ASML Stock: Why The World’s Only EUV Maker Could Be Wall Street’s Biggest Blind Spot

Image Source: Pexels

ASML Holding N.V. (Nasdaq: ASML) isn’t just a semiconductor equipment maker, it’s the only company in the world that produces extreme ultraviolet (EUV) lithography machines. These machines are essential for advanced chipmaking, enabling the smallest and most powerful semiconductors used in AI accelerators, smartphones, and high performance computing.

ASML’s customers include the world’s largest and most advanced chip manufacturers such as TSMC, Intel, and Samsung Electronics, the very companies producing chips for industry giants like Nvidia, Apple, and Qualcomm. In today’s world, where the global economy runs on silicon, ASML stands as a critical gatekeeper to the future.

In Q2 2025, ASML posted net sales of €7.7 billion, a gross margin of 53.7%, and net income of €2.3 billion. It secured €5.5 billion in new orders, including €2.3 billion for EUV tools, and €2.1 billion from its high-margin Installed Base Management service business. The company also delivered its first TWINSCAN EXE:5200B, a next generation high NA EUV machine designed for even smaller and more powerful chips.

Shareholders benefited from €1.4 billion in buybacks and a €1.60 interim dividend. Despite these strong results, shares dropped nearly 9% after management gave a cautious 2026 outlook, pointing to macro uncertainty, U.S.-China trade tensions, and new export restrictions.

What Wall Street may be missing is that ASML’s monopoly in EUV is not only secure but getting stronger. While headlines dwell on short term growth risks, the €5.5 billion backlog and recurring service revenue point to healthy demand. With AI, 5G, autonomous vehicles, and data center growth all requiring advanced chips, ASML sits at the heart of major tech megatrends. The move to high NA EUV could further cement its dominance, making customers even more reliant on its technology and services.

Risks remain – macro headwinds could delay capital spending, geopolitical tensions might affect sales, and emerging lithography technologies like Canon’s NIL could slowly challenge market share. However, building a competing EUV platform would require years, massive R&D investment, and access to a unique supply chain of 5,000 specialized suppliers. Even with government driven efforts for chip independence, duplicating ASML’s capabilities is highly unlikely.

So the question is: Has Wall Street underestimated just how strong ASML’s monopoly and long term growth potential really are? Let’s explore that through the IDDA Framework: Capital, Intentional, Fundamental, Sentimental, and Technical.

IDDA Point 1 & 2: Capital & Intentional

Before investing in ASML, ask yourself:

Do you want exposure to a company with a monopoly in advanced chipmaking technology, supplying every major semiconductor producer in the world?

Are you looking for a stock positioned at the heart of megatrends like AI, 5G, automation, and semiconductor independence?

Do you believe recurring, high-margin service revenue and deep integration with clients create one of the most defensible business models in tech?

ASML isn’t just selling machines, it’s building the foundation of the modern digital economy. Its EUV tools are essential for producing the most advanced chips, and its high NA EUV roadmap keeps it years ahead of potential competition. The company’s strategy is clear: defend its monopoly, deepen customer relationships, and grow recurring revenue from services and upgrades, all while pushing the limits of chipmaking.

Historically, ASML’s long-term trend has been bullish, but pullbacks can be steep, sometimes reaching 61%. Investors must assess their risk tolerance and have the conviction and patience to ride out short- to medium-term volatility, knowing the company’s strong moat and vital role in critical technology cycles have historically rewarded those who stayed the course.

IDDA Point 3: Fundamentals

ASML Holding N.V. is a Dutch company and the sole global supplier of extreme ultraviolet (EUV) lithography machines, which are essential for producing the most advanced semiconductors used in AI, 5G, advanced computing, and data centers. Its customers include industry leaders such as TSMC, Intel, and Samsung.

In Q2 2025, ASML reported net sales of €7.7 billion, a gross margin of 53.7%, and net income of €2.3 billion (29.8% margin). The company recorded €5.5 billion in net bookings, including €2.3 billion in EUV orders, and €2.1 billion in revenue from its Installed Base Management (IBM) services. It also shipped its first TWINSCAN EXE:5200B, a next generation EUV machine designed for smaller, more powerful chips, while returning capital to shareholders through €1.4 billion in buybacks and an interim dividend of €1.60 per share.

ASML holds a monopoly in advanced EUV lithography, with no direct rival close to matching its capabilities. Its extensive supply chain of 5,000 specialized suppliers, along with control of critical component providers like Carl Zeiss optics, creates high switching costs and deep client integration.

The company is well positioned for growth, driven by long term demand from AI, automation, 5G, and the global push for semiconductor independence. Recurring, high margin service revenue from its IBM segment, a strong €5.5 billion backlog, and heavy R&D investment of about €1 billion per quarter (including high NA EUV development) reinforce its competitive edge.

