Palantir Stock Growth Looks Unstoppable – But This One Risk Could Change Everything

Image Source: Pixabay

Palantir Technologies (NYSE: PLTR) has become one of the most talked-about AI stocks of 2025 and for good reason. Its Q2 results showed explosive growth, profitability is accelerating, and demand for its Artificial Intelligence Platform (AIP) is surging across government and commercial sectors.

Palantir’s strong growth and rising U.S. commercial sales show it’s building momentum as a serious long-term AI leader.

But beneath the impressive headlines lies a risk that many investors may be overlooking. As the company pushes deeper into the mainstream and its valuation stretches higher, one key factor could determine whether Palantir becomes the next great AI success story – or hits a wall it can’t break through.

In this post, we’ll break down Palantir’s fundamentals, sentiment, and strategy using the IDDA framework – and reveal the one risk that could change everything for PLTR investors.

IDDA Point 1 & 2: Capital & Intentional

Before investing in PLTR, ask yourself:

Do you want exposure to one of the most unique AI companies serving both governments and corporations with high security, high impact solutions?

Do you believe Palantir’s ontology framework and AI orchestration tools give it a sustainable edge in the growing enterprise AI race?

Are you comfortable with its premium valuation and limited global reach, betting that execution, profitability, and product adoption will continue accelerating?

Palantir’s strength comes from its strong government ties, fast-growing commercial business, and unique AI technology. It has now been profitable for two years in a row, with more cash on hand and increasing free cash flow, showing its business is becoming more stable. To address investor concerns about share dilution, the company has also approved a $1B share buyback program.

Still, for all its promise, Palantir can still be seena high risk, high reward play. The market is pricing in long-term dominance, and any stumble, whether from geopolitical pressure, slowing growth, or overreaching on strategy – could lead to sharp pullbacks. But if you believe in the company’s vision and its role as a “mission-critical” AI operator for the West, the upside could be substantial.

For conservative investors, the smart move may be to wait for a more reasonable entry point. But for those with conviction in AI infrastructure and a long-term horizon, Palantir could be more than just a ‘trade’ – it could be a cornerstone of tomorrow’s AI economy.

IDDA Point 3: Fundamentals

Palantir is a leading AI company that helps governments and businesses make better decisions through its platforms – Gotham and Foundry. Its software brings together complex data, learns over time, and provides deeper insights than traditional analytics.

A key feature that sets Palantir apart is its ontology framework, which is designed to uncover hidden connections in data and improve decision-making. The term “ontology” comes from philosophy, where it refers to the study of the nature and relationships of being. In Palantir’s case, this framework reflects its ability to map out complex, interconnected problems and provide solutions. This approach allows Palantir to handle challenges across many areas, including business, government, and military operations.

Palantir recently launched its Artificial Intelligence Platform (AIP), which makes it easier for non technical users to work with powerful AI tools like large language models. The company has also sped up its traditionally slow sales process by running “boot camps,” where clients quickly see personalized demonstrations of how Palantir’s software can solve their biggest challenges.

Financially, Palantir is on solid ground. As of June, it held $900 million in cash, $5 billion in safe investments like U.S. Treasuries, and has no debt. Its cash position improved by $700 million in 2025, and it has now been profitable for two years in a row, with 2024 profits more than doubling from the year before.

Concerns about heavy stock-based compensation are also easing. While there was a one-time $120 million expense in late 2024 when the stock price jumped above $50, the overall percentage of revenue used for stock-based pay has been shrinking. To further reduce dilution, Palantir announced a $1 billion share buyback plan in 2023. Profitability overall is expected to keep improving.

On the growth side, Q2 revenue climbed nearly 50% from the year before, and the company raised its 2025 outlook to above 50% growth. U.S. commercial demand is booming, with almost double the revenue, a growing client base of 485 companies, and 42 contracts each worth more than $10 million.

Even with these strong results, Palantir’s high valuation is a concern. The stock trades at about 300 times future earnings, which raises the question of whether much of its growth is already priced in. Its focus on large organizations could also make it harder to expand into the wider small and medium sized business market. On top of that, Palantir’s close ties to U.S. defense and sensitive data could limit adoption internationally due to geopolitical pushback.

Still, many investors remain optimistic about Palantir’s future. With its unique mix of AI, advanced data tools, and high customer loyalty, the company is positioned to grow quickly and strengthen its role as a key player in both government and commercial AI markets.

