$3.1B In Cash, AI In The Crosshairs, And The S&P 500 On Blockchain — Is S&P Global Stock Changing Everything?

Image Source: Pixabay

S&P Global Inc. (SPGI) is a powerhouse in credit ratings, benchmarks, analytics, and market data. They own and operate the S&P 500 index — the benchmark most investors track — but their reach goes far beyond that. From finance to energy, infrastructure, and global supply chains, their products touch almost every corner of the economy.

Revenue pours in from index licensing, credit ratings, market intelligence, and commodity insights, making them one of the most influential forces in global finance.

Lately, S&P Global has been making bold moves that are quietly reshaping the future of finance — and could change the way your portfolio grows, whether you own their stock or not.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess S&P Global’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong Q2 2025 earnings

S&P Global beat expectations with revenue up 6% to $3.76 billion. GAAP operating margin increased by 40 basis points and adjusted margin improved by 70 basis points. Adjusted EPS rose 10% to $4.43. Management reaffirmed full-year guidance for 5%–7% revenue growth and adjusted EPS of $17.00 to $17.25. The company plans up to $1.3 billion in accelerated share repurchases and expects to return about 85% of adjusted free cash flow to shareholders in 2025.

Major portfolio reshaping

They are selling their 50% stake in OSTTRA — a post-trade services joint venture with CME Group — to global investment firm KKR for $3.1 billion, with the deal expected to close in the second half of 2025. This frees up cash, reduces operational complexity, and shifts the focus toward higher-margin data, analytics, and index licensing.

Strategic AI infrastructure play

The launch of the Transatlantic AI Data Center & Power Index positions S&P Global to benefit from the AI boom by tracking and monetizing the massive infrastructure and energy buildouts driving AI adoption. This taps into a long-term growth trend without the volatility of direct AI tech investments.

Blockchain expansion with tokenized S&P 500

Through a partnership with Centrifuge, S&P Global brought the S&P 500 on-chain for the first time. This opens new distribution channels in the DeFi world and adds a potential revenue stream from blockchain-based index licensing.

Deeper integration with cloud and AI ecosystems

Expanded partnerships with Databricks and Snowflake make it easier for clients to access and analyze S&P Global data directly in AI-ready cloud platforms. This increases adoption, reduces integration costs, and strengthens customer retention.

Resilient, diversified revenue

With income streams from credit ratings, indices, market intelligence, and commodities, S&P Global is less exposed to single market cycles. Its recurring, high-margin index licensing and subscription data services offer steady cash flow even in volatile markets.

Regulatory and competitive pressures

Credit rating agencies continue to face scrutiny from regulators, and any changes in rating methodologies or compliance rules could affect demand. Competitors like Moody’s and MSCI are innovating quickly in similar high-margin segments, keeping competitive pressure high.

Fundamental risk: Low to medium

IDDA Point 4: Sentimental

Overall sentiment is bullish for S&P Global. Analysts remain positive after Q2 2025 earnings, with most major firms like JPMorgan, UBS, Barclays, Oppenheimer, and Wells Fargo maintaining Buy or Overweight ratings. Investors see S&P Global as a stable, high-margin player that is also making forward-looking bets on AI infrastructure and blockchain, which adds excitement to its traditional business model.

Strengths

Strong analyst support with multiple target price increases following recent results.

Q2 2025 earnings beat expectations and management reaffirmed full-year guidance, boosting confidence.

Strategic moves such as the OSTTRA sale, AI Data Center & Power Index launch, and tokenized S&P 500 show adaptability to future market trends.

Growing integration with Databricks and Snowflake strengthens positioning in the AI and cloud ecosystem, appealing to institutional clients.

Diversified business model with recurring revenue streams from credit ratings, indices, and data services reduces perceived risk.

Risks

Regulatory scrutiny on credit rating agencies could impact demand or require operational changes.

Competition from Moody’s, MSCI, and other data providers is intensifying, especially in high-margin index and analytics segments.

High valuation relative to the market could limit upside if earnings growth slows or if market sentiment turns risk-off.

New ventures like tokenization and AI indices are promising but unproven in terms of meaningful revenue contribution.