Looking ahead, the semiconductor market is expected to hit $1 trillion by 2030, growing about 9% a year. ASML’s gross margins are already above 50% and could approach 60% by then. However key risks include possible Intel CAPEX cuts, slower adoption of high-NA EUV, new competition like Canon’s NIL technology, and industry downturns.

Fundamental Risk: Medium

IDDA Point 4: Sentimental

Strengths

Monopoly Advantage – ASML is the only supplier of EUV lithography machines, giving it unmatched pricing power and market control.

Strong Long-Term Demand – AI, 5G, automation, and semiconductor independence are driving sustained need for advanced chips.

High Margins & Recurring Revenue – Gross margins above 50% and steady income from Installed Base Management services provide stability even in slow equipment sales cycles.

Risks

Macro & Geopolitical Risks – U.S.-China trade tensions and export restrictions could disrupt orders and limit growth.

Customer Concentration – Heavy reliance on a few major clients like TSMC, Intel, and Samsung increases vulnerability to their CAPEX cuts.

Technology Disruption Risk – Emerging alternatives like Canon’s nanoimprint lithography could eventually challenge EUV dominance if they become more viable.

After Q2 2025, ASML’s stock dropped 9% despite strong earnings, mainly because management gave a cautious outlook for 2026. This raised concerns about global economic uncertainty, U.S.-China trade tensions, and new export restrictions. The market seems to have overestimated the potential revenue decline, which some analysts believe makes the stock more attractive.

While short term worries have overshadowed ASML’s solid fundamentals and long term growth potential, many long term investors see this dip as a good chance to buy, given its monopoly in advanced chipmaking and key role in AI demand. Overall, bullish investors think the risks are temporary and remain confident ASML will keep its technology lead and pricing power as demand for advanced chips continues to grow.

