Could Booking Holdings Stock Be The Quiet Disruptor No One’s Watching?

Image Source: Pexels

Booking Holdings (BKNG) is not just the company behind Booking.com. They also own Priceline, Agoda, Kayak, and OpenTable—basically a big chunk of the online travel world. On the surface, they look like a standard travel booking giant. But recent moves hint they might be shifting the rules of the game.

Between AI-powered travel planning, a long-term global flights partnership, aggressive buybacks, and strong international growth, they’re quietly positioning themselves for something bigger than most investors notice at first glance.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess Booking Holdings’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Strong earnings growth in 2025

Booking Holdings posted solid results in Q1 and Q2 2025. Q2 room nights grew 8% and gross bookings rose 13% year-over-year. Revenue was up 16%, beating analyst expectations. Q1 also showed healthy growth with adjusted EPS up 22% and EBITDA up 21%. This points to strong post-pandemic travel demand and efficient operations.

Big capital returns to shareholders

In late 2024, Booking announced a $20 billion share buyback program and raised its dividend by 10% to $9.60 per share. These moves signal confidence in their long-term cash flow and financial strength.

AI integration for competitive edge

The company is leaning into AI with its “AI Trip Planner” and virtual assistant “Penny.” These tools help customers build trips faster while also improving Booking’s marketing efficiency. This could drive higher conversion rates and customer loyalty.

Expanding flights business through partnerships

Although the European Union blocked their €1.6 billion acquisition of Etraveli, Booking secured an eight-year extension of its partnership with Etraveli. This lets them expand their flights offering in over 50 countries without the regulatory headaches of a takeover.

Strong international growth

International bookings, especially in Europe, are driving revenue gains and offsetting slower U.S. growth. This geographic mix helps diversify revenue streams and reduces reliance on one market.

Regulatory headwinds in Europe

The EU’s decision to block the Etraveli acquisition shows that regulators are watching Booking closely. This could limit future acquisition opportunities in Europe and force the company to rely more on partnerships or organic growth.

Slower U.S. market momentum

While international travel is strong, U.S. bookings have softened. If this trend continues, it could pressure growth, especially if global travel demand cools.

Fundamental risk: Low to medium

The company has strong fundamentals, consistent cash flow, and global diversification. The main risks come from regulatory challenges in Europe and uneven demand across regions.

IDDA Point 4: Sentimental

Overall sentiment is bullish for Booking Holdings. Investors see strong fundamentals, consistent earnings beats, and smart use of AI as signs of long-term growth potential. While regulatory headwinds remain, the market appears optimistic that partnerships can offset acquisition limits.

Strengths

Analysts have lifted price targets to the $5,400–$5,750 range after multiple quarters of earnings beats.

The $20 billion buyback program and dividend hike create investor confidence in management’s commitment to shareholder returns.

AI-powered tools like “Penny” and the “AI Trip Planner” are seen as innovation drivers that could keep Booking ahead of competitors.

Strong international travel demand, especially in Europe, signals resilience even if the U.S. market softens.

The extended partnership with Etraveli is viewed as a creative workaround to regulatory blocks, keeping the flight expansion story alive.

Risks

The blocked Etraveli acquisition shows that regulators can slow Booking’s growth plans, especially in Europe.

Softer U.S. booking trends could weigh on sentiment if international demand slows.

The travel sector remains sensitive to geopolitical tensions or macroeconomic downturns that could reduce discretionary spending.

Investors may be cautious about how much AI integration will truly move the needle on profitability.

Sentimental risk: Low to medium

Confidence is high now, but sentiment could turn quickly if growth slows or regulatory pressure increases.

