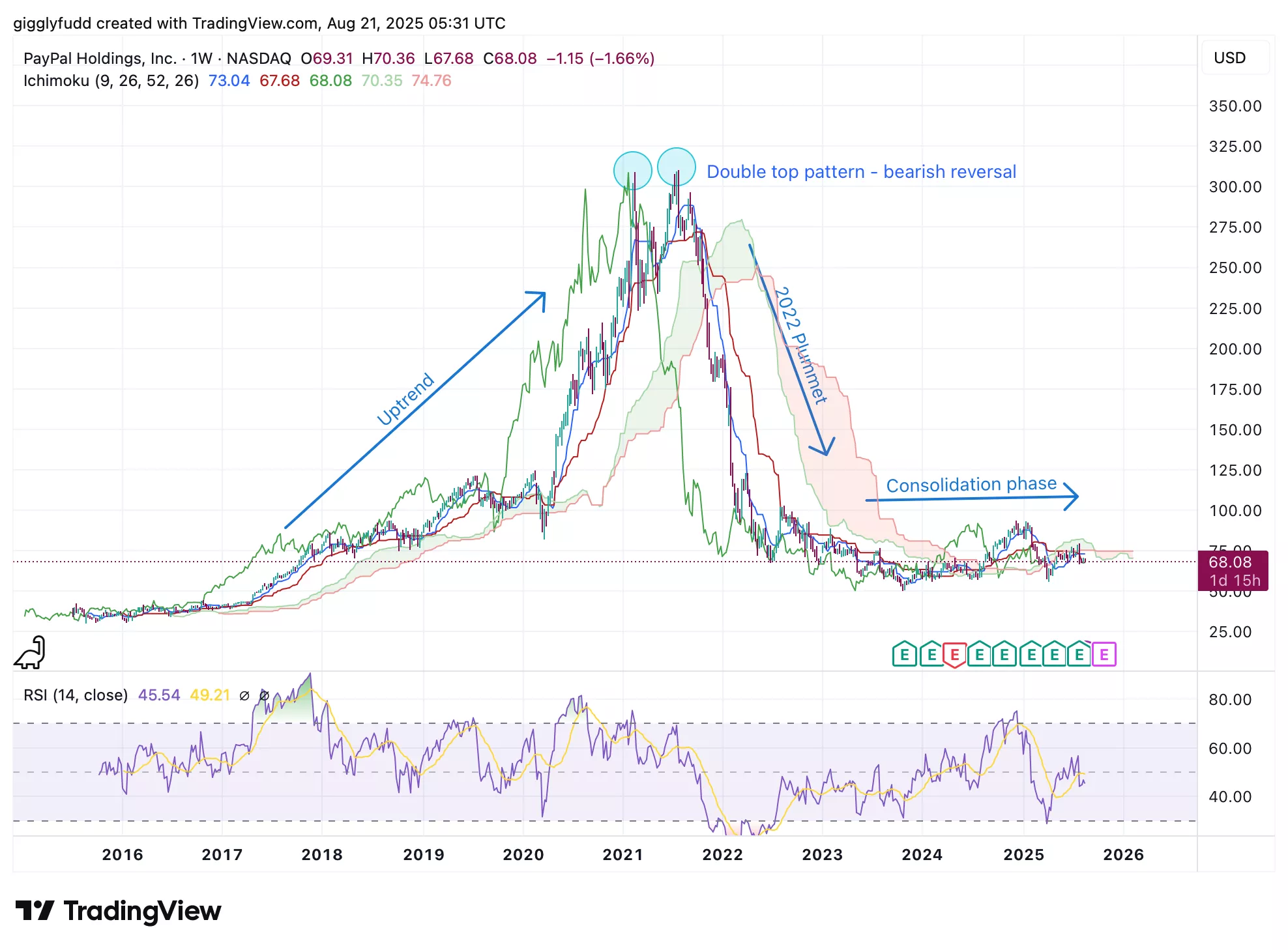

On the weekly chart:

Pattern is consolidating sideways, showing indecision in the market, so neither bullish nor bearish

Future Ichimoku cloud is bearish and flat, pointing to weak downside pressure or the bottom of the consolidation range

Latest candlesticks sit below the cloud, with the cloud continuing to serve as resistance

On the weekly chart, PYPL performed strongly until August 2021, when it peaked at 310. After forming a double top, which is a bearish reversal pattern, the stock fell sharply through 2022 into the 60 – 100 range, where it has been consolidating ever since. The Ichimoku cloud is bearish but flat, with candlesticks sitting below it, signaling weak downward momentum and the lower end of consolidation. The cloud also continues to act as a resistance zone, highlighting market indecision with no clear bullish or bearish trend.

(Click on image to enlarge)

On the daily chart

Similar to the weekly chart, the current pattern is consolidating (moving sideways)

Future Ichimoku cloud is bearish but flat, suggesting the lower end of consolidation or weak downward momentum

Candlesticks remain below the cloud, with the cloud acting as a resistance zone

On the daily chart, the stock entered a downtrend at the start of 2025 after forming a double top. It bottomed in early April and began a slight recovery, but is now consolidating. The pattern is moving sideways, reflecting mixed sentiment, so neither strongly bullish nor bearish. The future Ichimoku cloud is bearish but flat, pointing to weak downward momentum or the lower end of consolidation, while candlesticks remain below the cloud, which continues to act as a resistance zone.

This consolidation phase may offer swing trading opportunities for those looking for short term profits.

(Click on image to enlarge)

Investors looking to get into PYPL can consider these Buy Limit Entries:

Current market price: 67.73 (High Risk)

60.02 (Medium Risk)

55.80 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

74.66 (Short term)

78.92 (Medium term)

85.30 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on PayPal (PYPL)

PayPal has gone from being the undisputed leader in online checkout to fighting harder for relevance in today’s crowded payments landscape. Venmo is gaining traction as it evolves beyond peer-to-peer transfers, and Braintree has stabilized with a sharper focus on profitability.

New initiatives like PayPal World and Pay with Crypto could expand its reach, while disciplined cost control has driven six consecutive EPS beats and improved margins. The company remains cash rich, with a manageable balance sheet, and is returning nearly all free cash flow to shareholders through buybacks.

Yet, this strength is clouded by one major risk: branded checkout is losing ground. Once PayPal’s crown jewel, its growth continues to lag global e-commerce, with rivals like Apple Pay and Shopify Pay gaining share inside ecosystems they control.

Add in cash flow volatility and heavy reliance on buybacks to support shareholder returns, and execution risk becomes central to the investment case. If PayPal can’t stabilize its checkout dominance, the market may continue to treat it as a legacy player rather than a growth story.

From a technical perspective, PYPL has been consolidating since its drop from all-time highs. The weekly Ichimoku cloud is bearish and flat, with candlesticks sitting below resistance, signaling market indecision. Until the stock breaks clearly above the cloud, upside potential looks limited in the near term.

Key Takeaways:

PayPal’s turnaround is real, with improving margins, Venmo’s growth, and promising new initiatives. But one risk – the erosion of its branded checkout – could undermine that progress. For long term investors, the stock looks undervalued with upside potential, but patience and confidence in management’s execution are essential.

Overall Stock Risk: Medium – High

More By This Author:

Palantir Stock Growth Looks Unstoppable – But This One Risk Could Change Everything

Intel Stock Surges On Government And SoftBank Backing – But Is It Too Early To Buy?

3 Things Investors Are Missing About Shopify Stock Right Now