UnitedHealth Stocks Biggest Test Yet: Why Buffett’s $1.57B Bet Might Prove The Market Wrong

Image Source: Pexels

UnitedHealth Group (NYSE: UNH) has been through one of its roughest years – leadership changes, a DOJ probe into possible Medicare fraud, regulatory scrutiny, and multiple earnings downgrades.

The stock plunged over 46% year-to-date before getting a lifeline in the form of Berkshire Hathaway’s $1.57 billion investment. That vote of confidence sparked a double-digit pre-market rally, but the long-term story runs deeper than a single headline.

Despite the turmoil, UnitedHealth remains a healthcare giant with a diversified revenue model. Optum’s position in data analytics, pharmacy services, and value-based care creates a competitive moat, while management focuses on stabilizing medical costs and margins.

The latest dividend increase of 5.2%, the largest yield in over a decade,suggests financial health far stronger than consensus EPS forecasts imply. In fact, payout safety metrics show UNH can sustain dividends even in a “worst-case” earnings scenario.

Buffett’s Berkshire Hathaway $1.57 billion investment suggests that Wall Street may be overlooking how the sell-off has already priced in much of the bad news.

The stock now appears undervalued, and its strong dividend highlights underlying stability. With major investors stepping in and the company still showing long-term strength, there’s potential for a recovery once the legal and cost pressures ease.

However, regulatory and legal challenges from the DOJ probe could linger, while higher medical expenses may continue to weigh on profits in the short term. Optum’s slowdown also needs to turn around, and after Berkshire’s big investment, there’s a chance of short-term volatility as some investors lock in quick gains.

The bigger picture? UnitedHealth is still a dominant healthcare leader at a turning point – facing near term turbulence, but supported by strong institutional backing, reliable dividends, and an undervalued stock price. Let’s break this down using the IDDA framework (Capital, Intentional, Fundamental, Sentimental, Technical).

IDDA Point 1 & 2: Capital & Intentional

Before investing in UNH, ask yourself:

Do you want exposure to a market leader in healthcare services with multiple revenue streams and a proven ability to scale businesses like Optum in analytics, pharmacy, and value-based care?

Are you looking for a company with a dividend track record that stays strong even under earnings pressure – currently offering the highest yield in a decade?

Do you believe that Berkshire Hathaway’s stake, combined with UNH’s market dominance, undervaluation, and margin recovery potential, can drive a long term turnaround?

Historically, even high-quality healthcare stocks can see steep drawdowns when legal and regulatory risks surface and UNH’s volatility this year has tested investor patience. If you buy the “resilient leader + institutional backing + dividend fortress” thesis, the current setup could be an attractive entry point. But if you have a low risk tolerance or want short-term certainty, this stock’s recovery path may feel too bumpy for comfort.

IDDA Point 3: Fundamentals

UnitedHealth Group’s underlying business remains much stronger than recent headlines suggest. The company earns money from multiple areas, with its Optum division leading in data analytics, pharmacy services, and value-based healthcare. This gives it a durable advantage in today’s cost-conscious healthcare market.

Even after leadership changes, regulatory investigations, and big cuts to its earnings forecast, UnitedHealth is still producing healthy amounts of free cash flow which is the extra money left over after running the business. It also has plenty of room to reduce costs further. Management is focusing on bringing its medical expense ratio (the percentage of revenue spent on patient care) back toward its historical level of around 81%. Margins could also improve if the company can reduce the cost of buying prescription drugs, especially if policy changes work in its favor.

From a value perspective, the stock still looks inexpensive compared to where it has traded in the past. Even after a strong jump in price following Berkshire Hathaway’s $1.57 billion investment, UnitedHealth’s share price is still less than half its previous highs of over $600. When you compare its price to the amount of profit it generates, it remains well below historical norms, meaning investors today are paying less for each dollar of the company’s earnings than they typically would.

Its dividend which is the regular cash payment to shareholders adds another layer of strength. The latest quarterly dividend of $2.21 per share is a 5.2% increase from last year, showing management’s confidence in the business. That dividend is well-supported: based on current earnings forecasts for 2025, the payout uses about half of expected profits. Even in a worst case scenario where profits are cut in half, it would still be only about 62% of earnings.

Another safety measure, the Dividend Cushion Ratio, sits at a healthy 2.72 times under conservative assumptions, well above the level that signals risk. On top of that, the current dividend yield of 3.25% is the highest in at least a decade, far above the ~2.2% level seen during the COVID market panic.