Fundamental Risk: Medium-High

IDDA Point 4: Sentimental

Strengths

Palantir has built best-in-class AI software positioned to benefit from the global shift toward digitization and automation.

Its ontology framework and AI orchestration tools enable machine learning across all levels of an organization, making AI more accessible and impactful.

The new boot camp-style sales strategy is driving rapid growth, especially in the U.S. commercial segment, which has a large and expanding addressable market.

Risks

Palantir’s customer base is mostly limited to Western-aligned governments and corporations, restricting global market reach.

Falling AI costs and the rise of competing large language models (LLMs) may lower barriers to entry and increase competition.

Its dual-class share structure gives insiders significant control, raising concerns about unchecked spending or non-core investments that don’t align with shareholder interests.

Investor sentiment around Palantir is sharply divided. Bulls are energized by the company’s strong growth narrative, soaring AI demand, and expanding U.S. commercial traction, driving a wave of upward analyst revisions and retail enthusiasm. The brand is viewed as a key player in national security and enterprise AI, making it a must-own in the current tech rally. However, growing concerns over its lofty valuation, potential international resistance due to data sensitivity, and limited SMB appeal are fueling skepticism.

Some view the stock as being in bubble territory, with little margin of safety, and worry that a macroeconomic downturn or geopolitical pushback could trigger sharp downside. While optimism is high, especially around its AI potential, sentiment is becoming increasingly cautious as Palantir’s rapid rise tests the limits of investor confidence.

Sentimental Risk: Medium-High

IDDA Point 5:Technical

On the weekly chart:

The stock has been in an uptrend since 2024, experiencing a pullback before surpassing its previous high.

The Ichimoku future outlook remains bullish, reinforcing strong long term upward momentum.

Candlesticks, along with the Kijun, Tenkan, and Chikou lines, are well above the cloud supporting the bullish momentum

(Click on image to enlarge)

On the weekly chart, the stock has been in an uptrend since 2024, breaking out after forming a saucer bottom which is a classic bullish reversal pattern. It experienced a pullback before surpassing its previous high, and the Ichimoku future outlook continues to reinforce strong long term momentum.

Candlesticks, along with the Kijun, Tenkan, and Chikou lines, remain well above the cloud, supporting the bullish trend, though the setup also suggests the stock may be primed for a short-term pullback.