Sentimental Risk: Medium – High

IDDA Point 5: Technical

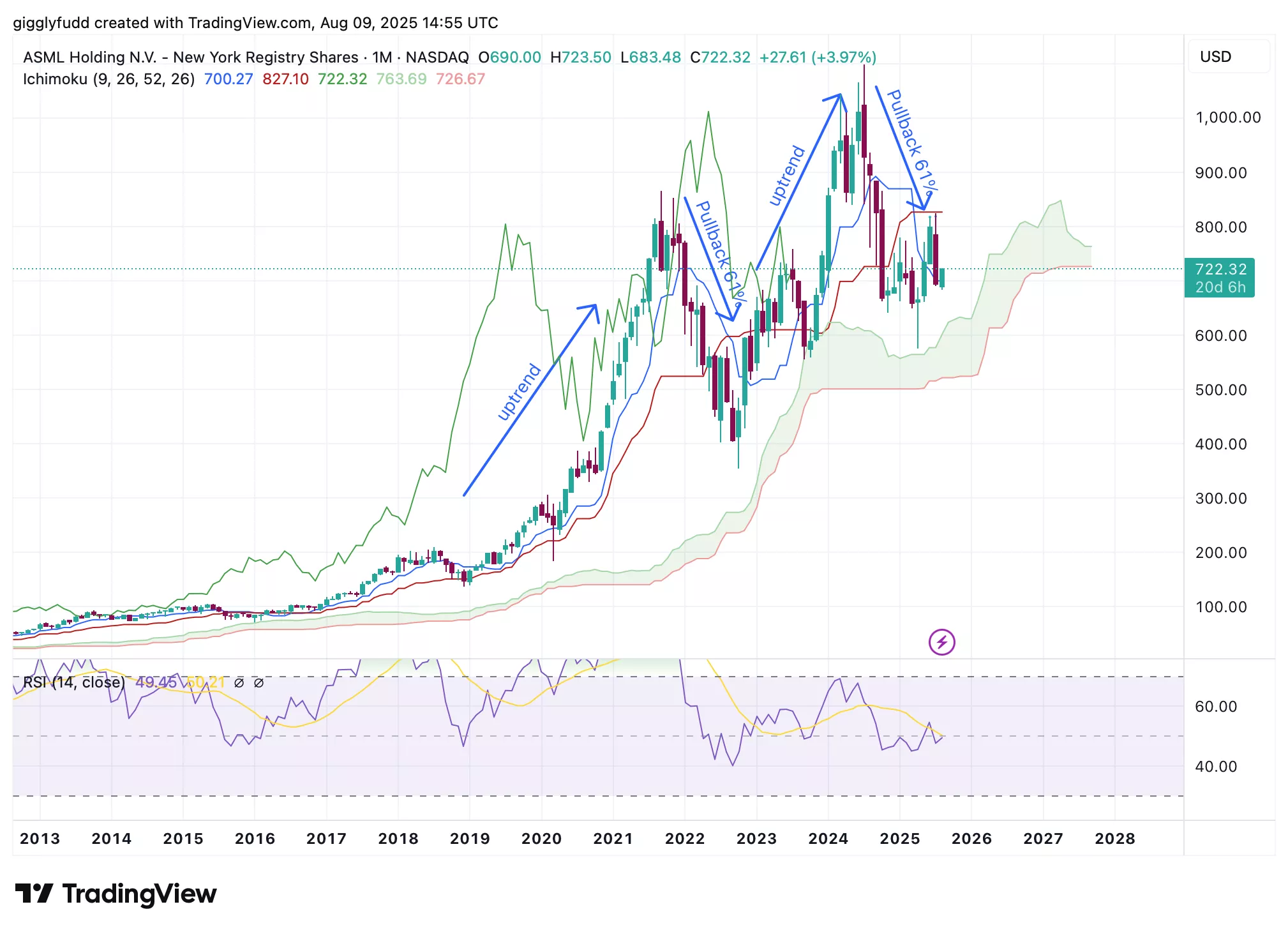

On the monthly chart:

Long-term uptrend pattern, with pullbacks of up to 61%

Ichimoku cloud has remained bullish, with no history of turning bearish

Pullbacks have consistently tested the cloud as support, and it has always held which reinforces the upward momentum

On the monthly chart, ASML has maintained a clear long term uptrend, even though it has experienced substantial pullbacks of up to 61%. These deep corrections are part of its historical price behavior, reminding investors that while the long term trajectory has been bullish, the journey often comes with periods of significant volatility.

Throughout this history, the Ichimoku cloud has remained firmly bullish, with no record of turning bearish on the monthly timeframe. This indicates that the overall trend structure has never shifted into a prolonged downtrend, reinforcing the strength of ASML’s long term momentum.

During market pullbacks, the price has repeatedly tested the Ichimoku cloud, which has acted as a strong area of support. Each time, the cloud has held and helped facilitate a rebound, demonstrating its reliability as a technical support zone in ASML’s long term chart pattern.

(Click on image to enlarge)