All of this suggests that while UnitedHealth has challenges ahead, much of the bad news is already reflected in its current share price. This leaves room for recovery over time as the company works through its current issues.

Fundamental Risk: Medium – High

IDDA Point 4: Sentimental

Strengths

Strong Dividend Growth & Safety – Dividend increased 5.2% YoY, well-covered even under conservative profit scenarios, with the highest yield in over a decade.

Institutional Vote of Confidence – Berkshire Hathaway’s $1.57B stake signals strong belief in the company’s long-term value.

Undervaluation – Shares are trading at less than half their previous highs and below historical valuation levels, suggesting room for recovery.

Risks

Regulatory & Legal Headwinds – DOJ probe into potential Medicare fraud creates uncertainty and potential financial penalties.

Earnings Pressure – EPS guidance withdrawn; consensus sees up to 41% YoY decline in FY25 earnings due to higher medical costs and Optum slowdown.

Near-Term Volatility – Sharp post announcement rally may trigger profit-taking, with risk of a “sell the news” pullback.

Market sentiment toward UnitedHealth shifted quickly after Berkshire Hathaway’s $1.57 billion stake, which triggered a strong rally and renewed confidence following a year of leadership changes, regulatory challenges, and earnings cuts.

While short-term swings and profit-taking are likely, many investors see the company’s dividend growth and high yield as a stronger signal of stability than near-term earnings forecasts.

The market’s heavy focus on negative headlines, including the DOJ probe and rising medical costs, has likely made the outlook too pessimistic, leaving the stock undervalued compared to its history and peers.

The return of former CEO Stephen Hemsley is seen as a stabilizing factor, given his successful track record, and institutional buying could help drive a recovery if momentum holds. Overall, sentiment is cautiously optimistic, with many believing most of the bad news is already priced in and that meaningful upside remains once current challenges are resolved.