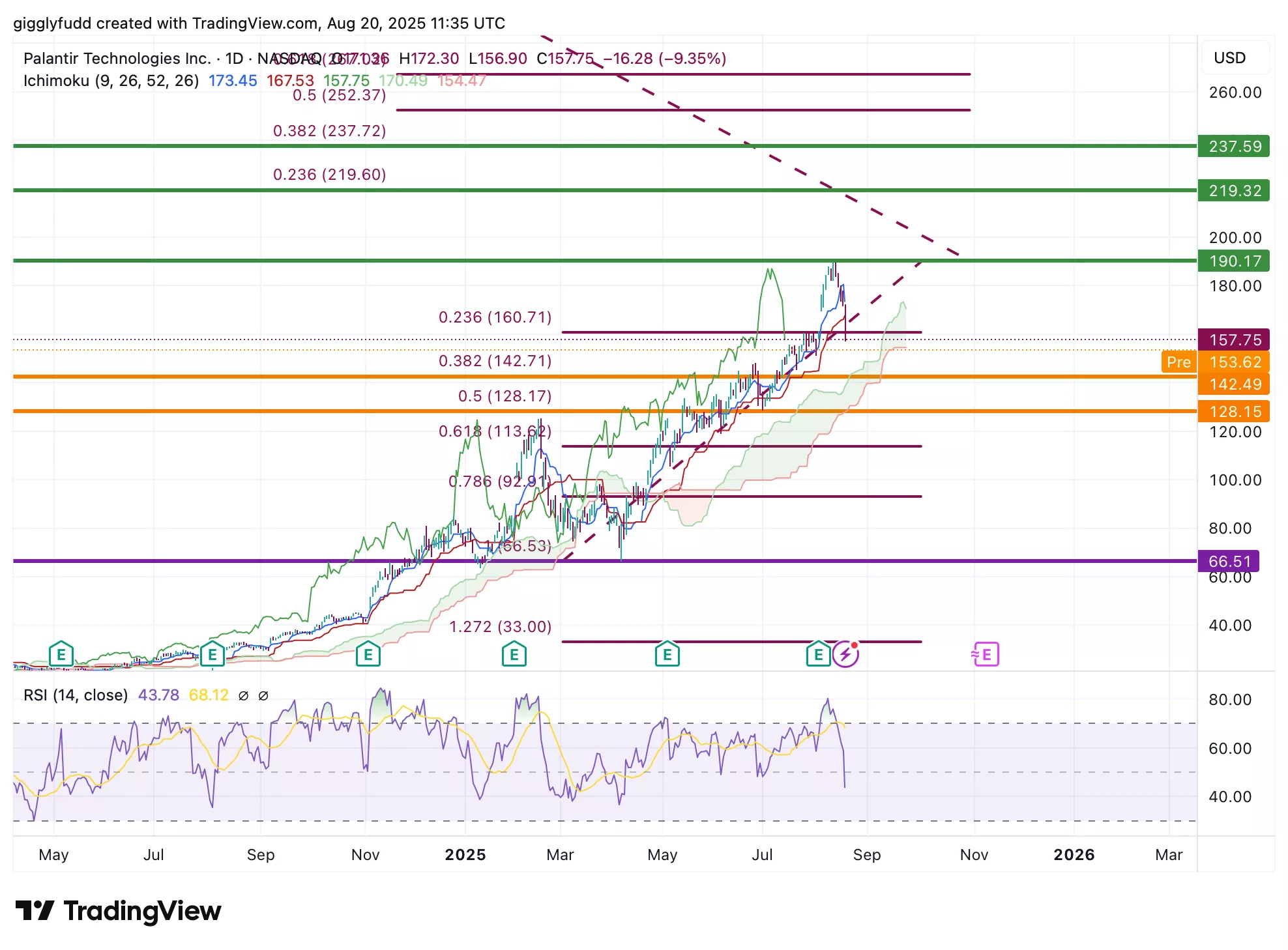

On the daily chart:

The stock remains in a strong uptrend, having broken past its February 2025 high of 125 and climbing to a recent peak of 190.

The Ichimoku outlook continues to indicate strength, signaling sustained long-term upward momentum.

Candlesticks, supported by the Kijun, Tenkan, and Chikou lines, are holding above the cloud even during pullbacks, further confirming the prevailing bullish trend.

The stock is in a clear uptrend, breaking past its February 2025 high of 125 after a 50% retracement and climbing to a new peak of 190.

The Ichimoku outlook continues to signal strength, pointing to sustained long-term momentum. Candlesticks, supported by the Kijun, Tenkan, and Chikou lines, remain above the cloud even through pullbacks, reinforcing the prevailing bullish trend.

(Click on image to enlarge)

The current market price has pulled back and has touched past the 23% Fibonacci retracement level

Investors looking to get into PLTR can consider these Buy Limit Entries:

Current market price: 153.62 (High Risk)

142.49 (Medium Risk)

128.15 (Low Risk)

Investors looking to take profit can consider these Sell Limit Levels:

190.17 (Short term)

219.32 (Medium term)

237.59 (Long term)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical Risk: Medium

Final Thoughts on Palantir (PLTR)

Palantir has grown from a defense contractor into one of the most influential AI companies today. Its Gotham platform is still vital for governments, while Foundry and its Artificial Intelligence Platform (AIP) are gaining momentum in the business world.

The company’s U.S. commercial sales have nearly doubled in the past year, and new contracts with NATO and the U.S. Army highlight its strong government presence. Palantir is profitable, holds plenty of cash, and is positioning itself as a key player in both national security and enterprise AI adoption.

But this growth comes with risks. Palantir’s focus on sensitive data and close ties to Western governments may limit its reach overseas. Some countries are already pushing back over privacy and sovereignty concerns, and with the stock trading at a very high valuation, much of its future success may already be priced in. If geopolitical barriers or competition from larger tech players limit its market, today’s optimism could quickly fade.

Technically, the stock remains in an uptrend, hitting new highs after earnings. While short term pullbacks are possible, the long term trend is still intact as long as support levels hold.

Key Takeaways: Palantir is one of the strongest AI growth stories of 2025, with rising revenues, profitability, and reliable government contracts. However, its heavy reliance on Western markets and high valuation mean investors need patience and careful risk management.

Overall Stock Risk: Medium-High

More By This Author:

Intel Stock Surges On Government And SoftBank Backing – But Is It Too Early To Buy?

3 Things Investors Are Missing About Shopify Stock Right Now

UnitedHealth Stocks Biggest Test Yet: Why Buffett’s $1.57B Bet Might Prove The Market Wrong