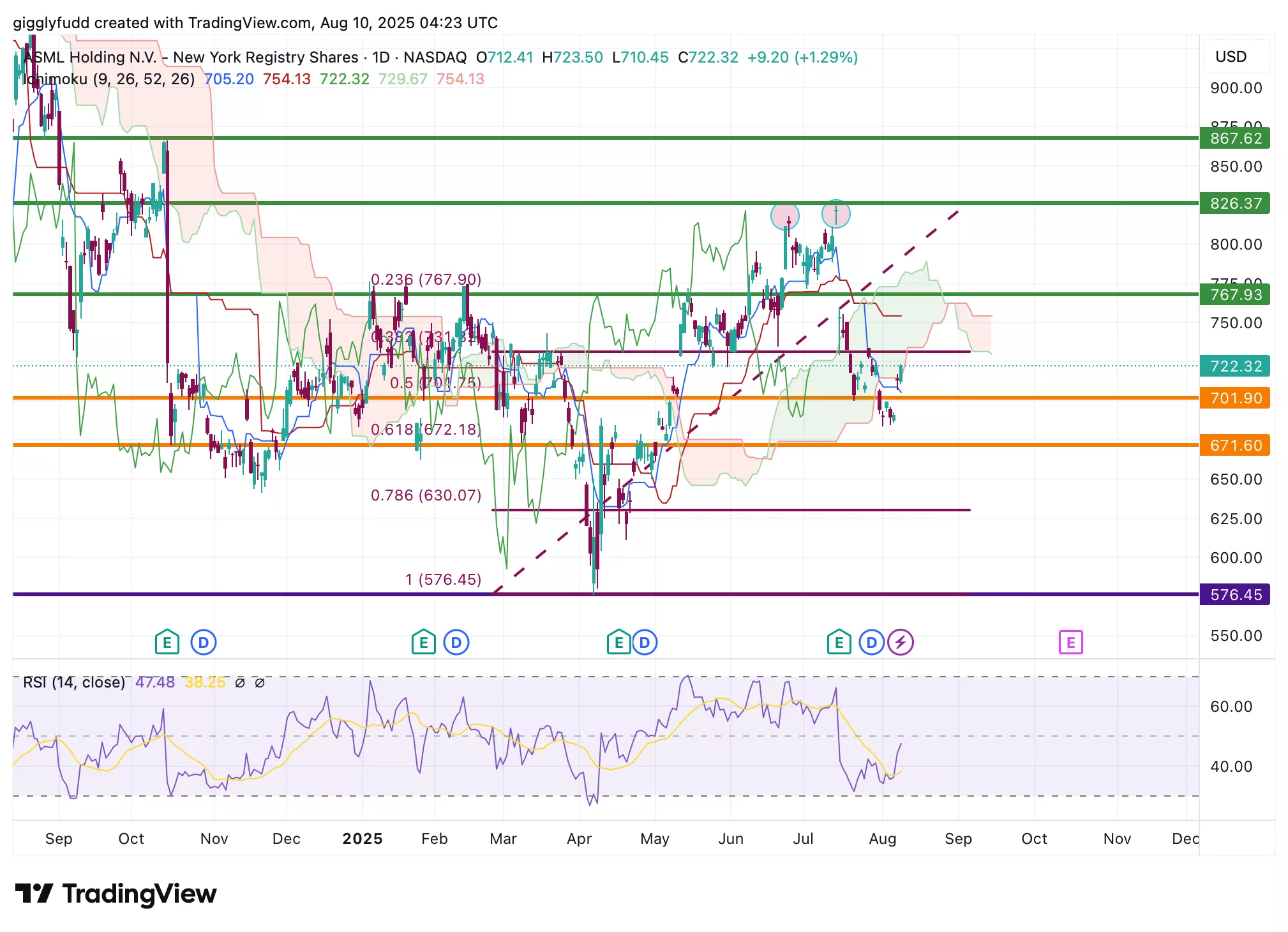

On the daily chart:

The future Ichimoku cloud has turned bearish, reinforcing the current downward momentum.

The price pattern remains in a downtrend, following the formation of a double top after management’s cautious 2026 outlook.

Candlesticks are positioned just below the cloud, which is acting as a key resistance zone.

On the daily chart, the future Ichimoku cloud has shifted to a bearish configuration, reinforcing the existing downward momentum. This change in cloud color and slope indicates that sellers still hold control in the short term, and it may take a decisive reversal to shift sentiment back in favour of the bulls.

The broader price pattern is currently trending downward, with a clear double top formation (marked by the red circles) adding to the bearish outlook. This pattern developed after management issued a cautious outlook for 2026, which weighed on investor confidence and intensified selling pressure. As a result, buyers have been hesitant to drive the price higher without stronger signs of growth stability.

At present, the candlesticks sit just below the Ichimoku cloud, which is acting as a key resistance zone. The latest bullish candlestick has now edged into the cloud, but this overhead barrier must be decisively broken for the daily trend to shift bullish. Until that occurs, the technical bias remains tilted to the downside.

(Click on image to enlarge)

Investors looking to get in ASML can consider these Buy Limit Entries:

Current market price 722.32 (High Risk)

701.90 (Medium Risk)

671.60 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

767.93 (Short term)

826.37 (Medium term)

867.62 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium-High

Final Thoughts on ASML (ASML)

ASML’s position in the semiconductor supply chain is unlike any other. As the sole producer of EUV lithography machines, it holds a monopoly over the most advanced chipmaking technology – supplying giants like TSMC, Intel, and Samsung, who in turn produce chips for Nvidia, Apple, and Qualcomm. Q2 2025 results were strong yet the market focused on management’s cautious 2026 outlook, sending shares down nearly 9%.

What Wall Street may be missing is that ASML’s competitive moat is not only intact but widening. Its €5.5 billion backlog, recurring high margin service revenue, and long term demand drivers like AI, 5G, and semiconductor independence point to a robust growth runway.

The transition to high NA EUV technology could deepen customer dependence and further entrench its market dominance. While risks such as macro headwinds, export restrictions, and potential emerging competition exist, replicating ASML’s technology and supply chain is a near impossible task in the foreseeable future.

Historically, ASML’s long-term trend has been bullish, but pullbacks can be steep, up to 61%, meaning investors must be ready for short to medium term volatility. Technically, the monthly chart still shows a strong uptrend with the Ichimoku cloud acting as reliable support, while the daily chart points to a short-term downtrend with a double top and bearish cloud. This calls for caution in the near term, but the overall bullish outlook remains for patient investors.

Key Takeaway: Buy on Pullbacks or Accumulate Cautiously

ASML’s monopoly position, deep integration with the world’s leading chipmakers, and exposure to powerful secular trends make it one of the most strategically important companies in tech. While short term volatility may persist due to macro and geopolitical factors, the current weakness could offer a compelling entry point for long term investors before the market fully recognises its enduring dominance.

Overall Stock Risk: Medium-High

More By This Author:

Spotify’s Stock Growth Engine Is Running But Is Wall Street Missing This Profit Lever?

The Sell-Off In Adobe Stock Looks Scary… Is This A Red Flag Or A Hidden Green Light?

3 Clues Applied Digital Stock Might Be The Sleeper Giant No One’s Watching