IDDA Point 5: Technical

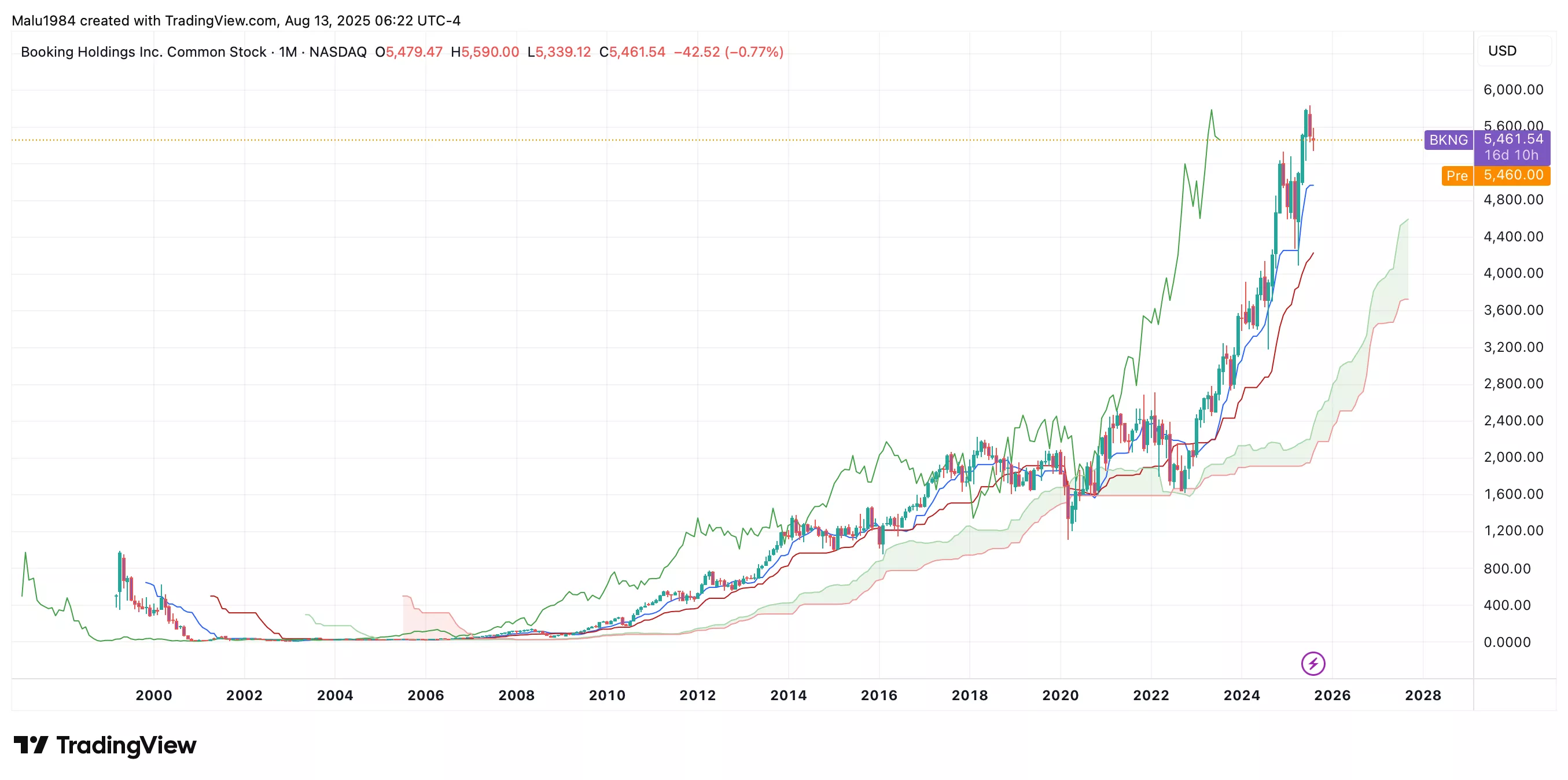

Monthly Chart

Booking Holdings has been a growth stock since 2000, maintaining a strong long-term uptrend.

The Ichimoku cloud is bullish with candles well above the cloud.

The conversion line has been above the baseline since 2023, supporting long-term momentum.

(Click on image to enlarge)