Sentimental Risk: High

IDDA Point 5: Technical

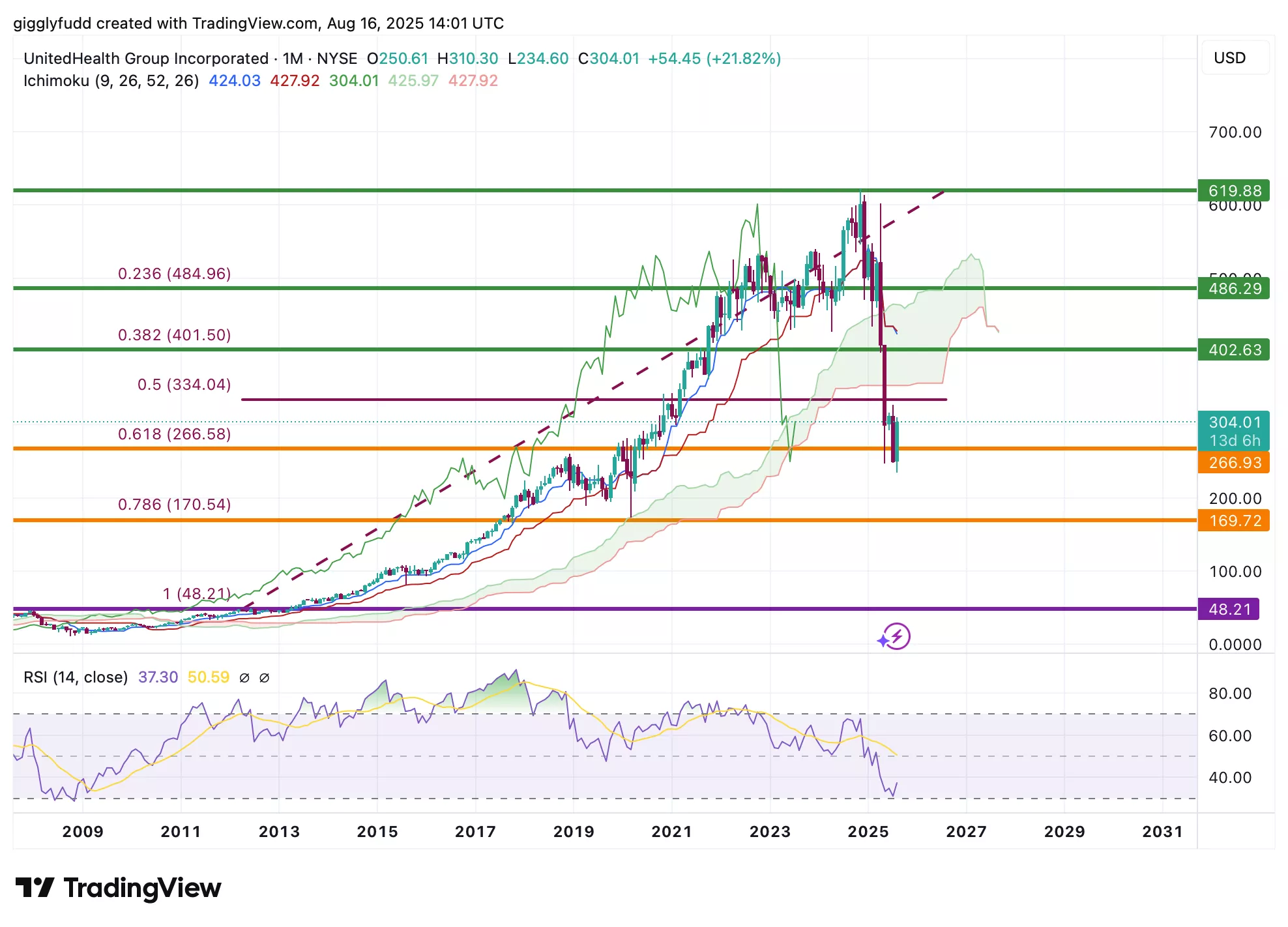

Current pattern shows a steep downtrend, reflecting strong bearish momentum.

The bullish Ichimoku cloud has thinned, signaling the start of a downward shift.

RSI is oversold at 37.30.

On the weekly chart, UNH had been rising steadily until December 2024, when it began a sharp decline, retracing as much as 61% on the Fibonacci retracement level.

This plunge was driven by several factors: rising medical costs squeezing profits, the resignation of CEO Andrew Witty, and the company withdrawing its 2025 earnings forecast. Adding to the pressure, a DOJ probe into possible Medicare fraud, along with a cyberattack and public backlash, deepened investor uncertainty.

However, the most recent candlestick is bullish, reflecting renewed optimism after Berkshire Hathaway’s $1.57 billion investment. With RSI in oversold territory, this could signal a potential bottoming out or the beginning of a recovery from the steep downtrend seen this year,presenting an opportunity to get in before a further rebound.

(Click on image to enlarge)

Investors looking to get into UNH can consider these Buy Limit Entries:

Current market price 304 (High Risk – FOMO entry)

266.93 (High Risk)

169.72 (Medium Risk)

48.21 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

402.63

486.29

619.88

Hold for dividends

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: High

Final Thoughts on UnitedHealth (UNH)

UnitedHealth isn’t just another health insurer; it’s a diversified healthcare platform, with Optum driving growth through data, pharmacy services, and value-based care.

The stock’s crash wasn’t from a broken business, but a perfect storm of rising medical costs, leadership turmoil, a withdrawn forecast, and a DOJ probe into possible Medicare fraud. Add in a cyberattack, public backlash, and leadership uncertainty, and the sell-off turned extreme,even though the business remains structurally strong.

What the Street may be missing is that dividends and institutional backing tell a more stable story than earnings headlines. UNH’s latest dividend hike,its biggest in a decade, is still well covered, even under lower profit scenarios.

Buffett’s Berkshire Hathaway investment reinforces confidence in the company’s ability to recover. With the stock trading far below past highs and historical averages, the market seems to be pricing in a worst-case scenario while overlooking UNH’s resilience.

Risks remain: the DOJ probe may drag on, medical costs are still rising, and Optum needs to regain momentum. Volatility is likely, especially after the Berkshire rally, but none of this erases UNH’s dominance or its ability to generate strong free cash flow.

Technically, the stock is still in a steep downtrend, with weak momentum signals. But the most recent candlestick turned bullish, hinting at renewed optimism. With the stock looking oversold, it could be nearing a bottom or at least a short-term recovery bounce. The key test will be whether it can hold support and break through resistance to confirm a longer-term turnaround.

Key Takeaways:

UNH is quite bruised but not broken. For long-term investors, this setup looks like an opportunity to accumulate cautiously on weakness, backed by dividends, institutional conviction, and a discounted valuation. For shorter-term traders, volatility and sharp rallies create short term profit opportunities, but patience is required until the structure fully repairs.

Overall Stock Risk: Medium – High

More By This Author:

MNDY Stock: The Truth Behind The Crash & What The Street Got Wrong$3.1B In Cash, AI In The Crosshairs, And The S&P 500 On Blockchain — Is S&P Global Stock Changing Everything?

Could Booking Holdings Stock Be The Quiet Disruptor No One’s Watching?