3 Things Investors Are Missing About Shopify Stock Right Now

Image Source: Pixabay

Shopify (Nasdaq: SHOP) isn’t just a storefront builder anymore, it has transformed into a full “Retail Operating System” that powers payments, shipping, capital, tax, marketing, and even offline commerce.

Its ease of use, scale, and growing ecosystem of add ons have made it the go-to platform for SMBs, while Shopify Plus is helping the company win bigger enterprise deals.

Q2 highlighted why Shopify is considered one of the strongest growth stories in tech. The company delivered strong revenue growth, added major enterprise clients, and saw momentum across areas like B2B and offline sales.

Operating efficiency improved, though margins faced some pressure from partnerships. Financially, Shopify remains solid with healthy cash reserves, manageable debt, and positive free cash flow.

Yet, despite Shopify’s strong fundamentals, there are three things investors may be overlooking. First is its valuation, the stock is priced for perfection, leaving little room for disappointment. Second is its risks where competition from major players and reliance on small business customers make it vulnerable if conditions change. Third is volatility as Shopify has a history of sharp swings that can catch investors off guard. These are the blind spots the market isn’t fully talking about.

So where does this leave investors today? Let’s map it using the IDDA (Capital, Intentional, Fundamental, Sentimental, Technical).

IDDA Point 1 & 2: Capital & Intentional

Before investing in SHOP, ask yourself:

Do you want exposure to the leading SMB e-commerce platform, with a sticky ecosystem of add-ons like Payments, Shipping, and Capital driving higher attach rates?

Are you looking for growth from both small businesses and enterprises as Shopify expands with Shopify Plus and international expansion?

Do you believe scale, operational leverage, and a strong cash position can sustain growth even with margin pressure in the short term?

Historically, Shopify has been one of the most volatile high-growth stocks. It dropped more than 80% in 2022 when sentiment turned against unprofitable growth names, only to rebound nearly 6x as fundamentals improved. That kind of movement requires conviction and patience. If you buy into Shopify’s long-term “Retail Operating System” thesis, the growth runway is still massive. But if your risk tolerance is lower, the valuation premium and volatility may outweigh the potential upside right now.

IDDA Point 3: Fundamentals

Shopify continues to deliver impressive results, with revenue growing more than 30% last quarter and GMV climbing 31% to $2.7 billion which is well ahead of guidance and analyst expectations. Merchant solutions revenue surged 37%, offline GMV grew 29%, and B2B GMV posted triple digit gains. The company also added enterprise names like Starbucks, Canada Goose, and Miele, showing its appeal to both small merchants and larger businesses.

At its core, Shopify’s strategy is to be the one stop shop for small and midsize businesses. Its simple yet powerful platform combines add on features like payments, shipping, and capital into a turnkey solution that creates high switching costs for merchants. This “Retail Operating System” has helped Shopify build a wide moat and capture the largest merchant base of any platform. The company is also gaining traction with enterprises through Shopify Plus, allowing customers to stay on the platform as they scale.

Ease of use, a strong support community, and an expanding developer ecosystem make Shopify attractive to businesses of all sizes. With search optimization, blogs, and referrals driving merchant acquisition, the company benefits from efficient marketing spend and growing operating leverage. Over time, scale should help margins improve further.

Financially, Shopify is in a strong position. As of the end of 2024, it held $5.5 billion in cash against just $920 million in convertible debt due in 2025. Free cash flow is solid and growing, though margins are still short of mature software levels above 20% as the company continues to reinvest in growth. Shopify does not currently pay dividends or buy back shares, but it has a history of making small acquisitions to strengthen its platform and add new merchant solutions.

Looking ahead, Shopify is expected to grow revenues at 20 – 25% annually, potentially reaching $22 billion by 2028. With attached rates on add-ons rising and more enterprises joining, free cash flow margins could expand from 18% today toward 25%, pointing to a long runway for growth.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Shopify’s growth remains strong, driven by new merchant additions, rising GMV, and high adoption of add-on services.