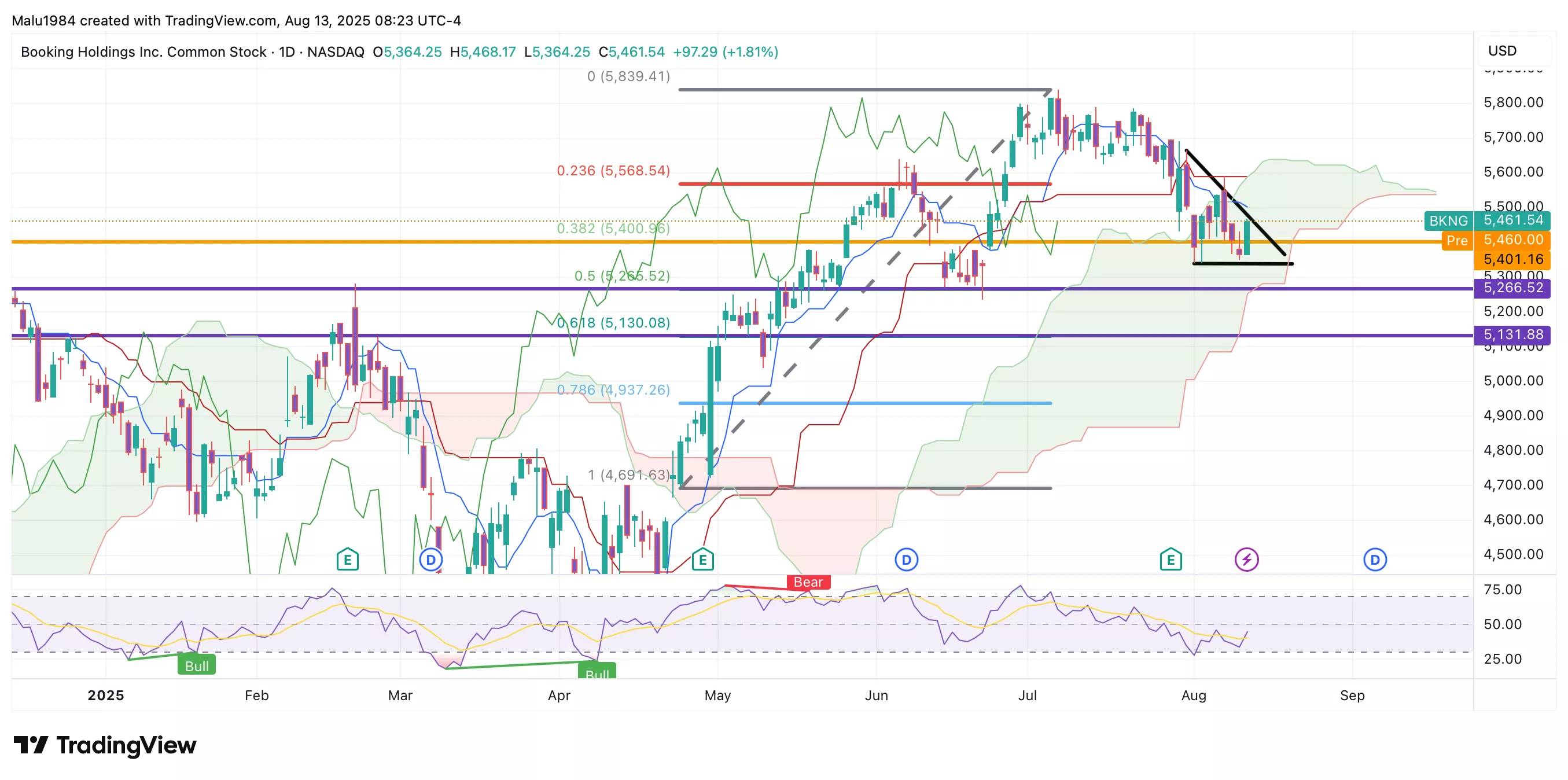

Daily Chart

Ichimoku cloud is green, signaling a bullish overall trend.

Candles are inside the cloud, indicating consolidation rather than a clear breakout.

The conversion line is below the baseline, suggesting short-term weakness within the broader trend.

RSI is at 44, which is neutral but leaning toward oversold territory.

After hitting an all-time high of $5,836 on July 8, 2025, the stock dropped to $5,341 on August 1 and has been consolidating since.

The chart shows a descending triangle pattern. In a descending triangle, sellers are becoming more aggressive (lower highs) while buyers keep defending the same support. This often leads to a potential breakdown if sellers win, but it can also break to the upside if buyers overpower sellers—especially inside a bullish long-term trend.

Price is currently testing the lower boundary of the pattern, which aligns with a key support level.

(Click on image to enlarge)

Buy Limit (BL) levels:

High Risk

Moderate Risk

Low Risk

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Overall technical outlook

Long-term momentum remains bullish thanks to strong historical growth and a positive monthly chart setup. In the short term, the descending triangle on the daily chart signals a possible breakout or breakdown ahead. A move above the descending trendline could restart the bullish run, while a drop below support might trigger a deeper pullback.

Technical risk: Medium

The bigger trend is still up, but near-term consolidation could go either way.

Summary: Final Thoughts

Booking Holdings continues to show strong fundamentals, with consistent revenue and earnings growth, a healthy cash position, and shareholder-friendly moves like a $20 billion buyback and a dividend hike. International bookings are driving results, AI tools are improving the customer experience, and long-term partnerships like the Etraveli deal are keeping their expansion plans alive despite regulatory blocks.

Market sentiment is generally bullish. Analysts have raised price targets, and investors see the company’s AI integration and strong global presence as key growth drivers. Still, the blocked Etraveli acquisition highlights the risk of regulatory pushback, and softer U.S. booking trends could limit upside if international demand slows.

Technically, the long-term trend is bullish with a strong monthly Ichimoku setup. In the short term, the daily chart shows a descending triangle, suggesting consolidation before the next move. A breakout above the pattern could confirm the long-term bullish bias, while a breakdown below support might signal a deeper pullback.

Overall, Booking Holdings is in a strong position but faces medium-level risks from regulation and near-term chart patterns.

Overall risk: Medium

The company’s long-term growth story is intact, but short-term volatility is likely before a clear direction emerges.

More By This Author:

ASML Stock: Why The World’s Only EUV Maker Could Be Wall Street’s Biggest Blind Spot

Spotify’s Stock Growth Engine Is Running But Is Wall Street Missing This Profit Lever?

The Sell-Off In Adobe Stock Looks Scary… Is This A Red Flag Or A Hidden Green Light?