Sentimental risk: Low to medium

IDDA Point 5 – Technical

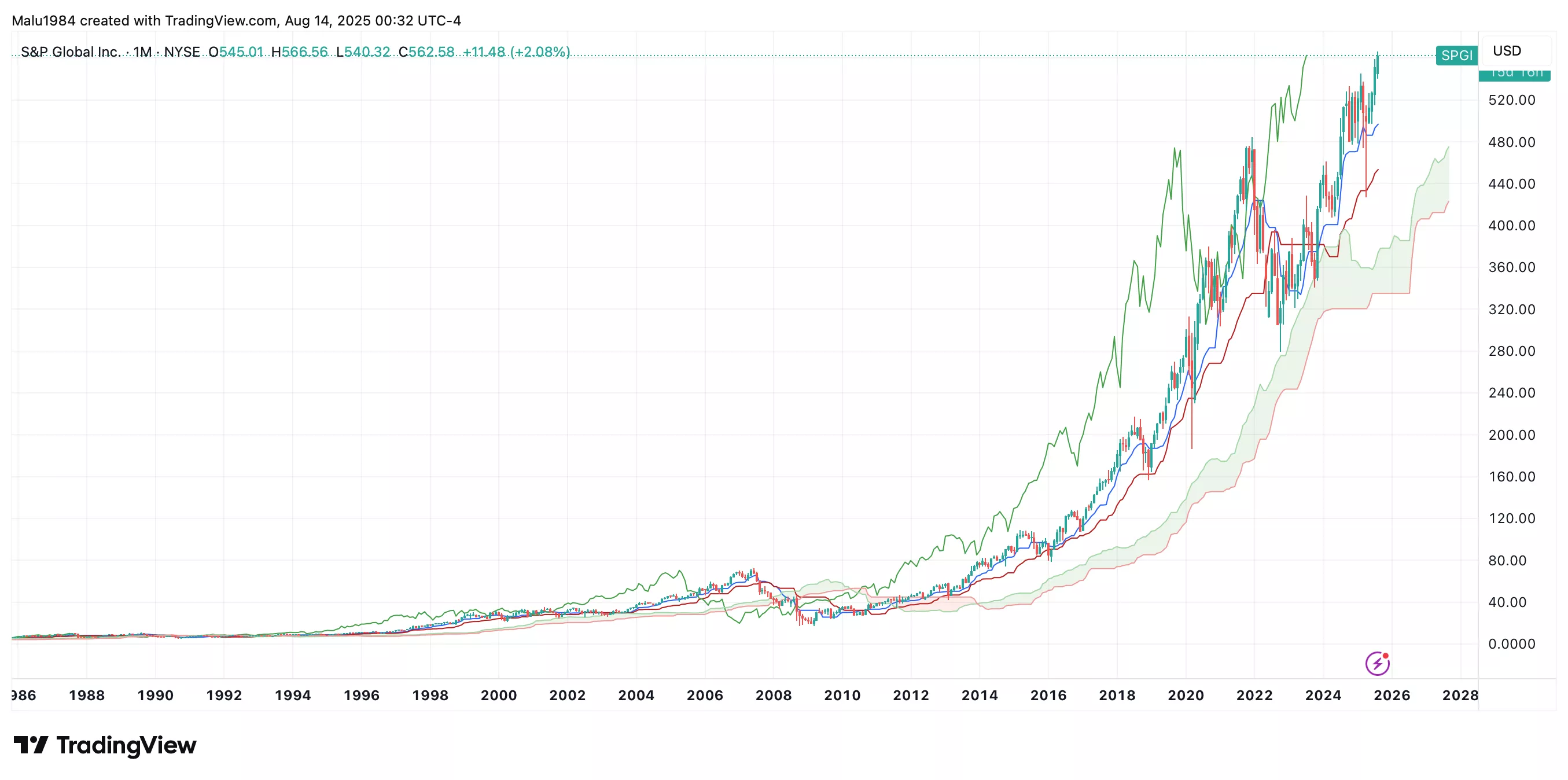

Monthly Chart

Growth stock structure remains intact with a steady uptrend.

Ichimoku Cloud is green and price candles are well above the cloud, signaling strong long-term momentum.

Conversion line is above the baseline, which is another strong bullish signal.

(Click on image to enlarge)