The platform is simple, feature-rich, and highly attractive for small and midsize businesses.

Shopify is successfully moving upmarket, gaining traction with mid market and enterprise customers.

Risks

The stock often trades at very high valuations, which could be hard to justify if growth slows.

Heavy reliance on SMBs makes Shopify vulnerable to economic downturns and high failure rates among small businesses.

Competition from giants like Amazon, Salesforce, and Adobe could intensify as Shopify expands.

Despite Shopify’s strong business performance, investor sentiment remains cautious because of its sky-high valuation. The recent rally has raised concerns that much of its future growth may already be priced in, while margin pressures and limited near term expansion make the stock harder to justify at current levels.

Shopify has also shown extreme volatility in the past, with steep declines followed by sharp rebounds, yet still trailing broader market performance due to ongoing valuation concerns. Many investors view it as a classic “beat and raise” stock, which carries significant downside risk if growth slows. As a result, even with stellar fundamentals, sentiment currently leans cautious.

Sentimental Risk: High

IDDA Point 5: Technical

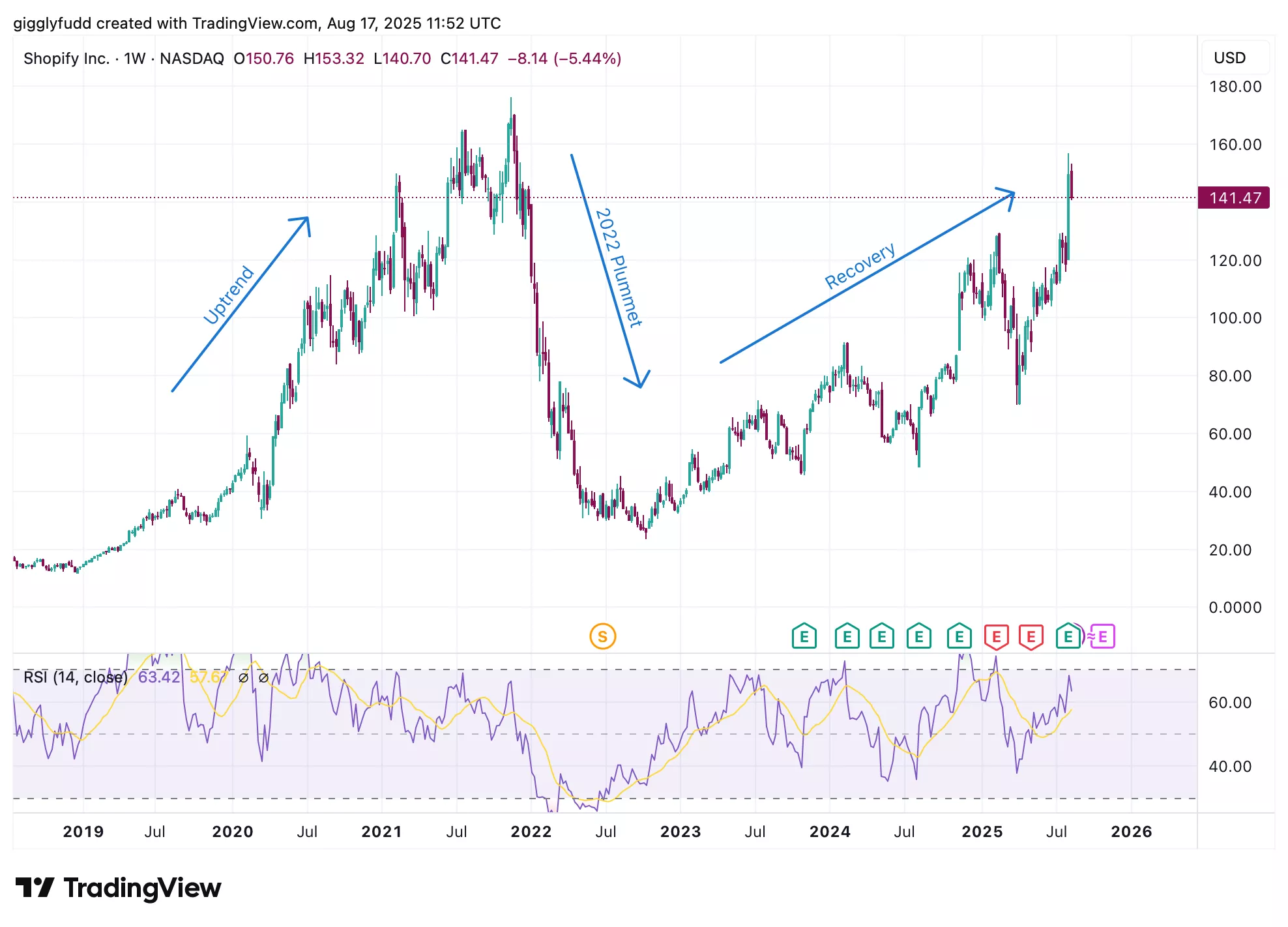

On the weekly chart

Pattern has been in a gradual uptrend since 2023 after its sharp 2022 plunge, though marked by choppy and significant pullbacks.

The stock jumped at least 24% following its Q2 earnings release.

No clear signs of a bearish reversal or pullback are present.

On the weekly chart, Shopify was in a strong uptrend from 2019 through late 2021, reaching a high of 176. In 2022, the stock collapsed, retracing more than 80% due to rising interest rates and inflation fears. Since 2023, it has been in a choppy recovery with large pullbacks of up to 78% or more, reflecting ongoing volatility and still trading below its previous highs. Currently, there are no bearish reversal signals, such as a bearish engulfing pattern or evening star, to suggest a pullback is imminent.

(Click on image to enlarge)

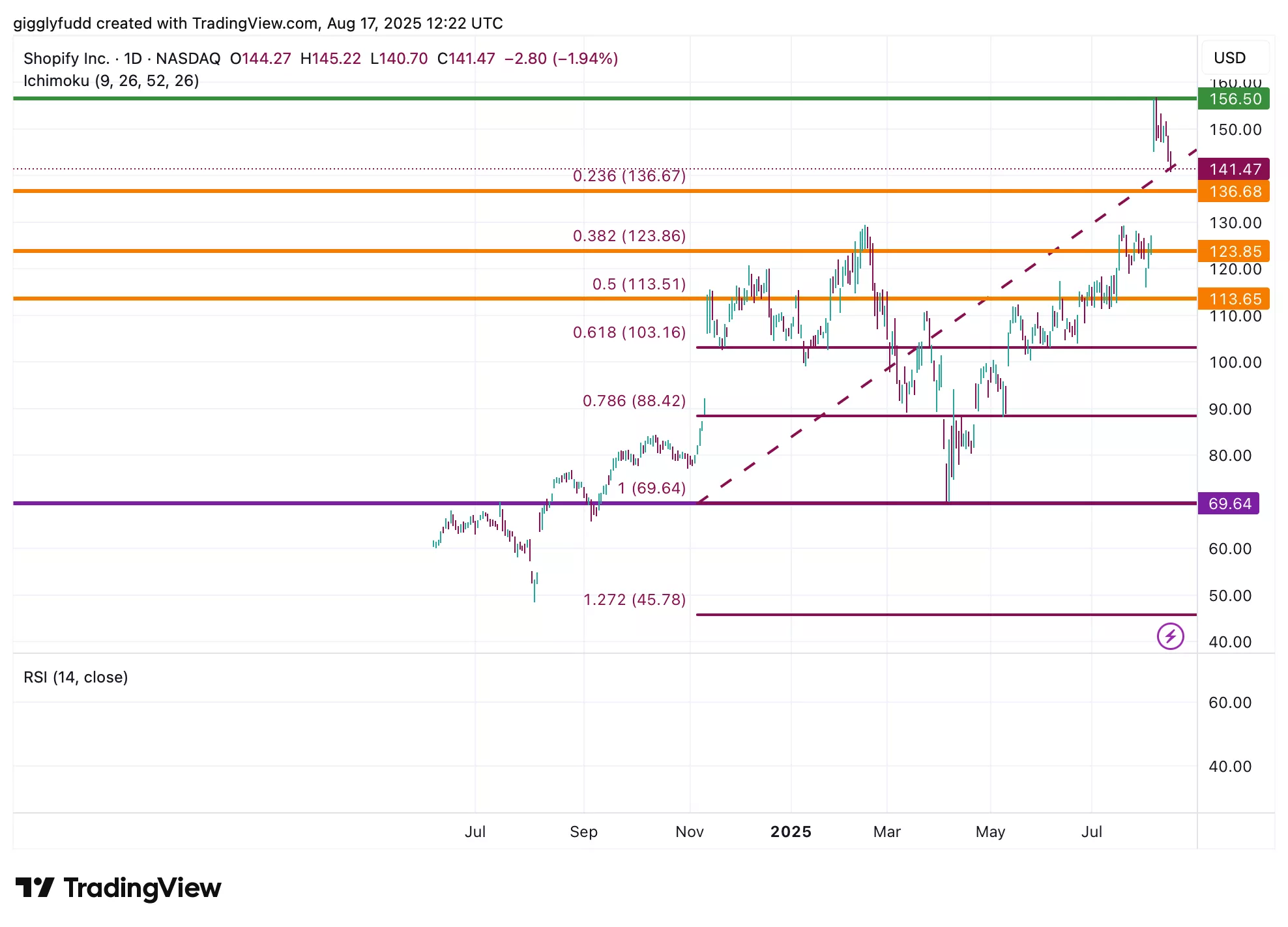

On the daily chart:

The future Ichimoku cloud is bullish, signaling continued upward momentum.

Candlesticks remain above the cloud, with the cloud acting as a support zone.

Recent candlesticks following the stock surge have turned bearish, suggesting the early signs of a pullback or short-term downtrend.

On the daily view, the stock has been in an uptrend since April 2025, with a sharp jump after the Q2 earnings release. Currently, the future Ichimoku cloud is wide and bullish, while candlesticks sit above it, reinforcing upward momentum. However, the latest bearish candlesticks hint at a possible short-term pullback, which can be an opportunity for investors to get provided this suits their risk tolerance and strategy.

(Click on image to enlarge)

Investors looking to get into SHOP can consider these Buy Limit Entries:

141.47 (High Risk – FOMO entry)

136.68 (High Risk)

123.85 (Medium Risk)

113.65 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

171.83 (Short term)

181.31 (Medium term)

196.64 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on Shopify (SHOP)

Shopify isn’t just an e-commerce storefront builder, it has become a full “Retail Operating System” that powers payments, marketing, shipping, and even offline commerce. Its simplicity and ecosystem of add-ons make it the go-to platform for small businesses, while Shopify Plus is helping it expand into larger enterprises.

What many investors may be missing is that Shopify’s fundamentals remain strong, enterprise adoption is accelerating, and its wide moat continues to deepen. At the same time, the stock’s high valuation and past volatility make it vulnerable to pullbacks, even when the business itself is performing well.

Risks include reliance on small business customers, tougher competition from big tech rivals, and margin pressures that may take time to improve.

Technically, the stock is recovering from its steep selloff and remains in an uptrend, though short-term pullbacks are possible.

Key Takeaways: Shopify is still one of the strongest growth stories in tech with a long runway ahead. For long term investors, it’s worth keeping on the radar, but patience is needed given the premium valuation and potential volatility. Short-term investors can take advantage of Shopify’s volatility to capture potential profits.

Overall Stock Risk: Medium – High

More By This Author:

UnitedHealth Stocks Biggest Test Yet: Why Buffett’s $1.57B Bet Might Prove The Market Wrong

MNDY Stock: The Truth Behind The Crash & What The Street Got Wrong

$3.1B In Cash, AI In The Crosshairs, And The S&P 500 On Blockchain — Is S&P Global Stock Changing Everything?