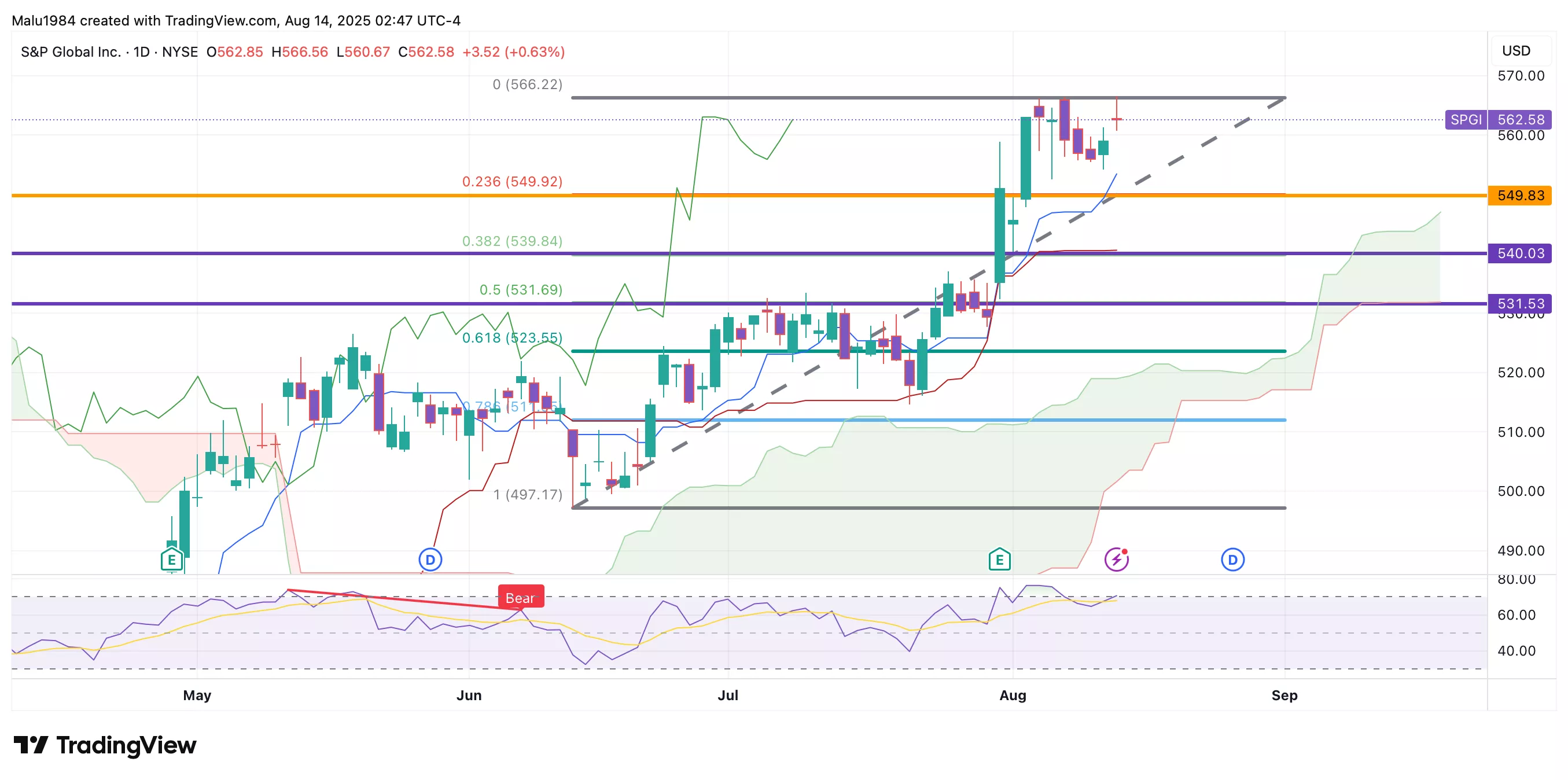

Daily Chart

Overall trend is bullish with candles above the cloud.

Conversion line is above the baseline, confirming positive short-term momentum.

RSI is at 70, indicating overbought conditions that could lead to short-term consolidation or pullback before continuing higher.

Overall, the technical outlook is bullish. Both long-term and short-term trends point upward with strong momentum. However, the high RSI suggests the stock may pause or retrace slightly before resuming its uptrend, which can present better entry points for new investors.

Overall, the technical outlook is bullish. Both long-term and short-term trends point upward with strong momentum. However, the high RSI suggests the stock may pause or retrace slightly before resuming its uptrend, which can present better entry points for new investors.

Buy Limit (BL) levels:

$549.83 – High Risk

$540.03 – Moderate Risk

$531.53 – Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Medium

The trend is strong and momentum is bullish, but the RSI at overbought levels raises the chance of a short-term pullback before the next leg higher.

Summary: Final Thoughts

S&P Global stands out as a market heavyweight with strong fundamentals, solid earnings growth, and a diversified business model that generates steady, high-margin revenue.

Recent strategic moves — selling its OSTTRA stake to KKR, launching an AI Data Center & Power Index, and bringing the S&P 500 on-chain — show it is willing to adapt and expand into future-facing markets. These initiatives, paired with deep integration into cloud and AI ecosystems, position the company for long-term relevance and potential growth.

Sentiment around the stock remains positive, supported by multiple Buy and Overweight analyst ratings, reaffirmed guidance, and a consistent track record of execution. The bullish technical picture reinforces this view, though overbought conditions suggest the possibility of a short-term pause or pullback.

Risks to watch include regulatory scrutiny on credit ratings, increasing competition from peers like Moody’s and MSCI, and uncertainty around how quickly new ventures like tokenization will deliver meaningful revenue. A high valuation also leaves the stock more sensitive to any slowdown in growth.

Overall, S&P Global combines a stable core business with calculated bets on new trends, making it an appealing watchlist candidate for long-term investors.

Overall risk: Low to medium

More By This Author:

Could Booking Holdings Stock Be The Quiet Disruptor No One’s Watching?

ASML Stock: Why The World’s Only EUV Maker Could Be Wall Street’s Biggest Blind Spot

Spotify’s Stock Growth Engine Is Running But Is Wall Street Missing This Profit Lever?